Overview Of Business Valuation Parameters In The Energy-PDF Free Download

Wiley & Sons, 2003. Print. Fishman, Jay E., Shannon P. Pratt, and James R. Hitchner, PPC’s Guide to Business Valuations. Business Valuation Review. American Society of Appraisers. Business Valuation Update. Business Valuation Resources. A .pdf copy of the ASA’s Business Valuation Standards can be downloaded from the following

2 Business Valuation Update February 2018 Business Valuation Resources Market Multiple adjustMents: Get a Grip On Grp Business Valuation Update (ISSN 2472-3657, print; ISSN 2472-3665, online) is published monthly by Business Valuation Resources, LLC, 111 SW Columbia Street, Suite 750, Portland, OR 97201-5814.

Automated Valuation Models (AVMs) are computer-based systems which encompass all data concerning real estate in a particular area and are capable of producing more consistent valuation reports within a short time. Traditional valuation methods employed by valuers somewhat delay the valuation process. For

Classification makes it easier to understand where individual valuation models fit into the big . In the broadest possible terms, stock valuation methods fall into two main categories: absolute and relative valuation approaches. Absolute valuation attempts to find an intrinsic value of the stock based on company's fundamentals, such as .

Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the . valuation and financial instrument analysis, as well as much more. . Introduction to Valuation 1 A Philosophical Basis for Valuation 1 Generalities about Valuation 2

John Wiley & Sons, Inc. C1.jpg. EQUITY ASSET VALUATION. . 1 Introduction to Free Cash Flows 108 2 FCFF and FCFE Valuation Approaches 109 . 11 Valuation Indicators and Investment Management 231 12 Summary 233 Problems 236. CHAPTER 5 Residual Income Valuation 243. Learning Outcomes 243

valuation services and terms for the 409a valuation report. Once this is signed and the invoice for the valuation services is settled, we can start running the report. Get your 409A valuation. Running the Report: 10-20 days After the data is provided an

Jun 15, 2016 · The discussions and examples in this Valuation Advisory make specific assumptions for 52 illustrative purposes only. While general principles have been provided for guidance to assist in the 53 valuation of customer-related assets, assumptions used in the valuation of any asset

We will teach 4 valuation methods Trading Comparables Transaction Comparables Sum-of-the-Parts Valuation Discounted Cash Flow Analysis (DCF) 2. Why is Valuation important? . The SCIENCE is performing the valuation, the ART is interpreting the results in order to arrive at the "right"price. TECHNOLOGY can help you do this more efficiently.

ing how well the estimates produced by exogenously imposed valuation models agree with stock prices. The problem is that the exogenously imposed valuation models, even if reasonable, are not the same as the actual models used by the . they use valuation methods that rely on trailing accounting information. Further-more, the adoption of .

i.e. the valuation models, can affect the accuracy of the forecast. Financial analysts can adopt several different valuation methods to evaluate companies, which are usually categorised into two different macro-classes: single-period valuation methods, i.e. market multiples, and multi-period valuation methods, such as discounted cash flow (DCF) and

June 30, 2021 Actuarial Valuation 1. This report, prepared as of June 30, 2021, presents the results of the annual actuarial valuation of the System. For convenience of reference, the principal results of the valuation and a comparison with the preceding year's results are summarized below. The current valuation and reported benefit amounts

Whether or not a valuation method is considered "reasonable"depends on the relevant facts and circumstances surrounding the subject closely held corporation as of the valuation date. A 409A valuation report is valid for a period of 12 months from the valuation date or an event which can have a material impact on the valuation, whichever is .

pre-money valuation. Post- money valuation is a simple sum-mation of the pre money and the investment made. E.g.- If the pre money valuation of a startup is 5 million and an invest-ment of 2.5 million is made. The post-money valuation would be 7.5 million. Thus, the new investor will own 2.5/7.5 33.33% of the company.

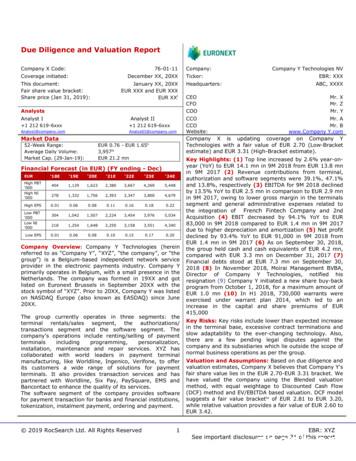

Valuation and Assumptions: Based on due diligence and valuation estimates, Company X believes that Company Y's fair share value lies in the EUR 2.70-EUR 3.31 bracket. We have valued the company using the Blended valuation method, with equal weightage to Discounted Cash Flow (DCF) method and EV/EBITDA based valuation. DCF model

E. Summary of Valuation Data Because this is a roll-forward valuation, this report is based on census data previously provided to us as of October, 2019 for the June 30, 2019 full valuation. Distributions of participants by age and service can be found on page 17. Valuation Year June 30, 2019 Valuation Date June 30, 2020 Measurement Date

of the business valuation process along with a checklist of source documents that will need to be provided. This Business Valuation Client Guide has been written to help remove some of the mystery of business valuation engagements and can be used as a step-by-step guide to help answer some common questions often raised by clients.

medium-sized enterprises. The existing business valuation methods have been discussed in this research. In order to examine the accurate business valuation methods, a case study has been conducted, in which two case were studied. The results of the case study show that the DCF-methods are accurate business valuation methods.

John E. Barrett, Jr., CPA/ABV, CBA, CVA Barrett Valuation Services, Inc. 989 Reservoir Avenue Cranston, RI 0910 Phone: (401) 942-3900 Fax: (401) 942-3988 Email: info@BarrettValuation.com www.BarrettValuation.com BVS Barrett Valuation Services, Inc. The Business Valuation Advisors 989 Reservoir Avenue Cranston, RI 02910 Return Service Requested

might impact the overall valuation of a specic business may not be taken into account for the purpose of this report. Valuation methods from the income, market and asset approach have been utilized to reach the valuation results for the subject company. The opinion of value given in this report is based on information provided by the user and

might impact the overall valuation of a speci c business may not be taken into account for the purpose of this report. Valuation methods from the income, market and asset approach have been utilized to reach the valuation results for the subject company. The opinion of value given in this report is based on information provided by the user and

Business Valuation ----- Page 6 Season 2 Season CC Valuation: Cost / Asset method Balance sheet focus The individual asst items have been restated . This valuation is conducted to reflect Fair Value R'000 Reported value Adjustment Adjusted value notes Assets plant and equipment 681 10 691 1

CHAPTER 4 RELATIVE VALUATION In discounted cash flow valuation, the objective is to find the value of an asset, given its cash flow, growth and risk characteristics. In relative valuation, the objective is to value an asset, based upon how similar assets are currently priced by the market.

1. Introduction to Business Valuation Introduction and Background Valuation Core Concepts 2. Valuation Approaches Income Approach Market Approach Asset (Cost) Approach 3. Challenges Involving Closely-Held Companies Discounts Other Challenges / Common Pitfalls

Valuation guidelines encourage the use of several valuation methods as they analyse the business value from different angles and result in a more comprehensive and accurate view. Equidam chooses to use the 5 valuation methods listed below, which will be described in details in the following pages.

comparables-based multiples valuation as well as multi-period valuation models with the aim of emphasizing their findings, inconsistencies and parts where further improvement is needed, and financially analyze Associated . difficulties of implementation of valuation methods which analysts face nowadays. Finally, Chapter 4 of this paper .

The Certificate in Financial Modelling and Valuation E-Learning aims to provide working professionals and students practical exposure to financial modelling and valuation, help them understand and build business as well as valuation models. The programme will ensure conceptual knowledge is imparted with a perfect blend of industry practices.

Real options valuation of a biotech project using fuzzy numbers . well suited for applying a real option approach to the valuation – dependent on the practitioner’s financial level. Next the concept of fuzzy numbers is introduced. The fuzzy pay-off method to real option valuation

Valuation is therefore of preference held by people. Valuation process is anthropomorphic The result is monetary terms: estimate the willingness to pay, or inferring their WTP through other means (asking people directly (stated preference), or calculate the economic value through revealed preference). Economic Valuation

Travel Cost Method) and Stated Preference (for instance Contingent Valuation and choice modelling Methods) can be utilized for Economic valuation. When the intention of the study in Non-market valuation is the consideration on the impact of a policy (such as

THE VALUATION TRIBUNAL (APPEALS) RULES, 2019 Commencement 1. These Rules may be cited as the Valuation Tribunal (Appeals) Rules 2019 and shall come into operation on the 16th day of September 2019. The Valuation Act, 2001 (Appeals) Rules, 2008 and Guidelines for the hearing of appeals are hereby rescinded. Interpretation 2.

Determinants of start-up valuation, including its three-sided interplay of factors related to start-ups, VC and its external environment are established before the specific valuation approach is presented and discussed. Traditional valuation methods, such as the DCF method, trading multiple method or

The objective of this report is to perform a valuation of Harvey Norman Holdings Ltd. (HVN) in 2003. In performing this valuation methods such as Dividend Discount Model, Relative valuation model and Free Cash Flow to Equity (FCFE) models were explored and FCFE model was chosen as

STANDARDS The International Valuation Standards Council (IVSC) The International Valuation Standards Council (IVSC) is an independent, not-for-profit, private sector organization that has a remit to serve the public interest. It was formed in London in 1981 and today has 50 Valuation Profe

ARGUS Valuation - DCF, otherwise ARGUS Valuation - DCF may not run properly. ARGUS Valuation - DCF will be available in a folder in the Start menu and as a shortcut on your Windows desktop. When you launch ARGUS Valuation - DCF for the first time, you will be prompt

McKinsey Valuation Discounted Cash Flow Model, Fifth Edition Designed to Help You Measure and Manage the Value of Companies 978-0-470-42457-5 Model Completes Computations Automatically Promoting error-free analysis, the McKinsey valuation model is updated and fully revised to match the strategies and approach in Valuation,

A number of other valuation models (discounted divi-dends, adjusted present value, economic value added, and abnormal earnings) are also discussed. Earlier versions of this working paper were entitled “A Tutorial on the McKinsey Model for Valuation of Companies”. Key words: Valuation, free cash flow, discounting, accounting data

valuation approaches and methods. All in all, depending on the valuation objective and method, the final result will be more or less reliable, more or less subjective, based on historical or forward-looking. The aim of this thesis is to present the different approaches to brand valuation, analyse in

Valuation Multiples by Industry https://www.eval.tech SIC Sector: (7000-8999) Services Report Date: 31 January 2019 Country: United States of America (U.S.A.) Industry Valuation Multiples The table below provides a summary of median industry enterprise value (EV) valuation multiples, as at the

The McKinsey DCF valuation model opens at the Valuation Summary sheet, one of the two output sheets. Before using the model, check that the Analysis ToolPak “Add-In” is active (see Tools, Add-Ins menu). Apart from the Valuation Summary sheet, the model follows a standard convention for the use of columns: A Row titles B Range names (if used)