What The Evolution Of Travel Means For Business

ExecutivePerspectivesWhat the Evolution of TravelMeans for BusinessJune 2021

BCG ExecutivePerspectivesIN THIS DOCUMENTTravel and tourism, including hospitality and leisure, was one of theareas most severely impacted by COVID-19, as lockdowns and travelrestrictions slowed activity to a trickle or stopped it altogether. Thisled to a direct loss of 4.5T in global GDP, and ripple effects were feltacross companies and industries as organizations struggled to findnew ways to connect with their customers and employees. Now withCOVID-19 vaccinations and cases controlled in some areas, short- tomedium-term demand spikes are expected, accompanying thelonger-term sustained changes needed to navigate the new world.WIDE-REACHING IMPLICATIONS OF CHANGESIN TRAVEL IMPACT MANY INDUSTRIESThe changes in global travel patterns will have broader impactsthroughout organizations worldwide. Leisure and business travelspending reallocated during the pandemic is starting to return.Other industries can apply learning from the travel industry, such ason navigating large demand fluctuations. Companies can also thinkabout changes to their business travel operating model and ways tomake business travel more sustainable.Sources: WTTC, BCG analysis and case experience1Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0TRAVEL & TOURISM RECOVERING AFTER DIFFICULT YEAR

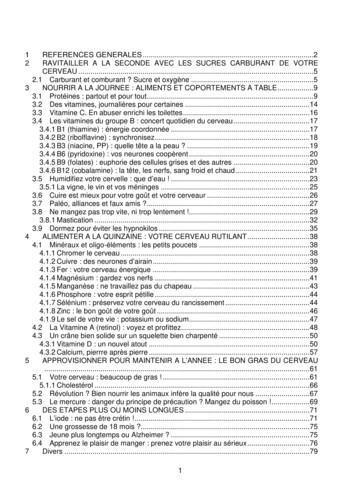

What the Evolution of Travel Means for BusinessA123TRAVEL & TOURISMTRENDSIMPLICATIONS FORALL COMPANIESIMPLICATIONS FORTRAVEL COMPANIESSource: BCG analysis and case experienceTravel demand is increasing, but recovery will vary by country and is tied to vaccine progressB Expect high near-term demand in leisure travel with potential structural changes inbusiness travelCConsumers are calling for increased sustainability as travel industry responds with initiativesAPrepare for volatility from consumer spending shifts with demand sensingBUpdate business travel operating model to account for hybrid and remote workCImprove business travel sustainability by reducing footprint and engaging suppliersAChanging customer needs require continued investment in safety and hygiene protocol,demand sensing, and sustainabilityBOpportunities exist to establish new cost baselines and implement scenario-based agileplanning to improve operations2Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0Summary

DEVELOPMENTS IN TRAVEL ANDIMPLICATIONS ACROSS SECTORSImpact and trends in travel and tourismImplications from travel recovery for all sectorsCopyright 2021 by Boston Consulting Group. All rights reserved. Updated 19 May 2021 Version 11.1.BCG ExecutivePerspectivesAGENDAUPDATED ANALYSES AND IMPACTEpidemic progression and virus monitoringEconomic and business impact3

There have been major disruptions to travel and tourismJob lossBusiness travelTourismAirlines- 4.5T 62M92%74%26%GDP loss in 2020from COVID-19impacts on traveland tourismOf all companiescontinue tosuspend most orall internationalbusiness travelas of May 2021Decrease in globalinternationaltourist arrivalsfrom 2019 to 2020Of all planes ownedby airlines are stillin storage as ofJune 2021Sources: WTTC, GBTA, UNWTO, CiriumEstimated jobslost in travel andtourism sectorglobally4Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0Economic impact

1A Travel and tourism trends Travel demand is increasing, butrecovery will vary by country and is tied to vaccine progress(January – April 2021 comparedwith January – April 2019)Countries that have seen better COVID-19 vaccineprogress are seeing faster travel recoveryGrowth in relative ticket volumes, 2021 vs 2019 over time(baselined to Jan 31, 2021 as 0%), destination data400%200%100%Israel 393%Vaccine dosesadministered perperson by Apr. 41.20.9 dosesadministeredper personBooking strength inIsrael up almost 400%vs. end of JanuaryUS 59%0%-100%Jan 24EU -20%Feb 7Feb 21Mar 7 Mar 210.50.2Apr 4With just 4% of Indonesians fully vaccinated and doses secured for only 80% of the population by 2022,tourist destinations such as Bali will see a slower return of travel1. Carrying capacity based on a measurement of ASKs or available seat kilometers for domestic and international arrivals, comparing 2019 and 2021 dataSources: TRIP, ARC/IATA, Our World in Data5Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0Global airline capacity1down due to lower demand

1B Travel and tourism trends Expect high near-term demand inLeisure travel has near-term pent-up demandas consumers feel safe to resume travelBusiness travel recovery isslower with structural changesSome domestic markets have recovered to near 2019levels, especially on weekends and holidays when leisuretravel is prevalent50% of travel managers expectreduced travel budgets as theyadd greater flexibility forremote-working roles% of 2019 domestic airline ticketing volumes 1US May '21US MemorialDay Weekend '2174%90%Other consumers are eager to travel soon: 56% rankedleisure travel among their top post-vaccination activities,second only to seeing family and friends1. As of May 2021Sources: BCG COVID-19-related measures survey of 300 global companies, TRIP, ARC/IATA, GBTA (April 2021), BCG analysisNew reasons for travel asremote and hybrid workersgather for training andaffiliationMost companies do not expectto return to full businesstravel until 2023 6Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0leisure travel with potential structural changes in business travel

Travel and tourism trends Consumers are calling for increasedsustainability as travel industry responds with initiativesTravelers who are looking formore green-friendly travel brands:68%The travel and transportation industry isresponding with sustainability initiativesMost major airlines have committed to net-zeroemissions by 2050 and are exploring sustainableaviation fuels (SAFs) to comply with new regulations 30% of global rail track systems have been electrified,and this is expected to grow to 40% in the next 5 yearsConsumer preferences will have impactson both leisure and business travelSources: SCI Verker Gmbh, American Express Global Travel Trends Report (March 2021), press search, CLIAThe cruise industry has already invested 24Bin sustainable ships, with a target of 40% reductionin carbon emissions by 20307Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.01C

Implications for all companies Prepare for volatilityfrom consumer spending shifts with demand sensingWhile leisure travel decreased, other consumer areas increased during pandemicLargerchangeduringCOVID-19Short-term spikesStructural changesCOVID-safehome renovationNew e-commercehabitsEarly pandemicgrocery panicSustainedpet care productsDemand sensingEXAMPLESSpending will begin to shift backfrom some categories as travelresumes and public spaces openGreater lasting impact on industryCompanies can prepare for volatility from demand fluctuations by bolsteringdemand-sensing capabilitiesCompanies must gather and analyze data from a variety of first- and third-party sources, suchepidemiological data; this information can provide indicators to support agile planningDemand sensing –lessons from travelThe travel sector facedmassive volatilityswings throughout thepandemic; increasingaccuracy of demandforecasts is importantto react quickly tochangesExample: Car rentalcompany implementeda real-time demandforecasting platform1and boosted demandsensing accuracy by30 ppFor example, products and investments (e.g., sales team deployments) can be adapted based ontrend shifts; supply chains and operations can also be optimized to scale up and down rapidly1. Using BCG Lighthouse real-time demand-forecasting platformSources: BCG and Skift, How the Disruption of Air, Cruise, and Hotel Capacity Created Unique Opportunities article (April 2021), press search, BCG Lighthouse, BHI, BCG case experience8Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0Consumer spending shifts2A

Implications for all companies Update business traveloperating model to account for hybrid and remote workTravel changes impact the future of work and how business relationshipswill be conductedBusiness travel in the future may look different: Duration will shift away from short, repeated trips Rationale includes bringing distributed/remote teams together for rapport and training Companies must be more flexible and change their business travel operating model42%Business travel management has shifted, and some fundsreallocated may not return as travel resumesof companies in May2021 plan to resumedomestic businesstravel in near future,up from 28% in March1Companies can update their business travel operating model:Train travel managersto manage new risks1. GBTA survey, (n 457-486 in May and N 253-362 in March)Sources: GBTA survey (March and May 2021), BHI, BCG case experience and analysisReassess baseline ofbusiness travelspendingImpact on future ofwork from businesstravel changesCompanies haveopportunity to develophybrid (onsite andremote) work model:Favor simplicity –focus on 2-3 mostrelevant models thatsupport businessobjectivesBiggest success factoris to test and learn.Pilot different modelsand test for 3-6 mo. tolearn and refineProvide cloud-based,integrated solutions9Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0Travel operating modelFuture of business travel2B

Implications for all companiess Improve business travelsustainability by reducing footprint and engaging suppliersClimate considerations are increasingly important; improving business travelsustainability can be a key part of a company’s broader sustainability plan50%of organizationsplaced higherpriority on travelsustainability inpast 12 months1Steps for companies to optimize travel carbon footprint: Develop a realistic net-zero pledge or emissions goal Invest in online tools that measure or estimate emissions Decide how to reach the reduction goal(e.g., reduce trips, optimize meeting locations)Engaging business travel suppliers (e.g., airlines, hotels, travel managementcompanies) in climate efforts can make a difference1Pressure from corporatecustomers can be effective2Emissions transparency isdifficult, but important to ask for3Sustainability efforts– examples:Technology companyshares sustainabilityinitiatives withtravelers and ispushing hotels toprovide better dataand emissionsreduction targets11 large corporationspartnered with a globalairline to acceleratesolutions thatdecarbonize aviationby allowing partners topay additional for SAF3TMCs2 can help push greeninitiatives and gather data1. Business Travel News (BTN), 2021, Sustainable Business Travel Survey, based on 315 buyer respondents (Feb – Mar, 2021). 2. Travel management companies. 3. Sustainable aviation fuelSources: Business Travel News, press search, BCG case experience10Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0Supplier engagementBusiness travel sustainability2C

Implications for travel companies Take opportunity to double down onchanges accelerated by COVID-19 and reset traditional approachesA. CUSTOMERS AND REVENUEB. COST AND OPERATIONSSafety and hygieneDemand sensingSustainabilityNew coststandardsAgileplanningContinue upholdingCOVID-19 safetystandards and encouragepractices such as hygiene,vaccination, etc. Adaptbusiness offeringsaccordinglyContinue to refineoperational andcommercial demandsensing platforms.Develop omnichannelcapabilities that supportcustomer loyaltyPush current status quo insustainability and makelonger-term investmentsthat lead to step-changeimprovements. Explorenew innovations andpartnershipsInstitutionalize lastingcost structure changesbrought on by COVID-19(e.g., organization andstaffing models, capitalassets) and establishnew baselinesInvest in digital andorganization capabilitiesthat allow for quick andaccurate planning forany possible scenarioand scaling up or downof operations as neededLodging company expandedofferings in remote locationsthat facilitated distancing,surpassing even 2019 salesTravel distributors areincreasingly integratingonline and offline offerings(e.g., use digital to upsell)Airline replicates sharkskinaerodynamics in coatingtechnology to boost fuelefficiency of cargo jetsMany ships in cruise industrywere scrapped or sold.Opportunity to buy modernships with better unit costsAirline implemented toolusing 1st- and 3rd-partydata to estimate staff needsfor up to 100 day-ofscenariosSources: BCG case experience and analysis, press search11Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.03

Mixed travel recovery sentiments across the world as certain regions look toreopen while others remain controlled; various tactics explored in recoveryAs of 27 May 2021May 27, 2021May 26, 2021EU governments agreed to allowquarantine-free travel for vaccinatedtourists from select countriesIsrael welcomes first tour group sincethe onset of the pandemic"Fortress Australia": Calls to open upborders are meeting resistanceMay 4, 2021May 24, 2021May 14, 2021G20 nations representing world'slargest economies support vaccinepassportsWith Tokyo Olympics less than 2months away, U.S. warns Americansnot to travel to Japan as cases increaseSingapore-Hong Kong travel bubblelikely delayed as COVID-19 restrictionstightenMay 18, 2021Dubai targets over 5.5 million overseastourists this year as more restrictionsare easedMay 21, 2021Virtual tourism can help rebuild travelfor a post-pandemic world12Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0May 19, 2021

BCG ExecutivePerspectivesImpact and trends in travel and tourismImplications from travel recovery for all sectorsAGENDAUPDATED ANALYSES AND IMPACTEpidemic progression and virus monitoringEconomic and business impact13Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0DEVELOPMENTS IN TRAVEL ANDIMPLICATIONS ACROSS SECTORS

Summary dashboardAs of 01 June 2021Epidemic ProgressionConsumer ActivityBusiness ImpactGlobal epidemic snapshotMobilityStock market performance172M13.6M3.7M2B# ofcases# ofactive cases# offatalitiesVaccine dosesadministeredMonth-onmonthgrowth ofnew 7x1.3x0.9x0.4xAsia30.9x1.7x3.3x1.0xEconomic ImpactIMF4 (Apr '21)GDP forecasts (YoY%)2021EuropeUSJapanChinaIndia0 24 64.4%Banks58 10 12 14 16 18 206.4%3.3%8.4%12.5%Mobility6(month vs.Jan '20)Domestic airtravel ticketsbooking7,8 7%-12%Month end vs. 02 Jan -12%CHN a56%26%34%US595961Germany616766China515251Steel production 138%157%SalesRetailgoods sales9(excl. auto &fuel, %China397%75%9%Volatility Index(S&P500)13International tradeTrade value14(YoY)Industrial productionPurchasingmanager’sindex15(base 50)1. Calculated as 7-day rolling average; 2. Calculated as monthly average of daily cases vs. previous month; 3. Includes Middle East and Oceania; 4. IMF Apr 2021 forecast; 5. For India, forecast is for financial year; for others, it is for calendar year; YoY forecasts; range from forecasts (where available) of World Bank, International Monetary Fund, JP Morgan Chase; Morgan Stanley; Bank of America;Fitch Solutions; Credit Suisse; Danske Bank; ING Group; HSBC; As of reports dated 08 June 2020 to Mar 01 2021; For India's GDP forecast, World Bank's 2020 forecast from 08 June provides the upper bound of the forecast range; 6. Mobility values are calculated as the average of mean monthly mobilities in workplace, public transit, retail & recreation, and grocery & pharmacy and compared to abaseline from 03 Jan – 06 Feb 2020; Europe mobility values are calculated as the average of Germany, France, UK, Spain, and Italy; 7. Calculated as change in last 14 days rolling average value as compared to same period last year; 8. As of 01 Mar 2021; 9. Retail goods sales include online & offline sales and comprise food & beverages, apparel, cosmetics & personal care, home appliances, generalmerchandise, building material; do not include auto, fuel & food services; 10. Europe includes 27 countries currently in EU; 11. For China, Jan & Feb are reported together due to National Holidays. 12. Figures represent passenger vehicle (including sedan, hatchback, SUV, MPV, van and pickup) sales data for over same month in previous year; Europe value calculated as cumulative sales inGermany, France, UK, Spain, and Italy; 13. Underlying data is from Chicago Board Options Exchange Volatility Index (VIX); Volatility Index is a real-time market index that represents the market's expectation of 30-day forward-looking volatility and provides a measure of market risk and investors' sentiments; 14. Calculated as sum of imports and exports, measured in USD and compared toprevious year period; EU trade values between EU and all outside countries 15. PMI (Purchasing Manager's Index) is a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding ( 50), staying the same (50), or contracting ( 50); 16. Data corresponds to G-20 countries (minus Indonesia). Sources: JHU CSSE, Our World in Data, WHO, World Bank,IMF, Bloomberg, Google Mobility, US Census Bureau, Eurostat, PRC National Bureau of Statistics, ACEA actuals, Marklines, ARC ticketing data, STR, Statista, CBOE, OECD, BEA, GACC (customs) China, ONS, BCG14Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0To be updated in forthcoming editions

Case counts reduced as vaccine rollout continues, especially inNorth America and EuropeEpidemic ProgressionAs of 01 June 20211,000,000India drovemassive surgein new casesand recentSouthdecline in fricaNorthAmericaSouth AmericaNorth AmericaAfricaEurope200,0000Mar Apr May JunJulAug Sep Oct Nov Dec Jan Feb Mar Apr May JunMonth-onmonth growth 215% 15% 50% 60% 10% 10% 40% 45% 10% 0% (40%) 20% 60% (15)%of new cases21. Includes Oceania (Australia, New Zealand, Papua New Guinea and surrounding island nations of the Pacific ocean); 2. Calculated monthly as average of daily cases comparedto previous month daily cases and rounded to nearest 5%. Sources: Johns Hopkins CSSE; Our World in Data; Worldometer; press search; BCG172M# of confirmed cases13.6M# of active cases3.7M# of fatalities15Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0Key observationsDaily new cases (7-day rolling average)

Despite progress on vaccination across the world, caution required asconcerning variants spread among immune-naïve populationTime series view of variant frequencyVariants of concern compared with wild type4 variants of concern are 80% of sequenced samplesRelative antibody resistance10010.0x80B.1.351(South Africa)B.1.351 – 6%60B.1.1.7 – 48%40(India)P.1 (Brazil)P.1/P.2 – 7%2019A20C20G19B20D20H/501YV2/B.1.35120A20E (EU1)20I/501YV1/B.1.1.720B20F20J/501YV3/P.1 B.1.617 – 17%Jan-200B.1.61721A/B.1.617B.1.1.7Wild type1.0x(UK)1.5xLikely range(Originally detected)2.0xRelative transmissibilityNote: Several of the concerning variants (e.g., those first identified in the UK and South Africa) share mutations (e.g., N501Y) while also having distinct mutations (some more than others)Sources: JAMA, Nextstrain, Financial Times, Virological; Centers for Disease Control and Prevention; cov-lineages.org, Lancet Infectious Diseases, press search; Axios variant tracker; Nature16CopyrightCopyright ated1030JuneApril20212021VersionVersion2.02.0As of 23 May 2021

COVID-19 has broad geographic reach today with countriesat different stages in their fightNon-exhaustiveContinuationResurgenceCurve was never quite flattened; ongoing battleCurve was flattened but saw one or more resurgencesDaily new confirmed cases per million1Daily new confirmed cases per million11,0005000Mar ‘20Jun ‘20Sep ‘20ArgentinaDec ‘20BrazilMar ‘21Jun ‘21Jun ‘20UAEFranceCrush and containSep ‘20Dec ‘20SwitzerlandGermanyMar ‘21Jun ‘21SpainVaccinatedCurve was flattened and case counts continue to remain lowDaily new confirmed cases perMar ‘20million1Curve reduced through vaccination progressDaily new confirmed cases per million11,0005000Mar ‘20Jun ‘20AustraliaSep ‘20Singapore1. Data shown as 7 day rolling average of daily new cases per millionSources: Our World in Data; BCGDec ‘20JapanMar ‘21South KoreaJun ‘21Mar ‘20Jun ‘20Sep ‘20USDec ‘20UKMar ‘21Jun ‘21Israel17Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0Epidemic ProgressionAs of 01 June 2021

Many large economies expected to continue recoveryand reach 2019 GDP levels between 2021 and 2022Economic ImpactAs of 01 Jun 2021GDP forecast levels indexed to 2019 value (Base: .492103.892.092.690.4882021 forecastvs. 2019201920202021202299-104%2019 GDP levels (Index)201920202021202296-98%Forecast IMF (Apr 6, 2021)20192020202120222019107-115%Forecast World Bank (Jan 5, cast range from leading banks2Note: As of reports dated 08 June 2020 to 01 Mar 2021, YoY forecast 2020 values are estimated actual GDP; 1. For India, forecast is for financial year; for other countries, the forecast is for calendar year; 2. Rangefrom forecasts (where available) of JPMorgan Chase; Morgan Stanley; Bank of America; Fitch Solutions; Credit Suisse; Danske Bank; ING Group; HSBC; Sources: Bloomberg; World Bank; IMF; BCG18Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0US

Retail and recreation mobility recovered fastest;public transit mobility remains lower in most countriesEconomic ImpactAs of 31 May 2021Workplace1, public transit2, and retail and recreation3 mobility compared with baseline of January 2020 to February 0AustraliaAug20Nov20Feb21May21ItalyFeb20Workplace mobilityRetail and recreationLockdown y21South KoreaMay20Aug20Nov20Feb21May21SwedenPublic transit b201. Tracked as changes in visits to workplaces; 2. Tracked as changes in visits to public transport hubs, such as underground, bus and train stations; 3. Tracked as changes for restaurants, cafés, shopping centers, theme parks,museums, libraries and cinemas; 4. Refers to average lockdown start and easing dates for larger lockdowns; Note: Data taken as weekly average compared with baseline (average of all daily values of respective weeks duringFeb 15 2020–Feb 28 2021); Sources: Google LLC "Google COVID-19 Community Mobility Reports". https://www.google.com/covid19/mobility/ Accessed: 01 Mar 2020; Press search; BCG19Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0US

Manufacturing PMI recovery globally indicates continuedpositive momentumEconomic ImpactAs of 01 June 2021Manufacturing PMI before, during, and after the crisisChina1127 10 112 3 3 4 2 3 5MayAprMarJan1 ovOctSepAugJulyJunMayAprJapan1. Lockdown dates are only pertaining to Hubei province; Note: PMI (Purchasing Manager's Index) is a diffusion index that summarizes whether market conditions, as viewed by purchasing managers, are expanding,staying the same, or contracting. 50 is neutral, 50 is considered to be positive sentiment and 50 is considered to be negative sentiment; Sources: Markit South Korea Manufacturing PMI SA; Jibun Bank JapanManufacturing PMI SA; China Manufacturing PMI SA; Swedbank Sweden PMI SA; Markit/BME Germany Manufacturing PMI SA; Markit Italy Manufacturing PMI SA; Markit US Manufacturing PMI SA; DecOctNovSepAugJun-12Aug-8-0.2-2 -1 -1-5 -3July-24 31 30FebNeutrallevel 50-5JulyAprMay-7-10-1315 13 12 14 19 16Jun6 9 102 4MarLockdown easing15 5 5 41 3 3 trallevel 50Lockdown started2 2-2 0-6 -8 -9 -7 -3Sweden 0Neutrallevel 50-5 -3MayMar-10-14 to 02 11 1 1 1 1South KoreaNeutrallevel 50-29 to -15220Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0AprItaly -30Neutrallevel yFebMarJanDecOctNovSepJulyAugJun17 16 14-5-5-16 -13-10MayApr-141 2116 8 8 8 7Apr0-2MarNeutrallevel 50Mar11 127 7 9 9 93331MarNeutrallevel 50AprGermanyUS

Monthly passenger vehicle sales showpromising upward trendsEconomic ImpactAs of 01 June 2021Monthly passenger vehicle1 sales, YOY % change vs. past yearSweden26%AprFebJanDecNovOctSepAugJuly6%7% 10% 7% 1% bApr-13%-15%-29%-23% -15%-45%JanDecNov21%0% 7%11%9%-6%-14% -35%OctSepAugJulyJunMayLockdown easing-7% -20%-38%-26%-50%AprLockdown started nMayApr13% 14%-7% -14% -11%-14%-23% -8%-97% -48%-14% to 0%47%Dec2% 9% 1%-29% to -15%9%South Korea32,646%461 -30%75%1. Passenger vehicle sales includes data on, where available, hatchback, MPV, pickup, sedan, SUV, mini trucks, light trucks, and vans; 2. Stimulus policies: Launched subsidies for car purchases in 10 cities, lessened purchase restriction in high tiercities and extended NEV subsidies; 3. South Korea's growth in auto sales from Mar through June 2020 is supported by recent tax cuts for individual consumption goods (e.g., cars), several carmakers (e.g. Audi, VW) launching new models and theincreased appreciation by the Koreans of cars as a safe mode of transport and as a travel alternative for camping during COVID-19, supported by recently passed legislation to allow a variety of different cars to be modified into 'camping cars'Sources: Marklines; BCG21Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version yAprFebJan397%12%14%11%11%10%9%9%6% 28%1%-5% -20% -4% -3%-31% -19%-49%-32%-61%-3% -13%DecNov36%10%8%Apr6%-14%OctSepAugJul-12% -20%-26%JunMayApr-47% -30%90%113%61%Mar6% 1%China2MarGermanyMayUS

Retail goods sales (excluding auto and fuel) have grown comparedwith pre-COVID-19 levels in most countriesEconomic ImpactAs of 01 Jun 2021Retail goods sales include online and offline sales and comprise food and beverages, apparel, cosmetics andpersonal care, home appliances, general merchandise, building material; do not include auto, fuel, and food 21Mar'21Apr'21US1%-15% -4%3%4%5%7%6%5%2%10%6%19%-UK2-5% -18% -9%1%3%5%6%8%5%6%-4%-2%8%38%Spain-13% -29% -18% -5%-3%-3%-3%-2%-5%-1%-9%-6%13% %7%1%14%5%8%-3%5%6%10% 13% 18%-12% an1%-6%-29% to -15%34%3%5%-14% to 0%7%34% 18%4%9% 0%1. Retail goods sales categorization may be different across countries; seasonally adjusted values taken; country-specific categorization; 2. UK figures includes total retailsales excluding automotive fuels sourced from Office for National Statistics United Kingdom as data is no longer reported in Eurostat after Brexit 3. For China, Jan & Feb 2021are reported together due to national holidaysSources: US Census Bureau; PRC National Bureau of Statistics; Eurostat; Office for National Statistics United Kingdom; Ministry of Economy JapanRetail goods sales haverebounded with YoY growthseen in most countriesUS has seen consistentretail sales growth sincemid 2020China has seen very strongretail growth in 2021compared YoY with earlymonths of 2020, when it hadstrict lockdownsSome European countrieshave seen retail sales dipscoinciding with increasedcases and lockdowns22Copyright 2021 by Boston Consulting Group. All rights reserved. BCG Executive Perspectives updated 10 June 2021 Version 2.0Growth of retail goods sales (excluding auto and fuel)1, YOY % change vs. same month past year

DE-AVERAGED VIEWRetail store sales in China have rebounded across categories;apparel sales continue to be impacted in other countriesAs of 01 Jun 2021Economic ImpactFood and beverage storesPersonal care and cosmetics storesJan Feb Mar Apr'21 '21 '21 '215% 2% 5%-USJan Feb Mar Apr'21 '21 '21 '2112% 11% 10% 10% 10

as consumers feel safe to resume travel. Travel and tourism trends Expect high near-term demand in leisure travel with potential structural changes in business travel . Some domestic markets have recovered to . near 2019 levels, especially on . weekends and holidays . when leisure travel is prevalent . 1B. Business travel recovery is

May 02, 2018 · D. Program Evaluation ͟The organization has provided a description of the framework for how each program will be evaluated. The framework should include all the elements below: ͟The evaluation methods are cost-effective for the organization ͟Quantitative and qualitative data is being collected (at Basics tier, data collection must have begun)

Silat is a combative art of self-defense and survival rooted from Matay archipelago. It was traced at thé early of Langkasuka Kingdom (2nd century CE) till thé reign of Melaka (Malaysia) Sultanate era (13th century). Silat has now evolved to become part of social culture and tradition with thé appearance of a fine physical and spiritual .

On an exceptional basis, Member States may request UNESCO to provide thé candidates with access to thé platform so they can complète thé form by themselves. Thèse requests must be addressed to esd rize unesco. or by 15 A ril 2021 UNESCO will provide thé nomineewith accessto thé platform via their émail address.

̶The leading indicator of employee engagement is based on the quality of the relationship between employee and supervisor Empower your managers! ̶Help them understand the impact on the organization ̶Share important changes, plan options, tasks, and deadlines ̶Provide key messages and talking points ̶Prepare them to answer employee questions

Dr. Sunita Bharatwal** Dr. Pawan Garga*** Abstract Customer satisfaction is derived from thè functionalities and values, a product or Service can provide. The current study aims to segregate thè dimensions of ordine Service quality and gather insights on its impact on web shopping. The trends of purchases have

Chính Văn.- Còn đức Thế tôn thì tuệ giác cực kỳ trong sạch 8: hiện hành bất nhị 9, đạt đến vô tướng 10, đứng vào chỗ đứng của các đức Thế tôn 11, thể hiện tính bình đẳng của các Ngài, đến chỗ không còn chướng ngại 12, giáo pháp không thể khuynh đảo, tâm thức không bị cản trở, cái được

Le genou de Lucy. Odile Jacob. 1999. Coppens Y. Pré-textes. L’homme préhistorique en morceaux. Eds Odile Jacob. 2011. Costentin J., Delaveau P. Café, thé, chocolat, les bons effets sur le cerveau et pour le corps. Editions Odile Jacob. 2010. Crawford M., Marsh D. The driving force : food in human evolution and the future.

Le genou de Lucy. Odile Jacob. 1999. Coppens Y. Pré-textes. L’homme préhistorique en morceaux. Eds Odile Jacob. 2011. Costentin J., Delaveau P. Café, thé, chocolat, les bons effets sur le cerveau et pour le corps. Editions Odile Jacob. 2010. 3 Crawford M., Marsh D. The driving force : food in human evolution and the future.