Faster Payments 101 - NACHA

FasterPayments 101An Introduction to FasterPayments in the US

The term “faster payments” is broadly used in the payment industry to indicatesimply that increased speed, convenience and accessibility are essentialfeatures for the future of the payment and settlement system.Same day. Instant. Immediate. Real time. A wide variety of approachesto faster payments are emerging in the marketplace.The industry is taking bold steps to create faster, secure solutions for aThe Payments Innovation Alliance, comprised of a diverse membershipvariety of payments needs: new capabilities have been added to existingof corporates, third-party processors, fintechs and FIs, has created thispayment networks, fintech companies are introducing customer-facingeducational primer to impart some foundational understanding of fasterinterfaces that leverage these networks in new ways, and new rails arepayments and the momentum behind its adoption in the U.S. This resourcebeing created to meet the needs of today and the future.provides at-a-glance information allowing users to compare solutionsThe term “faster payments” is broadly used in the payment industry toindicate simply that increased speed, convenience, and accessibilityand provide resources for more information on how to assess the fasterpayments landscape.are essential features for the future of the payment and settlementFaster Payments 101 is a necessary precursor to the Faster Paymentssystem. In addition to the expedited movement and availability of funds,Playbook, currently under development by the Alliance, which will assistthe more efficient and transparent provision of information about theorganizations – both FIs and business end users – in determining whichtransaction is a key component of the faster payments value proposition.solutions may be best for them and/or their customers and how best toSince the launch of PayPal in 1998, other funds transfer solutions havedevelop a faster payments strategy.been introduced into the market by other providers such as VenmoWhile the Playbook is a deeper dive into faster payments, this introductory(acquired by PayPal in 2013), Cash App (formerly Square Cash), andtool is not just a primer, but it is also a call to action. While there isFacebook Messenger. While not initially instant (many of these solutionsno mandate to adopt a faster payments strategy, now is the time fornow are) and with delivery via app to customers’ mobile devices, adoptionorganizations to put aside any lingering anxiety about faster paymentsis significant and growing – particularly among younger consumers.so they can better plan for the future. Becoming fully informed about theIn addition, such faster payments solutions are gaining groundfaster payments landscape will help organizations to make decisions aboutwith businesses.potential investments in offerings that improve the customer experience.Now is the time for FIs of all sizes and types – including credit unions,community and regional banks – to become educated on this changingHaving their own strategies also will help organizations more proactivelysupport the faster payments needs of their business clients as well.environment and the faster payments options available to them, so theyThere are multiple departments within organizations that can benefit fromcan meet the needs of their customers. Likewise, it is important thatthis resource. This baseline tool is designed for everyone from the cornerbusinesses that sell products and services to consumers, as well as buyoffice to legal and compliance to operations to create further dialogue andfrom or sell to other businesses, understand the various faster paymentsexploration – and to ultimately propel the industry forward.solutions and how they can benefit their payables and receivables needs.* This tool is not intended to be exhaustive nor does it represent an endorsement of aparticular solution. Organizations will make decisions based on their own business needsand use cases.

Timeline ofPaymentMilestonesAdvancements in types of paymentsChecks – 1762: The first printed check. National Banking Act – 1863: The U.S. Congress passed the Act tocreate a national banking system and establish a national currency.Wires – 1872: The first widely used service for wire transfers was launched.are constantly evolving. As technologychanges so does the ability to make and Credit cards – 1950: The first universal credit card, which could be used atreceive payments. The timeline to the righta variety of establishments, was introduced by the Diners’ Club Inc.details major payment milestones since theinvention of the check. As noted, many ofthese solutions that might be considered“legacy” are actually fairly new entrants toACH Network – 1974: ACH Associations from California, Georgia, NewEngland and the Upper Midwest region formed Nacha to write and maintain therules for the Network.the payments ecosystem.Debit cards – 1984: The first nationwide debiting system was implemented,built on the credit card infrastructure and ATM networks already in place.Electronic check (E-check) conversion – 1998-2007:Federal ReserveActivitiesACH Network adopts the functionality of allowing paper checks to be converted intoan ACH debit.Check 21 Act – 2004: The Check Clearing for the 21st Century Act (Check21) is a federal law designed to enable banks to handle more checks electronically,2013: Federal Reserve issues PaymentsSystem Improvement PublicConsultation Paper for commentwhich makes check processing faster and more efficient.Same Day ACH – 2016: Same Day ACH goes live, enabling businesses andconsumers to send and receive payments and payment-related information on the sameday through the ACH Network. Additional enhancements are planned through 2021.2015: Federal Reserve issues Strategies forImproving the U.S. Payments System,leading to the formation of the FasterPayments Task Force2018: Federal Reserve announces formationof Faster Payments CouncilMasterCard MoneySend, RTP network, SHAZAMNetwork (faster payments), Visa Direct, Zelle – 2017ExcheQ – 2019

Steps in a TransactionConsiderationsConsumer/Business End-UserSupport Layer (mobile, online, app)What end-user portal or channel is supported?Can you reach all parties and is the sender of the payments always known?Authentication/AddressingHow is the initiator of the payment securely identified?How and on what channel is authorization/authentication recognized?Messaging and/orInformation with PaymentDo messages require instant acceptance and response?How much information is included directly with the payment and in whatformat is the information?Will the information be easily integrated into AR, AP or ERP systems?How will AR and AP flows and reporting be impacted by the receipt ordelivery of information?Is the amount and format of information adequate for corporate processing?Faster PaymentsMechanismWhat is the solution that moves the payment?What gateway processors support it?When are funds considered “good funds”?Funds PostingSettlement (ACH, distributedledger, Fed account)How soon is the payment available and when is it posted to therecipient’s account?When and how does settlement occur between the parties?Visit FasterPaymentsPlaybook.org for more information.

In addition to existing banking regulations,faster payments solutions are governed by rulesrelating to each individual mechanism.Same Day ACH is governed by the Nacha Operating Rules, buttransactions must also adhere to regulations such as RegulationE or UCC 4A. The Clearing House has Operating Rules andParticipation Rules for RTP transactions, but a series of ServiceLevel Agreements might exist between partners to the transactionand other regulations including Regulation E. Understanding howprivate sector rules interact with other banking regulations andthe roles and responsibilities of each party in the transaction mayimpact the decision to offer a specific solution. The chart below isnot exhaustive of the various rules and regulations for each solution,but provides an idea of what an institution should be aware of whenembarking on a faster payments strategy.Example Governance for Faster Payments MechanismsMechanismMain GovernanceSourceNachaSame Day ACHNacha Operating RulesRegulation E, UCC 4A, etc.The Clearing HouseRTP networkRTP Operating RulesRTP Participation RulesRegulation E, UCC 4A, etc.Service Level AgreementsZelle Operating RulesRegulation E, Service LevelAgreements, UCC 4A(for B2B transactions)Early WarningZelle Other Prevailing Lawsor Regulations

Comparing Attributes of US Faster Payments SolutionsThis represents a sample of the more commonly used faster payments solutions in the marketplace as of February 2019.Payment Type(Includes only monetarytransactions)NachaSame Day ACHDollar LimitsClearingMechanismPush, Pull 100,000ACH NetworkThe Clearing HouseRTP networkPush 25,000RTP Early WarningZelle PushVaries by FIACH Network,Debit Card NetworkVisa DirectPushP2P: 10,000Disbursements: 50,000Card NetworkMastercardMoneySend PushP2P: 10,000A2A: 25,000B2C: 50,000Debit Card NetworkPush, Pull 49,999Card NetworksPushVaries by FIACH NetworkSHAZAMNetworkExcheQ

Funds Posting:PaymentMessagingStandardAmount/Typeof Informationwith PaymentSettlementTimingReal TimeSame DayPrimaryGovernanceNacha, ISO 20022, XML, ASC X12 820,ASC X12 835, ASC X12 Data Segments,UN/EDIFACT, Nacha-endorsedbanking conventionsUp to 799,920 CharactersSame DayNacha Operating RulesISO 20022140 bytesImmediate24/7/365RTP Rules, Service LevelAgreementsProprietary, Nacha,Debit Card200 CharactersSame Day for Debit Card,1-2 Days for ACHZelle Operating Rules, CardAgreements, Service LevelAgreementsISO 8583Varies by CaseSame Day or Next DayVisa Operating RulesISO 8583Varies by CaseSame Day or Next DayMastercard Operating RulesISO 8583170 CharactersNext DaySHAZAM Operating RulesNachaStandard Nachainformation email/SMSSame Day or Next DayNacha Operating Rules

The Payments Innovation Alliance introduces theFaster Payments Playbook. The Faster PaymentsPlaybook will coach organizations on: Why a faster payments strategy is needed How to develop a strategy The consequences and opportunity costs of not developing a strategy How to implement a chosen strategy Handling operational and post-implementation challengesThe Playbook is both an educational and decisioning platform thatwill help FIs and corporates, as well as additional audiences, developa faster payments strategy – from concept to reality. The Playbookwill be a living resource that will change over time to reflect newdevelopments on the faster payments landscape.For more information on the FasterPayments Playbook initiative or to jointhe Project Team, -02 2021 Nacha. All rights reserved.

Nacha, ISO 20022, XML, ASC X12 820, ASC X12 835, ASC X12 Data Segments, UN/EDIFACT, Nacha-endorsed banking conventions ISO 20022 Proprietary, Nacha, Debit Card ISO 8583 ISO 8583 ISO 8583 Nacha Payment Messaging Standard Same Day Immediate 24/7/365 Same Day for Debit Card, 1-2 Days for

recognized and licensed providers of ACH education, publications and support. Regional Payments Associations are directly engaged in the NACHA rulemaking process and Accredited ACH Professional (AAP) program. NACHA owns the copyright for the NACHA Operating Rules & Guidelines. The Accredited ACH Professional (AAP) is a service mark of NACHA.

Oct 06, 2020 · ACH FILE . STRUCTURE NACHA File Layout Guide. ACH INPUT FILE STRUCTURE . The NACHA format is composed of 94 character records. All records and fields are required, except the record 7 - Entry Detail Addenda Record that is optional. RECORD TITLE RECORD TYPE CODE . File Hea

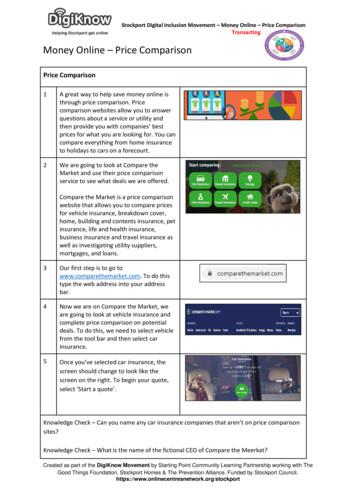

Same day electronic transfers - make same day electronic transfers for domestic transactions using Faster Payments. Future dated payments - create efficiency through control of your payments by setting them for the date they are due. Pre-fund your Sage Payments e-money account by Faster Payments, regular standing order or a one-off payment.

Airline Payments Airline Payments Handbook Thomas Helldorff Thomas Helldorff The Airline Payments Handbook : Understanding the Airline Payments World This book puts together "all there is to know about airline payments" into a single reference guide, helping you to answer some of the most prominent payments questions: How do payments work?

Verkehrszeichen in Deutschland 05 101 Gefahrstelle 101-10* Flugbetrieb 101-11* Fußgängerüberweg 101-12* Viehtrieb, Tiere 101-15* Steinschlag 101-51* Schnee- oder Eisglätte 101-52* Splitt, Schotter 101-53* Ufer 101-54* Unzureichendes Lichtraumprofil 101-55* Bewegliche Brücke 102 Kreuzung oder Einmündung mit Vorfahrt von rechts 103 Kurve (rechts) 105 Doppelkurve (zunächst rechts)

Concepts of Treasury Management Current Events in Payments Panel Cybersecurity Assessment Tools for the Non-IT Professional Demystifying Blockchain – Understanding Its Value Downstream Risk - Operational Risk Do You Really Understand the Nacha Operating Rules? Enterprise Risk

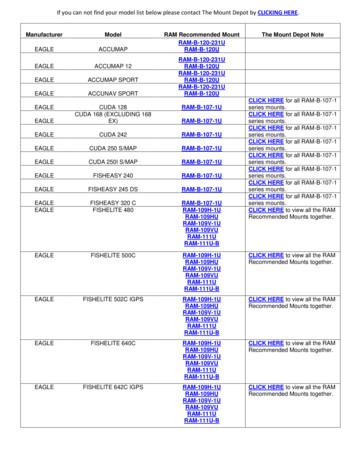

FISHFINDER 340C : RAM-101-G2U RAM-B-101-G2U . RAM-101-G2U most popular. Manufacturer Model RAM Recommended Mount The Mount Depot Note . GARMIN FISHFINDER 400C . RAM-101-G2U RAM-B-101-G2U . RAM-101-G2U most popular. GARMIN FISHFINDER 80 . RAM-101-G2U RAM-B-101-G2U . RAM-101-

ASME Materials Division 2019 Fall News 5 2019 Awards Nadai Medalist: The Nadai Medal is awarded in recognition of significant contributions and outstanding achievements which broaden the field of materials engineering. The 2019 Nadai Medalist is Ellen M. Arruda, Tim Manganello/ Borg Warner Department Chair of Mechanical Engineering, and the Maria Comninou Collegiate Professor of Mechanical .