Make Your Money Work For The Long Term.

Make your moneywork for the long term.Athene Performance Elite Fixed Indexed Annuity and Liquidity Rider(61689) headquarteredin WestDes Iowa,Moines,Iowa,whichissues annuitiesin 49This material is provided by Athene Annuity and Life Company headquarteredin West DesMoines,whichissuesannuitiesin 49 statesandstatesD.C.,(excludingand AtheneNY)and in D.C.Productsnot availablestates.Annuity& LifeAssuranceCompanyinofallNewYork headquartered in Pearl River, New York, which issues annuities only in New York. Products not available in all states.68000(09/01/21)

Athene — a different kind of company.At Athene Annuity and Life Company, a subsidiary of Athene Holding Ltd., weknow that unconventional times demand unconventional thinking. We’re driven todeliver innovative solutions that help you outperform in our increasingly complexfinancial world.A leader in annuities.The Athene group of companies embodies strength and stability, now and inthe future. Our drive, discipline and confidence can help you achieve more.Athene trades onthe New York StockExchange under thesymbol "ATH."One of the largest providers of fixed andindexed annuities in the United States.Founded in 2009.Through our acquiredcompanies, we haveserved customers formore than 100 years. 202.8 billion in total GAAP assets1 182.6 billion in total GAAP liabilities 18.7 billion in total GAAPAHL shareholders’ equityPlease refer to the back page for details.2Policyholder protectionis, and has always been,our first priority.Financial strength ratings2A.M. BestAS&PA FitchAA.M. Best 3rd highest of 16S&P 5th highest of 21Fitch 6th highest of 19

An Athene Performance Elite fixedindexed annuity may be right for youif you want GuaranteesTax DeferralYou can choose the certainty of a fixedrate of interest that is declared each yearby the insurance company and subjectto minimum guarantees. Your annuitywill always have a Minimum GuaranteedContract Value.Annuities provide the advantage of taxdeferred interest accumulation. Youdon’t pay taxes on any growth until youwithdraw money.2Growth PotentialYou can pursue additional growth withinterest credits that are based in part on theperformance of an external market index.A Premium BonusAthene Performance Elite annuities includea bonus that’s applied to the money youuse to purchase your annuity.1IncomeAt the annuity’s maturity date, you haveoptions to create a regular stream ofincome — either for a certain period of timeor for the rest of your life.A Death BenefitYour annuity can offer your loved ones aquick source of funds to settle matters afteryour death.3ProtectionThere is no direct downside market riskto your money.1A Premium Bonus is not available on Performance Elite 7. Premium Bonus annuities include a Premium Bonus Vesting Schedule and may include alower Cap Rate, lower Participation Rate or other limitations not included in similar annuities that don’t offer a Premium Bonus.2Current law already provides tax deferral to IRAs, so there is no additional tax benefit obtained by funding an IRA with an annuity. Consider the otherbenefits provided by an annuity, such as lifetime income and a Death Benefit.3After annuitization, payments will be consistent with the settlement option selected.3

Protect and grow yourretirement nest egg.Whatever life sends your way.The primary purpose of Athene Performance Elite fixed indexedannuities is to help you accumulate money for retirement.They feature a variety of interest crediting strategies that are designed togrow your money and help protect you from market downturns.But growing your savings doesn’t meangiving up access to your money.Athene Performance Elite Plus annuities include a Liquidity Rider, for anannual charge, that gives you additional flexibility should the need arise.Athene Performance Elite Plus also provides an enhanced Premium Bonus,which will give an immediate increase to your annuity’s Accumulated Value.Premium BonusThe Athene Performance Elite annuities include a Premium Bonus that iscredited at issue and provides an immediate increase to your annuity’sAccumulated Value.1The bonus and any earnings on the bonus are subject to a Premium BonusVesting Adjustment. See page 11 for additional information.14Premium Bonus not available on Performance Elite 7.

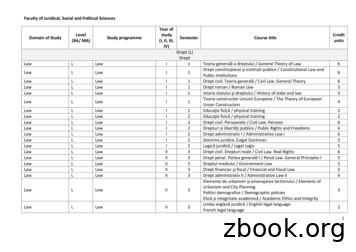

Athene Performance Elite annuities include:AtheneAthenePerformance Elite 7Performance Elite 10 & 15üPremium BonusConfinement Waiver of Withdrawal Charges(Not Available in CA & MA)üüTerminal Illness Waiver of Withdrawal Charges(Not Available in CA)üüFree Withdrawalsü 5% (Years 2 )üü 10% (Year 1 ) Required Minimum Distributions (Year 1 )Athene Performance Elite Plus annuities include:Rider ChargePremium BonusüAtheneAthenePerformance Elite 7 PlusPerformance Elite 10 & 15 Plus0.95%0.95%üüEnhanced Premium BonusConfinement Waiver of Withdrawal Charges(Not Available in CA & MA)üüTerminal Illness Waiver of Withdrawal Charges(Not Available in CA)üüüüüü Access to 20% free withdrawal if nowithdrawal taken prior yearüüReturn of Premium (After 4th contract year)üüEnhanced Annuitization(Not Available in CA or FL)üüFree Withdrawals Required Minimum Distributions (Year 1 )Enhanced Free Withdrawals 10% (Year 1 )Enhanced Liquidity5

Growing your money.Interest Crediting StrategiesStrategies are methods used to calculate how much interest, if any,will be credited to your annuity. Athene Performance Elite annuitiesallow you to allocate your money among one or more of theavailable interest crediting strategies. You can reallocate availablefunds at the end of each crediting period.Fixed Crediting StrategyThe fixed crediting strategy provides aguaranteed rate of interest that is used tocalculate and credit interest to your annuitydaily. Athene declares the guaranteed rate forthis strategy each Contract Year.Indexed Crediting StrategiesWith indexed crediting strategies, you receiveinterest credits that are linked in part to theperformance of external market indices.Interest you earn is credited at the end of eachIndex Term Period.Indexed crediting strategies offer twobenefits. You have the potential to earninterest credits that are based in part onthe growth of the market index. You’re alsoguaranteed to never earn less than 0%interest. So even though it’s possible that youmay have years when you have no interestcredited to your contract, you will not loseany money in your annuity due to marketlosses — even during economic downturns.In exchange for this protection, indexedcrediting strategies limit the interest rate youcan receive. The limit can take the form ofa Cap Rate or a Participation Rate. Athenedeclares the caps and participation rates atthe beginning of each term period.1Optional Strategy ChargeHigher Cap and Participation Rates areavailable with a strategy charge. AnnualStrategy Charges are calculated on thecontract anniversary and deducted monthlyfrom the Accumulated Value.2Strategy Charge CreditA one-time Strategy Charge Credit will beadded to the Accumulated Value at the endof the Withdrawal Charge Period, if the sumof all strategy charges applied, minus the sumof all interest credits, is greater than zero.3Please refer to the Product Guide for additional details and available index options.1Please see the Indexed Strategy Inserts provided with this brochure for more information. Note that Athene may add or eliminate indexedcrediting strategies from time to time. A specific strategy may not be available for the life of your contract.2Not available on the Fixed Strategy. The Initial Annual Strategy Charge Rate is set at contract issue and guaranteed for the first Index TermPeriod. A new Annual Strategy Charge Rate will be declared at the start of each Index Term Period.3The Strategy Charge Credit will be applied to the Accumulated Value pro-rata across all funded strategies. If withdrawals subject to aWithdrawal Charge are taken (including a full surrender), the Credit will not be applied.6

Athene’s indexed interest creditingstrategies feature the following benefits: Any interest earned is credited at the end of thecrediting period. Your interest credits are “locked in” once credited,and cannot be lost due to market downturns. Interest credits will never be less than 0%.Protection from market downturnsYour money is not directly exposed to the risks of the stockmarket or individual stocks. We guarantee you will not losemoney due to market risk or losses.7

Access your moneywhen you need it most.Annual Free WithdrawalsAthene Performance Elite annuities provide annual free withdrawal privileges. AthenePerformance Elite 7 annuities allow up to a 10% annual free withdrawal beginning in thefirst Contract Year. Athene Performance Elite 10 and 15 annuities allow up to 5% beginningin the second Contract Year.Each year, you may withdraw up to the maximum free amount of your annuity’sAccumulated Value (as of the most recent Contract Anniversary) without a WithdrawalCharge, Market Value Adjustment (MVA) or any Premium Bonus Vesting Adjustment,if applicable.1Required Minimum Distributions (RMDs) are IRS mandatory withdrawals required withqualified contracts (such as an IRA).2 These withdrawals from your annuity contract areconsidered part of your free withdrawal, free of Withdrawal Charges, MVA or PremiumBonus Vesting Adjustment for the Contract Year.Confinement WaiverAfter the first Contract Year, you can withdraw up to 100% of your annuity’s AccumulatedValue if you’ve been confined to a Qualified Care Facility for at least 60 consecutive daysand meet the eligibility requirements. No Withdrawal Charge or MVA apply if you qualifyfor this benefit.To receive the Confinement Waiver, you cannot be confined at the time your contract isissued and confinement must begin at least one year after the Contract Date.3Terminal Illness WaiverYou can withdraw up to 100% of your annuity’s Accumulated Value if you’re diagnosedwith a Terminal Illness that is expected to result in death within one year and you meet theeligibility requirements. No Withdrawal Charge or MVA apply if you qualify for this benefit.This waiver is available after your first Contract Anniversary and the initial diagnosis ofTerminal Illness must be made at least one year after the Contract Date.31Withdrawals and surrender may be subject to federal and state income tax and, except under certain circumstances, will be subject to an IRSpenalty if taken prior to age 59½. Withdrawals are not credited with index interest in the year they are taken. Withdrawals in excess of thefree amount are subject to a Withdrawal Charge, MVA and any Premium Bonus Vesting Adjustment which may result in the loss of principal.Withdrawals are based upon the Accumulated Value of the last Contract Anniversary.2The IRS requires individuals to take a required minimum distribution (RMD) each year once you reach age 72. The deadline for taking RMDsis December 31 of each year. You may delay taking your first RMD (and only your first) until April 1 of the year after you reach the requiredbeginning age. If you choose to delay your first RMD, you’ll have to take your first and second RMD in the same tax year. If an IRA owner failsto withdraw the RMD, fails to withdraw the full amount of the RMD, or fails to withdraw the RMD by the applicable deadline, the amount notwithdrawn is taxed at 50%.38This benefit is NOT long-term care insurance nor is it a substitute for such coverage. Not available in all states. Additional limitations,variations and exclusions may apply. Please see the Certificate of Disclosure for more information. Confinement Waiver not available in MA.Confinement and Terminal Illness Waivers not available in CA.

Athene Performance Elite Plusincludes additional liquidity features:Enhanced Free WithdrawalsOn Performance Elite 10 and 15, the free withdrawal amount is increased to 10% per year andmay be taken as early as the first Contract Year. If no withdrawals are taken in a given year, up to20% of the Accumulated Value is available for withdrawal in the next year.Return of Premium BenefitAfter the fourth Contract Year, the Cash Surrender Value will never be less than the premiumminus premium taxes (if applicable) and prior withdrawals, including Withdrawal Charges,Premium Bonus Vesting Adjustment and Market Value Adjustment on those withdrawals.Enhanced Annuitization1Performance Elite 7 allows Enhanced Annuitization after the fifth Contract Year. PerformanceElite 10 allows Enhanced Annuitization after the seventh2 Contract Year. Performance Elite15 allows Enhanced Annuitization after the ninth Contract Year. You may elect to surrenderyour contract and apply the Accumulated Value to one of five settlement options. NoWithdrawal Charges, Premium Bonus Vesting Adjustments or Market Value Adjustmentswill apply upon election of this feature, provided one of the Settlement Options is electedand annuity payments commence. Please refer to the Certificate of Disclosure for specificsettlement options.Rider ChargeThe Liquidity Rider included with Athene Performance Elite Plus annuity has a charge thatis deducted from your annuity’s Accumulated Value during the Withdrawal Charge period.A Rider Charge will be assessed when any of the following occur: when you reach the endof a Contract Year; when you take a withdrawal; on the Annuity Date; upon surrender; uponthe date of proof of death; or if the rider is terminated. The rider may not be terminatedduring the Withdrawal Charge period.12Not Available in CA or FL for Performance Elite 7 Plus, Performance Elite 10 Plus and Performance Elite 15 Plus.In MD, Performance Elite 10 allows Enhanced Annuitization after the sixth Contract Year.9

Options for annuitizationIn addition to periodic or free withdrawals, Athene Performance Eliteprovides you with options for annuitization.10Annuity Payout OptionsDeath BenefitWhen your annuity matures (on the AnnuityDate), Athene Performance Elite gives youoptions to receive guaranteed lifetime income(called annuitization). The payment amount willbe based on your annuity’s Cash SurrenderValue and the annuitization option you choose.These options can be based a set period oftime, your lifetime or the lifetimes of your andyour Joint Annuitant.The Athene Performance Elite annuities include aDeath Benefit. It guarantees that your beneficiarywill receive your annuity’s full AccumulatedValue, Minimum Guaranteed Contract Value orReturn of Premium Benefit (Performance ElitePlus only), whichever is greater.It’s important to note that once you choose toannuitize, the payment schedule and the amount isfixed and can’t be altered.After annuitization, payments will be consistent withthe settlement option selected made payable to yournamed beneficiary.The Death Benefit will be paid as long as youhaven’t annuitized your contract.

Product LimitationsAthene Performance Elite annuities are designed to help meet yourlong-term savings and retirement needs. They include a WithdrawalCharge period. If you withdraw more money than the free amountallowed by your contract, or if you surrender the annuity before theWithdrawal Charge period ends, a Withdrawal Charge, Market ValueAdjustment and Premium Bonus Vesting Adjustment (if applicable)will be applied.These charges do not apply to free withdrawals, RMDs, payments made in settlement of yourannuity’s Death Benefit or Confinement and Terminal Illness waivers.1 For more information, seethe Product Details Insert provided with this brochure.Withdrawal ChargeMarket Value Adjustment (MVA)If you surrender your annuity or withdraw anamount that exceeds the Free Withdrawalamount during the Withdrawal Charge period,you will incur a Withdrawal Charge. In part,Withdrawal Charges allow the company toinvest your money on a long-term basis, whichgenerally allows higher credit yields thanpossible with a similar annuity of shorter term.For more information, see the Product DetailsInsert provided with this brochure.1A Market Value Adjustment applies towithdrawals in excess of the free withdrawalamount and full surrenders during theWithdrawal Charge period. If you take anexcess withdrawal before the end of yourWithdrawal Charge period, an MVA will beapplied to that excess withdrawal. If interestrates in the market are higher than whenyou purchased your annuity, the MVA isnegative, meaning an additional amount isdeducted from your contract value. The MVAmay increase or decrease the amount of theWithdrawal or Cash Surrender Value of yourContract depending on the change in interestrates. If interest rates have increased, stayedthe same or decreased by less than 0.25%,the MVA will be negative. If interest rates havedecreased by more than 0.25%, the MVA willbe positive. MVA is not applicable in all states.3Premium Bonus Vesting AdjustmentWithdrawals or surrenders in excess of the FreeWithdrawal amount will result in the loss of aportion of the Premium Bonus, if applicable.The Premium Bonus Vesting Adjustment is apercentage of the annuity’s Premium Bonusand any earnings on the Premium Bonus. It willnot be applied in the event of the death of theAnnuitant or to any Free Withdrawal amount,including those elected under the Confinementor Terminal Illness Waivers, if applicable.21Withdrawals and surrender may be subject to federal and state income tax and, except under certain circumstances, will be subject to an IRSpenalty if taken prior to age 59½. Withdrawals are not credited with index interest in the year they are taken. Withdrawals in excess of the freeamount are subject to a Withdrawal Charge, MVA and any Premium Bonus Vesting Adjustment which may result in the loss of principal if takenwhile Withdrawal Charges apply.2Premium Bonus not available on Performance Elite 7.3For more information, please see Certificate of Disclosure or Form 17653, Understanding the MVA.11

1Athene Holding Ltd. GAAP total assets, AHL shareholders’ equity and liabilities asof December 31, 2020. Pledged assets and funds in trust (restricted assets) total 16.1 billion and net reserve liabilities of 145.0 billion as of December 31, 2020.Athene Annuity and Life Company (AAIA), on a statutory basis, based on the financialstatement as of December 31, 2020: Total Admitted Assets: 76.56 billion; TotalLiabilities: 75.25 billion; Reserves Required: Direct - 62.90 billion; Assumed- 0.20 billion; Ceded - 14.98 billion; Net - 48.12 billion; Capital & Surplus:Common capital stock - 0.01 billion; Paid-in and contributed surplus - 1.17 billion;Unassigned surplus - 0.13 billion; Total Capital & Surplus: 1.31 billion.Athene Annuity & Life Assurance Company of New York (AANY), on a statutory basis,based on the financial statement as of December 31, 2020: Total Admitted Assets: 3.53 billion; Total Liabilities: 3.21 billion; Reserves Required: Direct - 2.66 billion;Ceded - 2.24 billion; Net - 418 million; Total Capital & Surplus: 320 million;Securities Pledged as Collateral (Cash) 2.95 million.The individual subsidiary insurance company is responsible for meeting its ongoinginsurance policy and contract obligations. Athene Holding Ltd. is not responsiblefor meeting the ongoing insurance policy and contract obligations of its subsidiaryinsurance companies.2Financial strength ratings for Athene Annuity & Life Assurance Company, AtheneAnnuity and Life Company, Athene Annuity & Life Assurance Company of NewYork and Athene Life Re Ltd. A.M. Best, S&P and Fitch’s credit ratings reflect theirassessment of the relative ability of an insurer to meet its ongoing insurance policyand contract obligations. A.M. Best rating as of March 2021 (A, 3rd highest of 16),S&P rating as of May 2021 (A , 5th highest out of 21), and Fitch rating as of August2021 (A, 6th highest of 19). Athene Holding Ltd.’s credit rating is bbb /A-/BBB for A.M. Best, S&P and Fitch, respectively.Neither Athene Annuity and Life Company nor its representatives offer legal or taxadvice. Please consult your personal attorney and/or advisor regarding any legalor tax matters.Guarantees provided by annuities are subject to the financial strength and claimspaying ability of the issuing insurance company.Fixed indexed annuities are not stock market investments and do not directlyparticipate in any stock or equity investments. Market indices may not includedividends paid on the underlying stocks, and therefore may not reflect the totalreturn of the underlying stocks; neither an Index nor any market-indexed annuity iscomparable to a direct investment in the equity markets.Athene Performance Elite [GEN (09/15) NB, GEN10 (04/14), TBS15 (09/12)] AthenePerformance Elite Plus [BONUS (04/17)] and Enhanced Liquidity Rider [ICC15 PEPR(11/14)] or state variations issued by Athene Annuity and Life Company, West DesMoines, IA. Product features, limitations and availability vary; see the Certificates ofDisclosure for details. Products not available in all states.This material is a general description intended for general public use. AtheneAnnuity and Life Company (61689), headquartered in West Des Moines, Iowa,and issuing annuities in 49 states (excluding NY) and in D.C., is not undertakingto provide investment advice for any individual or in any individual situation, andtherefore nothing in this should be read as investment advice. Please reach out toyour financial professional if you have any questions about Athene products or theirfeatures.The term “financial professional” is not intended to imply engagement in anadvisory business with compensation unrelated to sales. Financial professionals willbe paid a commission on the sale of an Athene annuity.ATHENE ANNUITIES ARE PRODUCTS OF THE INSURANCE INDUSTRYAND NOT GUARANTEED BY ANY BANK NOR INSURED BY FDICOR NCUA/NCUSIF. MAY LOSE VALUE. NO BANK/CREDIT UNIONGUARANTEE. NOT A DEPOSIT. NOT INSURED BY ANY FEDERALGOVERNMENT AGENCY. MAY ONLY BE OFFERED BY A LICENSEDINSURANCE AGENT.This brochure contains highlights only — for a full explanation of theseannuities, please refer to the Certificate of Disclosure which provides moredetailed product information, including all charges or limitations as well asdefinitions of capitalized terms.For use in AK, AL, AR, AZ, CA, CO, CT, DC, DE, FL, GA, HI, IA, ID, IL, IN, KS, KY, LA, MA,MD, ME, MI, MN, MO, MS, MT, NC, ND, NE, NH, NJ, NM, NV, OH, OK, OR, PA, RI,SC, SD, TN, TX, UT, VA, VT, WA, WI, WV and WY.We are Athene. And we are relentless when it comes to creating aninnovative portfolio of fixed annuities to meet your accumulation andretirement income needs.Athene Annuity and Life Company7700 Mills Civic ParkwayWest Des Moines, IA 50266-3862At Athene, we see every day as a new opportunity to measure ourselvesagainst the best — and then we don’t stop until we’ve set the bar evenhigher. We stand ready to help you achieve more.Athene.com68000(09/01/21)

Athene Performance Elite annuities provide annual free withdrawal priv ileges. Athene Performance Elite 7 annuities allow up to a 10% annual free withdrawal beginni ng in the irst Contract Year. Athene Performance Elite 10 and 15 annuities allow up to 5% be ginning in the second Contract Year.

Bruksanvisning för bilstereo . Bruksanvisning for bilstereo . Instrukcja obsługi samochodowego odtwarzacza stereo . Operating Instructions for Car Stereo . 610-104 . SV . Bruksanvisning i original

10 tips och tricks för att lyckas med ert sap-projekt 20 SAPSANYTT 2/2015 De flesta projektledare känner säkert till Cobb’s paradox. Martin Cobb verkade som CIO för sekretariatet för Treasury Board of Canada 1995 då han ställde frågan

service i Norge och Finland drivs inom ramen för ett enskilt företag (NRK. 1 och Yleisradio), fin ns det i Sverige tre: Ett för tv (Sveriges Television , SVT ), ett för radio (Sveriges Radio , SR ) och ett för utbildnings program (Sveriges Utbildningsradio, UR, vilket till följd av sin begränsade storlek inte återfinns bland de 25 största

Hotell För hotell anges de tre klasserna A/B, C och D. Det betyder att den "normala" standarden C är acceptabel men att motiven för en högre standard är starka. Ljudklass C motsvarar de tidigare normkraven för hotell, ljudklass A/B motsvarar kraven för moderna hotell med hög standard och ljudklass D kan användas vid

LÄS NOGGRANT FÖLJANDE VILLKOR FÖR APPLE DEVELOPER PROGRAM LICENCE . Apple Developer Program License Agreement Syfte Du vill använda Apple-mjukvara (enligt definitionen nedan) för att utveckla en eller flera Applikationer (enligt definitionen nedan) för Apple-märkta produkter. . Applikationer som utvecklas för iOS-produkter, Apple .

money. The Young Money Media group includes YOUNG MONEY magazine, youngmoney.com and YOUNG MONEY Live campus events. Subscriptions YOuNG MONeY Magazine 10950 Gilroy rd. Suite D Hunt Valley, MD 21031 888-788-4335, ext. 7 subscriptions@youngmoney.com YOUNG MONEY Magazine (iSSN-1098-8300) YOUNG MONEY is designed to provide

The ability to manage money has to be learned, developed, and practiced on a daily basis. There are eight steps to successful money management: 1. Get organized. 2. Decide what you want to do with your money. 3. Look at all available resources. 4. Decide how much money you are worth. 5. Find out how much money you make. 6. Find out how much .

och krav. Maskinerna skriver ut upp till fyra tum breda etiketter med direkt termoteknik och termotransferteknik och är lämpliga för en lång rad användningsområden på vertikala marknader. TD-seriens professionella etikettskrivare för . skrivbordet. Brothers nya avancerade 4-tums etikettskrivare för skrivbordet är effektiva och enkla att