GST For Jewellers Frequently Asked Questions

GST For JewellersFrequently Asked Questions

1.What is GST?Ans- GST is an indirect tax which will eliminate various taxes like VAT tax,Excise, Service tax, Octroi, etc.2.From when will be GST implemented?Ans- GST is likely to be implemented from 1st July 2017.3.Is income tax required to be paid after GST?Ans- Yes, income tax is direct tax and GST is indirect tax, hence Income Tax willbe required to be paid even after GST.4.What will be the GST on Gold and Gold Jewellery?Ans- GST rate on gold jewellery is 3%. However jewellers have to pay 5% onmaking charges on making jewellery but will be able to recover only 3%. Inputcredit of 2% will be available as refund, on making charges, if any.2

5.What is difference between GST & VAT?Ans- Under VAT Act, VAT is paid on purchase of goods and collected on sale ofgoods. A business entity is required to pay VAT on difference between VATcollected & VAT paid. But under GST, Octroi, Service Tax, Excise, etc. will alsobe eliminated and will be subsumed with GST. Hence, under GST law, tax is to bepaid on sale of goods minus tax paid on purchase of goods.6.Is it necessary to enroll under GST?Ans- Yes, please take help of your CA & tax consultant to enroll under GSTimmediately.7.What is the turnover limit for registration under GST?Ans- Turnover limit for registration under GST is Rs.20 Lacs. However, for NorthEast States this limit is Rs.10 Lacs.3

8.Is “Karigar” required to take GST number?Ans- Yes, if his income from making his jewellery exceeds from Rs.20 Lacs perannum than he must obtain GST number.9.If a registered jeweler gets his job work done from outside “Karigar”than how GST will be applicable?Ans- If a “Karigar” is also registered under GST than he will recover GST onmaking charges from jeweler. But if “Karigar” is not registered than jewelers willhave to pay tax on making charges paid to “Karigar”.10. If the jeweler has its own manufacturing unit how GST will beapplicable?Ans- To run a manufacturing unit one is already paying GST for power bills,telephone bills, purchase of goods, rent, consultancy fees, etc.4

11. How the GST will be applied on repairing of jewellery?Ans- GST will be applied on repairing charges only. However if some gold isadded while repairing goods, GST is used to be paid on additional gold used forrepairing.12. A customer wants to exchange a coin/bullion into ornaments how GSTwill be applied?Ans- Since the customer is exchanging one product to the other; GST will belevied on full value of the product. If customer is unregistered, than jeweler willalso have to pay GST on bullion received from customer apart from payment ofGST on full value of product exchanged.13. How will GST apply if a customer wants to convert a chain to amangalsutra?Ans- Since original product is getting converted to different product, GST will belevied on full value of mangalsutra. However, if it is termed as repairs only thanGST will be payable on additional gold value and labour charges.5

14. Is it necessary to write making charges separately while raising invoiceto the customers?Ans- If the international standards are to be adopted making charges and wastagemust be written separately while rising invoice to the customer. However,government has stated that jewellery will be taxed at 3% and hence there is noneed to write making charges separately. However, we are seeking clarity on theseissue from government.15. Is it necessary to prepare voucher etc. while issuing goods to “Karigar”?Ans- Yes, otherwise goods can be confiscated.16.Sometimes, one “karigar” directly send goods to another “Karigar” inthat case is it necessary to prepare voucher etc.?Ans- Yes, otherwise goods can be confiscated.6

17. My man takes 20kg. Goods to different states of which he brings backsome goods and he sales some goods, how SGT will be levied?Ans- GST will be levied on all goods which are sold, but he cannot take goods toother states where you don’t have office and where you have not applied for casualtaxable number in that state.18. I have one shop/office in Mumbai and another shop/office in Surat howGST will be levied?Ans- While transferring goods from one office to another which is in differentstate GST will be levied. However, input credit for be same will be available.19. If the goods are transferred for exhibition to a different state how GSTwill be levied?Ans- GST is always levied on supply but when the goods are taken to theexhibition there is no supply hence, GST shouldn’t be levied but clarifications7

from government are required. Current law says that GST will be applicable formovement of goods from one state to another for trade fairs and exhibition.20. What precautions are required under GST?Ans- The violation of GST is subject to penalties and precaution hence it isimportant that GST is followed rigorously.8

21.Give an example of GST?AnsPurchase :PriceGST e Bill100018%180Total Rs.3110009680Sales:PriceGST RateGSTJewellery4500003%13500Total Rs.450000GST to pay to government:13500Rs.Sales –13500(-) Purchase –9680Pay Government -38209

22. Can a businessman sent goods on approval to customer?Ans – Yes, a businessman can send goods on approval for a six months periodand tax is required to be paid only when goods are approved by the customer.23. Will businessman be required to declare stock as on 30th June 2017 ifGST is implemented from 1st July 2017?Ans – Yes, stock is to be declared, within 90 days.24. Should job worker himself compulsorily registered under GST?Ans- Yes, he must get himself registered because if he is not registered tax is tobe paid by the jeweler for all job work done by job worker.25. Will VAT credit on old stock will be available?Ans- Yes, but old stock should not be more than one year old. Also the old stockmust be sold within 6 months to avail VAT credit of old stock.10

26. Will excise credit on old stock will be available?Ans- In my opinion if excise paid is 1%, than excise credit will not be available.27. What is reverse charge mechanism?Ans- When you purchase goods, or make jewellery or spend any expenditurethrough unregistered dealer, a registered jeweler is required to pay GST on reversemechanism.28. What is E- way bill?Ans – When the goods are transferred from one place to other, form one office toother, E- way bill must be prepared. The responsibility of preparing E- way billwill be of a person who is transferring the goods. E-way must be prepared onGSTportal where in EBM number will be allotted. If goods are found to bemovingwithout E-way bill same can be confiscated.11

29. Is E-way bill required to be paid by a job worker while sending goods tojeweler?Ans- Yes, E-way bill must be prepared.30. Is E- way bill required to be made while transferring goods forhallmarking or sending goods to job worker?Ans- Yes, E-way bill must be prepared.We request you to take advice of your tax consultant or Chartered Accountant in this regard.For anymore clarification you may contact our national secretary CA Surendra Mehta on9769078934 / 9820127931 or email your queries to surendramehta@ibja.in12

GST For Jewellers Frequently Asked Questions . 2 1. What is GST? Ans- GST is an indirect tax which will eliminate various taxes like VAT tax, Excise, Service tax, Octroi, etc. 2. From when will be GST implemented? Ans- GST is likely to be implemented from 1st July 2017. 3. Is income tax required to be paid after GST? .

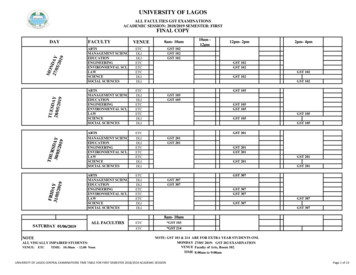

gst 201 8am- 10am gst 102 gst 102 gst 102 gst 105 gst 105 gst 105 12pm- 2pm gst 102 gst 102 gst 102 gst 105 gst 105 gst 105 y 9 arts management sciences education engineering environmental sci. law law science social sciences arts day faculty science social sciences arts management sciences

Budgeted balance sheet This budget is prepared using the asset, liability and owner’s equity accounts. If GST payable (on GST collected) is GST input tax credits (on GST paid), the net GST payable is shown as a current liability. If GST payable (on GST collected) is GST input tax credits (on GST paid), the net GST input tax

3. Implementation of GST And Acts of GST 4. Whom to Register under GST 5. Who is Exempted from Register under GST 6. GST Composition Scheme 7. Invoice and Its Format under GST 8. Bill of Supply and Its Format under GST 9. E – Way Bill under GST 10. Time of Supply under GST 11. Place of Supply of Goods

Frequently Asked Questions on Goods and Services Tax (GST) Q.1 What is Goods and Services Tax (GST) ? Ans. GST stands for Goods and Services Tax. GST will be a single destination based consumption tax that will replace existing taxes, including CENVAT, Octroi, Sales Tax, and Excise Duty, etc.

Frequently Asked Questions (FAQs) S. No. Questions Replies 1. What is the HSN Code and GST rate for lac or shellac bangles? Lac or shellac bangles are classifiable under heading 7117 and attracts 3% GST. 2. What is the HSN Code & GST Rate for kulfi? Kulfi is classifiable under heading 2105 and attracts 18%GST. 3.

GsT – COmpleTInG yOur ACTIvITy sTATemenT 5 01 TermS We uSe When we say: n sales, we are referring to the GST term supplies n purchases, we are referring to the GST term acquisitions n GST credits, we are referring to the GST term input tax credits n reporting period, we are referring to the GST term tax period

(Malaysia) BL 6 % Purchases with GST incurred but not claimable (Disallowance of Input Tax) (e.g. medical expenses for staff). GST Goods And Services Tax (Malaysia) NR 0% Purchase from non GST-registered supplier with no GST incurred. GST Goods And Services Tax (Malaysia) ZP 0% Purchase from GST-registered

Portland Cement (ASTM C150 including but not limited to: Type I/II Type III, Type V, and C595 Type IL; ASTM C 91 Masonry; ASTM C 1328 Plastic; Class G) Synonyms: Portland Cement; also known as Cement or Hydraulic Cement 1.2. Intended Use of the Product Use of the Substance/Mixture: No use is specified. 1.3. Name, Address, and Telephone of the Responsible Party Company Calportland Company 2025 .