Wealth Consilium

WealthConsiliumWealth stewardship advice for your familywww.consilium-llc.comWAre You thePicture of Wealth?hat doeswealthlook like?What doeswealth act like? Does itlook and act like YOU? Inthis article, we will examine what wealth looksand acts like. We’ll drawfrom the perspective ofwriters, researchers andthe wealthy.Let’s start with a basic question; do you think you arewealthy? It’s a worthwhilequestion because some wealthy people don’t thinkthey are wealthy.“According to a 2013 report by investment bank UBS, only28% of people with 1 million to 5 million in assets considered themselves wealthy. Even when you ask peoplewith more than 5 million in assets, only 3 in 5 considerthemselves wealthy.”—www.supermoney.comWhy do some wealthy people think they aren’twealthy? It is likely because they compare themselves1Source: 123RFto those with even more money. Wealth, like beauty,seems to be in the eye of the beholder.Despite that perspective, some have set levels ofincome or net worth they feel qualifies someone asbeing wealthy. UBS’s study, for example, used assetlevels from 1-5 million and 5 million and aboveas baselines. We’ll look at other measures of wealthcourtesy of an article appearing in www.supermoney.com, by Andrew Latham. We’ll begin with incomelevels.Wealth Consilium—December 2016

“According to the Tax Policy Center, in 2012, a household income of 208,810 would put you within the top5% richest households in the country. Getting into thetruly exclusive 1% group wasn’t so easy: you needed anincome of 521,411.”Some prefer a relative measure you could call“double whatever I make”. This supports our viewthat people tend to judge wealth by looking at thosewith more than them, not less. The “double whatI make“ definition is supported by several studies,including Spectrem Group’s 2008 and 2013 surveys.When people are asked how much it would take tobe rich, they tend to give a number twice as muchas their current income. If you make 50,000 a year,someone who makes 100,000 qualifies as rich. Ifyour annual income is 100,000, 200,000 is enough.If you’re worth 5 million, then 10 million is all itwould take, and so on.”pare it to income levels in about a dozen areas in theU.S. NYT Income ComparisonLikewise, you can take a global view of your rankingin the worldwide wealth picture by visiting Globalrich list This site will allow you to enter either your networth or your income level. You may find the resultssurprising.How did the wealthy get that way?The 2016 U.S. Trust wealth survey reveals that 52% ofwealthy people got their money by earning. Investments were cited as the 2nd highest driver of wealthcreation.Turning to net worth measures, we find in addition tothe UBS figures noted previously the following:“Leonard Beeghley, author of “Society in Focus”(2005), said, “top 5% of households or those with a networth—including home equity—of at least 1 million.”“Spectrem Investor Survey says, ”45% of investorsunder 40 felt 1 million was the threshold, but only 22%of investors older than 60 felt 1 million was enough tocall yourself rich.”Source: U.S. Trust Wealth SurveyDid the wealthy start life wealthy? No, nearly 60%started in the middle class. The percentage of thewealthy who started life poor and who started richwas not that different at 19% and 22% respectively.The 1% Club—“In the United States, it takes a household net worth of 6.8 million to join the much-maligned and admired 1% club.”Most writers and researchers seem to view the 1million-dollar mark in net worth as a sign a person iswealthy.So, are you wealthy? It turns out you can get a 3rdparty answer to that question. There are two onlinetools that will answer that question in a helpful, visualway. The first is found at the New York Times websiteand it allows you to plug in your income and com-2Source: U.S. Trust Wealth SurveyWealth Consilium—December 2016

Does Family Matter?According to the U.S. Trust survey, “Many of thewealthy grew up in strict but supportive households.Eight in ten describe their parents as firm disciplinarians who also encouraged individual interests andtalents. Nearly two-thirds say their parents weretolerant of their mistakes and failures. The three mostimportant values stressed in these families wereacademics (79%), financial discipline (68%) and workparticipation (63%). In light of these principles, it’s notsurprising that habits of financial responsibility wereadopted early in life—on average, the wealthy begansaving money at 14, and by age 15 were earningmoney for work outside the home.”Academic achievement was noted as a point ofemphasis in these families. Speaking of academicpursuits, per a joint study by Wealth Insight and EliteTraveler magazines, the following ten schools haveproduced more millionaires than any others: Harvard UniversityUniversity of PennsylvaniaStanford UniversityUniversity of OxfordUniversity of California, BerkeleyUniversity of Texas, AustinCornell UniversityPrinceton UniversityYale UniversityUniversity of MichiganSource: U.S. Trust Wealth SurveyHow to become a millionaireTen habits to becoming wealthyThe actor, comedian, and accomplished banjo playerSteve Martin once explained how to make thishappen. “Get a million dollars”, he advised. Comedyaside, how did the wealthy get that way? Did theyhave a secret formula hidden away somewhere likethe Kentucky Fried chicken recipe? Or were their keysto success in clear view for all to see?1. Forming good habits and practicingthem dailyAuthor Tom Corley has studied the habits of thewealthy and the poor. Corley shared his observations in his book Rich Habits; The Daily Success Habitsof Wealthy Individuals. He believes the following 10habits have helped the wealthy become wealthy:5. Devoting time each day to form lifelongrelationships2. Setting daily, monthly, yearly, long termgoals and focusing on them daily3. Engaging in self-improvement every day4. Devoting time each day to care for yourhealth6. Living each day in a state of moderation7. Accomplishing daily tasks each day, witha “Do it now” mindset8. Engaging in “rich thinking” every day9. Saving 10% of their gross income eachpaycheck10. Controlling their emotions and thoughtseach day3Wealth Consilium—December 2016

Corley dives even deeper by providing the followingbreakdown of the 1,440 minutes of the average successful person’s weekday:1,440 minutes of success 30 minutes or more engaged in reading for self-education for work or to helppursue a long-term goal, dream or majorpurpose. 30 minutes or more engaged in aerobicexercise. 15 minutes or more planning their day. 60 minutes dedicated specifically to pursuing a long-term goal, dream or majorpurpose. 70 minutes or less making phone calls,emailing, skypeing, etc. 420 minutes sleeping. 40 minutes networking, volunteering,relationship building. 500 minutes or more working. 75 minutes or less traveling for work. 75 minutes or less eating. 30 minutes dressing, bathing, etc. 10 minutes meditating.Both Corley and Siebold believe that there are differences in the way the wealthy think and act whencompared to those who aren’t wealthy.But what do wealthy people themselves attributetheir success to? According to the U.S. Trust WealthSurvey, they were “Shaped by a strong foundation intheir formative years, today’s wealthy are most likely toattribute their success to hard work (88%), personal ambition (77%) and their upbringing (69%). The importanceof hard work, discipline and achievement are consistentamong the wealthy — across generations, gender, anddiverse backgrounds.” 45 minutes dedicated to family 40 minutes running errands, recreation,cooking, home, miscellaneous.Author Steve Siebold in his book, How Rich PeopleThink, lays out 100 examples of the different thinkinghe found when studying the middle class and thewealthy (he describes them as world class). We share7 of these for your review:Source: U.S. Trust Wealth Survey4Wealth Consilium—December 2016

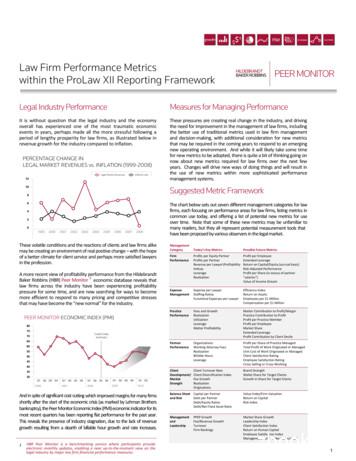

Champagne wishes andcaviar dreamsSome will recall that tagline from the 80’s TV show,“Lifestyles of the Rich and Famous”. So, are thewealthy spending all their money for bottles of DomPerignon and gold plated containers of Almas caviar(2.2 lbs. for just 25,000)?Per U.S. government expenditure surveys, thewealthy spend most of their money percentage wiseon their home/housing. In this way, they are not different from the non-wealthy. The following graphicillustrates where the money goes for the poor, themiddle class and the wealthy.So where do rich families differ from those with less?Per www.npr.org, “They are able to devote a muchbigger chunk of their spending to education, and amuch, much bigger share to saving for retirement.(The retirement line includes contributions to SocialSecurity and to private retirement plans, by the way.)”Has what the wealthy spend their money onchanged much over the years? According to DerekThompson’s 2014 article in www.atlantic.com, “Since1984, education spending has nearly doubled as ashare of a richer family’s budget.”While the percentage spent on housing is similarbetween rich and poor, the absolute dollar spent issignificant ” As a result, the top quintile outspendsthe bottom on housing by 21,000 a year (remember: that gap alone is basically the entire budget of alower-income family) and 13,000 more on transportation. “Source: www.atlantic.comSource: Bureau of Labor Statistics, Credit: Lam Thuy Vo/NPR5The Atlantic adds, “Reaching back to 1984, Healthcare spending and housing have also grown. By contrast,the portion of spending dedicated to things like reading,smoking, and clothes has declined rather significantly.“Wealth Consilium—December 2016

Michael Norton point out in their very useful book, Happy Money, money providesaccess to things—products, experiences,and services—that improve happinesslevels”. So David Lee Roth does have apoint.Raghunathan adds however that someresearch indicates that wealthier peopleare not happier. Why is that? “One reason is that wealth seems to make us lessgenerous, both in dollar terms and inbehavioral respects Researchers havetheorized that wealth makes us less generSource: www.atlantic.comous because it makes us more isolated—A Yacht Away from Happiness?and isolation also has a deleterious effect on happiness.So, does wealth bring happiness? It depends onWealth is isolating for both psychological and physicalwhom you ask. We’ll start with rock and roller Davidreasons. Psychologically, the acquisition of wealth—andLee Roth of Van Halen fame, who said “Money can’tmore generally, possessions that signal high status—buy you happiness, but it can buy you a yacht bigmakes us want to distance ourselves from others. Thisenough to pull up right alongside it”.may be due to a feeling of competition and selfishnessthat sets in with the acquisition of wealth or status. Itmay also be because, quite simply, we don’t need otherpeople to survive the way we did when we were poorer.”Jordan Michael Smith writing for the newrepublic.com addresses this issue. He references ChristianSmith and Hilary Davidson’s book The Paradox of Generosity and generosity’s link to happiness. “Americanswho describe themselves as “very happy” volunteeran average of 5.8 hours per month. Those who are“unhappy”? Just 0.6 hours.”Considering the possibility that David Lee Roth mightbe not be taken seriously by some, let’s see what anacademic perspective has to say on the subject.Raj Raghunathan in his Harvard Business Journalarticle, “Why Rich People Aren’t as Happy as TheyCould Be” argues, “All else being equal, more money isbetter. This is because, as professors Elizabeth Dunn andSource: U.S. Trust Wealth Survey6Wealth Consilium—December 2016

Raghunathan’s conclusion puts a nice bow on thediscussion,”Does this mean that you can’t be happy ifyou are rich? No. But what it does suggest is that it wouldbe smart to be watchful, and try to not develop thetendencies that accompany the acquisition of wealthand status. And if you want to go one step further, begenerous and give some of it away.”We now have a picture of what wealth looks andacts like. Does our picture remind you of you? Tohelp you decide we’ll leave you with a list of generalcharacteristics of the wealthy. Do you have a 1 million dollar net worth? Did you gain your wealth primarily by earning itand through investments?7 Did you grow up in a strict but supportivehousehold? Did your family prize academic achievement,and financial discipline? Do you practice many of the habits espousedby Tom Corley? Do you believe/think in a world class way asdescribed by Steve Seibold? Did you grow up in the middle class? Do you attribute your wealth to hard work andambition? Do you spend more money on your home thanany other expense?Wealth Consilium—December 2016

Author Tom Corley has studied the habits of the wealthy and the poor. Corley shared his observa - tions in his book Rich Habits; The Daily Success Habits of Wealthy Individuals. He believes the following 10 habits have helped the wealthy become wealthy: Ten habits to becoming wealthy 1. Forming

1.2 The Scope of our Wealth Management Services 1.3 Components of Wealth Management 1.4 Process of Wealth Management 1.5 Need for Wealth Management 1.6 Expectation of Clients 1.7 Challenges to Wealth Management in India 1.8 Code of Ethics for Wealth Managers 1.9 Review Questions 1.1 Introduction to Wealth Management What is 'Wealth Management'?

the top, and, thus, lower wealth mobility. Conversely, higher wealth mobility where self-made wealth replaces inherited wealth would result in more men at the top of the wealth distribution. Judged by this proxy, and corroborated by various data sources, wealth mobility decreased in the period 1925– 1969 and increased thereafter.

In this overview, we briefly define the concepts of "wealth" and "wealth creation", explain why a focus on wealth creation is important, discuss recent efforts to promote rural wealth creation, discuss what is known from past research about rural wealth creation, and introduce a conceptual framework for rural wealth creation and the theme

Suppliers are urged to implement complaint mechanisms, such as whistle-blower systems, hot lines or equivalent to promote the follow up of reported concerns. The anonymity of the worker shall be protected at all times. 6.2 Free competition Consilium Safety Group requires its Supp

Consilium on Cisco Finesse: Leverage standard Cisco Finesse Agent Desktop. CRM Screen Pop –better customer experience as customer identification step is instant, lower AHT. Faster implementation Less CRM-side expertise needed . as the CRM UI remains unchanged. IT friendly –simplicity of architecture and standard Cisco TAC support for .

M E QC-04-14-546-EN-N Rue de la Loi/Wetstraat 175 1048 Bruxelles/Brussel BELGIQUE/BELGIË Tel. 32 (0)2 281 61 11 www.consilium.europa.eu EUROPE AND YOU European Union

Fourth, for pension wealth, we capitalize an age-group speci c combination of wages and pension distributions. This approach allows us to parsimoniously incorporate the life-cycle patterns in pension wealth and associated income ows. While less important for top wealth, pension wealth accounts for 70% of wealth for the bottom 90% and 30% for the

Household net worth, or wealth, is known to exhibit a highly skewed distribution. Estimates of wealth concentration show that the top 0.1 percent of families held 22 percent of the wealth owned by U.S. households in 2012. 2 However, household wealth is a difficult concept to measure. In order to create