The Forex Complex 2022

The Forex Complex 2022

Index Our purpose . 3 Trading Forex . 3 How can I make money trading Forex? . 3 How do I start trading Forex? . 4 How do I receive the Forex signals? . 5 How do I start following the signals? . 5 Important Forex terms . 6 Lot size . 7 Pips . 7 Leverage . 8 Risk management . 9 How much leverage is right for you? . 9 How should I use take-profits and stop-losses? . 10 Method 1 . 10 Method 2 . 10 Final words and risk disclosure . 11 The Forex Complex 2022

Our purpose In this document you will find everything you need to know to execute your first successful Forex trade using our services. The Forex Complex aims to help you maximize your Forex profits by teaching you the basics of Forex, how to manage your risk and complete successful trades. Created by avid traders with a passion for Forex and helping others The Forex Complex will help you navigate through the world of Forex. It is important to note that we do not offer financial advice. The content provided by us is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. By basing our business model on affiliation, we have managed to keep our services 100% free. Trading Forex The word Forex is a combination of the terms foreign currency and exchange. Trading Forex is the process of changing one currency into another for a variety of reasons, usually for commerce, trading, or tourism. According to a 2019 triennial report, the daily trading volume for Forex reached 6.6 trillion dollars in April 2019. The foreign exchange market is where currencies are traded. Currencies are important because they enable purchase of goods and services locally and across borders. International currencies need to be exchanged to conduct foreign trade and business. How can I make money trading Forex? Getting started in Forex trading doesn’t require anywhere near the kind of capital that it takes to start investing in stocks or commodity futures. The Forex markets feature very low entry costs. Many traders open a Forex trading account with initial deposits of just 300. By now you are probably wondering, well how can I make money by trading Forex? To answer this question, we will give you an example: It is possible to make money trading currencies when the prices of foreign currencies rise and fall. Currencies are traded in pairs. One of the most common traded pairs is the EUR/USD. This pair consists of the Euro and United States Dollar. You may have seen a currency quote for a pair called EUR/USD with a rate of 1.1800. In this example, the base currency is the euro and the quote currency is the dollar. This means that for every 1 euro that you trade you receive 1.18 dollars. Investors buy a currency pair if they think the base currency will gain value in contrast with the quote currency. If they think the base currency will lose value in contrast to the quote currency, then they will sell the pair. Now let’s say that you buy 100 euros for 118 dollars. The euro then continues to gain value because of an increased demand for euros. This results in every euro now being worth 1.1900. Having invested 118 dollars for 100 euros, the investor would gain 1 dollar ( 119 118) if they sold the euros at this new exchange rate. The Forex Complex 2022

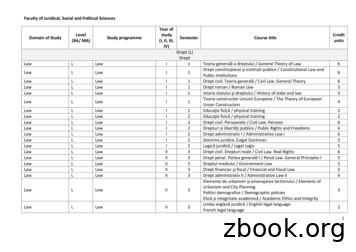

How do I start trading Forex? It’s quite easy to start trading Forex, especially when using Forex signals, we do most of the work for you. To start you’ll need three things: a trading platform, a broker and access to some quality signals. We’ll take you through the necessary steps down below. Step 1: Contact us via telegram to start your application process for our services - Clicking the link below will direct you to a chat with our support staff https://t.me/theForexcomplex Step 2: Sign up with our recommended broker (The broker depends on your location) - Visit their page by clicking the link below At the top of their page click the button live account As account type choose standard (raw ECN) As leverage choose 1:100 (We don’t recommend going higher if you’re new) Step 3: Download Metatrader 4 (MT4) on your phone, laptop or PC Step 4: Deposit funds into your broker account - We recommend starting with an equivalent of 300 US dollars Step 5: Connect your broker to your Metatrader 4 app - Open the MT4 app Go to manage accounts or settings Select new account and go to log into an existing account Sign in with the information provided via mail by your broker Follow the steps provided by your broker The Forex Complex 2022

How do I receive the Forex signals? We aim to offer between 3 and 8 Forex signals to our premium Telegram group every single day, however this can sometimes vary as we only send quality signals. If our analysis does not offer good buying or selling opportunities, we won’t share signals. Before we get into how you can follow these signals, we’ll talk some more about what exactly signals are. Forex signals are not financial advice, because we ourselves are avid traders we’ve decided to share our trades. Sharing our decisions to trade a certain currency pair is called a Forex signal. A Forex signal consists of three parts - The currency pair (remember how we talked about EUR/USD?) The take-profit (a TP is when an order is closed at a specified profit level) The Stop-loss (a SL is when an order is closed at a specified loss level) Working with take-profits and stop-losses allows us to minimize risk whilst trying to secure profit. Going forward we will refer to take-profits as TP’s and stop-losses as SL’s. How do I start following the signals? Following our Forex signals is a simple 4 step process: 1. 2. 3. 4. A signal is sent to the Telegram group containing one of our trades Open MT4 and select the trade option on the currency pair in question Enter the stop-loss and take-profit then continue to execute the trade Profit is made For visual instructions on how to trade with signals, please see the images posted on the page below. The Forex Complex 2022

The Forex Complex 2022

Important Forex terms We’ve listed some important Forex terms and trading jargon below in case you’re still relatively new to trading; this should help you understand the information we share better and help you get the most out of it. Lot size Forex is commonly traded in specific amounts called lots, or basically the number of currency units you will buy or sell. A “lot” is a unit measuring a transaction amount. The standard size for a lot is 100,000 units of currency, and now, there are also mini, micro, and nano lot sizes these are respectively 10,000, 1,000, and 100 units of currency. Pips Traders will often refer to “pips gained” or “pips lost”. This is because a pip is commonly used as an indicator of how a trade has progressed. A pip is actually an acronym for "percentage in point”. Most currency pairs are priced to four decimal places and the smallest change is the last (fourth) decimal point, as you can see four decimals were used in the earlier example of conducting a trade. There are however exceptions, such as the Japanese Yen, or certain commodities like Gold and Silver. With these currencies / commodities there are only two decimals, instead of four. The movement of a currency pair determines whether a trader has made a profit or a loss from the positions at the end of the day. A trader who buys the EUR/USD will profit if the euro increases in value relative to the US dollar. If the trader bought the euro for 1.1835 and exited the trade at 1.1901, they would have gained 1.1901 - 1.1835 66 pips. An increase of 0.0066 dollars (66 pips) may not seem like much, however with leverage a lot of money can be made by trading these small changes. The Forex Complex 2022

Leverage Leverage is the use of borrowed funds to increase one's trading position beyond what would be available from their cash balance alone. Brokerage accounts allow the use of leverage through margin trading, where the broker provides the borrowed funds. Using leverage when trading Forex is extremely common as Forex traders often use leverage to profit from relatively small price changes in currency pairs. Leverage, however, can amplify both profits as well as losses. This is why we always work with TP’s and SL’s. Within Forex it is quite normal to use leverage when making trades, this biggest reason for this being the fact that currencies markets are so large and liquid price deviations usually happen in the third or fourth decimal. Without leverage it would take very large funds to profit from these price deviations. Let’s create an example in which a trader benefits from using leverage in their trade: Imagine you have 500 euros to invest with and you decide that you want to trade 50.000 euros worth of EUR/USD. This means that you would have use a leverage of 1:100, in which you provide 1% of the total amount traded and the broker provides 99%. At the start of your trade EUR/USD trades for 1.1835, so you buy 50.000 euros worth of dollars. The price of the euro then rises relative to the dollar and you end up closing the trade at 1.1901. Now if you had not used any leverage, this would have meant that you bought 0.005 lots worth of dollars with your euro’s. (0.005 x 100.000 x 1.1901) – (0.005 x 100.000 x 1.1835) 3.3 dollars This means you would have made 3.3 dollars, but because you used a leverage of 1:100, you’ve just managed to trade 0.5 lots instead of 0.005 lots, thus increasing your profits to 330 dollars The Forex Complex 2022

Risk management So, you’ve created an account with a broker, deposited funds, installed MetaTrader 4 and have joined our telegram to start profiting from some premium signals. Sounds good right? Unfortunately, not every trade will profit. We pride ourselves into averaging a success rate of about 90%, meaning 9 of 10 trades will either break even or result in profits, but even the best traders have to deal with losses, it is a part of life. Luckily there are multiple ways to minimize your risk. How much leverage is right for you? In the earlier example above, we demonstrated how you can significantly increase your profits when trading with the use of leverage. Sadly, leverage can amplify both profits and losses. Our preferred broker offers a leverage of up to 1:500(!), however we do not recommend new traders to start out with this. A leverage of 1:100 is more than significant enough to start trading profitably. Portfolio size 300 - 399 400 - 599 600 - 799 800 - 999 1000 - 2999 3000 Suggested lots per trade 0.03 - 0.05 0.05 - 0.06 0.06 - 0.08 0.08 - 0.10 0.10 - 0.15 0.15 Leverages and lot sizes suggested in this PDF should not be held as financial advice as we do not know your financial situation The best way to decide which lot size is right for you is to use an online lot size calculator, you can find one via the link below: n-size To calculate your lot size simply choose the pair you want to trade, pick your account currency and add in the variables such as account size, risk ratio, stop-loss pips the type of lots your broker offers. The Forex Complex 2022

How should I use take-profits and stop-losses? As mentioned before, TP’s and SL’s are meant to secure profits and minimize risk, but how should you use them? There are multiple ways. As you may have noticed in the earlier example of how to conduct a trade, we used three TP’s and one SL. Method 1 The first method of using TP’s includes the use of multiple TP’s. Since MetaTrader won’t let you set multiple TP’s per trade you will have to conduct three trades, these being: Trade 1: This will include TP1, meaning this is the safest trade as it will trigger first. Trade 2: This will include TP2, meaning will trigger second. Trade 3: This will include TP3, meaning it will trigger last. A good way to minimize risk even further is to move the SL when a TP is hit, down below we will give an example of how this would work. 1. A signal is given, SELL GBPUSD 1.3916 TP1 TP2 TP3 SL 1.3896 1.3866 1.3816 1.4006 2. TP1 is hit, meaning the SL is moved from 1.4006 to 1.3896. 3. TP2 is hit, meaning the SL is moved from 1.3896 to 1.3866 (optional). 4. TP3 is hit, meaning that market was played perfectly, and maximum profit has been realized whilst minimizing risk. Now obviously this will not always work, by minimizing the gap between your TP and SL you are increasing the chance of your SL being hit. This method will make sure that a trade can not turn on you though. Another solution is to move the SL to entry once TP2 is hit, it’s quite uncommon for the market to suddenly turn around all the way to the entry point. Method 2 The second method of using TP’s and SL’s includes using only one TP, this could be either TP1, 2 or 3. This would allow you to put 100% into a single TP and thus either securing either more profit whilst taking more risk or minimizing your risk whilst securing less profit. The upside of this is that you will only have to manage one trade, the downside however is that you’re less flexible in taking profits. In general this method is more suitable for traders that have more time on their hands and are able to monitor their trades more actively. With this method it also possible to move your SL closer to TP3 throughout the trade to secure profits The Forex Complex 2022

Final words and risk disclosure Forex trading is a skill that requires patience and discipline. We highly recommend that you start out using the safer methods risk and reward wise as it takes time to develop your own strategies. As you start following our signals you will encounter both gains and losses, don’t let losses distract you. They are part of the game. This is where patience and discipline come into play, trying to recover losses by going in bigger on later trades is a great way to guarantee a loss of funds. Please see the graph below. Percentage lost Percentage needed to break even 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% 11% 25% 43% 67% 100% 150% 233% 400% 900% - The Forex Complex does not in any of its publications take into account any particular recipient’s investment objectives, special investment goals, financial situation, and specific needs and demands. Therefore, all publications of The Forex Complex are, unless otherwise specifically stated, intended for informational and/or marketing purposes only and should not be construed as: - business, financial, investment, hedging, legal, regulatory, tax or accounting advice, a recommendation or trading idea, or any other type of encouragement to act, invest or divest in a particular manner (collectively “recommendations”) The Forex Complex shall not be responsible for any loss arising from any investment based on a perceived recommendation. The Forex Complex 2022

Trading Forex The word Forex is a combination of the terms foreign currency and exchange. Trading Forex is the process of changing one currency into another for a variety of reasons, usually for commerce, trading, or tourism. According to a 2019 triennial report, the daily trading volume for Forex reached 6.6 trillion dollars in April 2019.

Forex System, 10 Minute Forex Wealth Builder, and Forex Hidden Systems. If you prefer to get a software you can look at . Supra Forex, Forex Multiplier, Turbo Forex Trader or Forex Killer. If you prefer to use an automatic trading system, you can start with . Fap Turbo, Forex Autopilot or Forex Auto Run.

May 02, 2018 · D. Program Evaluation ͟The organization has provided a description of the framework for how each program will be evaluated. The framework should include all the elements below: ͟The evaluation methods are cost-effective for the organization ͟Quantitative and qualitative data is being collected (at Basics tier, data collection must have begun)

Silat is a combative art of self-defense and survival rooted from Matay archipelago. It was traced at thé early of Langkasuka Kingdom (2nd century CE) till thé reign of Melaka (Malaysia) Sultanate era (13th century). Silat has now evolved to become part of social culture and tradition with thé appearance of a fine physical and spiritual .

6. The Basic Forex Trading Strategy 7. Forex Trading Risk Management . 8. What You Need to Succeed in Forex 9. Technical Analysis As a Tool for Forex Trading Success . 10. Developing a Forex Strategy and Entry and Exit Signals 11. A Few Trading Tips for Dessert . 1. Making Money in Forex Trading . The Forex market has a daily volume of over 4 .

1. Making Money in Forex Trading 2. What is Forex Trading Table of Contents 3. How to Control Losses with "Stop Loss" 4. How to Use Forex for Hedging 5. Advantages of Forex Over Other Investment Assets 6. The Basic Forex Trading Strategy 7. Forex Trading Risk Management 8. What You Need to Succeed in Forex 9.

forex. There are lots of other factors which will decide the rate of forex. 2. Forex brokers. Second major part of the structure of the forex market is the forex brokers. They are commission agents; they help to bring buyers of forex near to the sellers. Like other industry brokers, they sell or buy the forex on behalf of their customers. They .

On an exceptional basis, Member States may request UNESCO to provide thé candidates with access to thé platform so they can complète thé form by themselves. Thèse requests must be addressed to esd rize unesco. or by 15 A ril 2021 UNESCO will provide thé nomineewith accessto thé platform via their émail address.

̶The leading indicator of employee engagement is based on the quality of the relationship between employee and supervisor Empower your managers! ̶Help them understand the impact on the organization ̶Share important changes, plan options, tasks, and deadlines ̶Provide key messages and talking points ̶Prepare them to answer employee questions