Strategic Recalibration - Cimb

ANNUAL REPORT 2020 STRATEGIC RECALIBRATION Recalibrated Forward23 strategy to deliver sustainable financial returns - page 37 CONTINUED RESILIENCE Underlying business remains resilient and well-capitalised against shocks - page 40 ACCELERATING RECOVERY Reshaping our portfolio with focused investments to drive growth - page 44 Delivering Sustainable Financial Returns Disciplined Execution Customer Centricity Transform Fundamentals Purpose-Driven Organisation TO BE THE LEADING FOCUSED ASEAN BANK

Reducing the Environmental Impacts of this Annual Report We have taken conscious efforts to manage and minimise the environmental impact of our annual report and related processes. The total carbon footprint for printing CIMB Annual Report 2020 was However, you can make the greatest difference. Did you know that the equivalent of one football field of forest is cut down every second? Play your part. If you can, download the soft copy of CIMB’s Annual Report, Financial Statements and Sustainability Report, instead of requesting for a hard copy. 11,588kgCO2e, Printed with eco ink made from higher percentage of vegetable oil to reduce emission of volatile organic compounds (VOCs). Contains low levels of chemicals, thus less pollution to the environment throughout the printing process. View our Annual Report, Accounts and other information about CIMB Group Holdings Berhad at www.cimb.com compared to 14,987kgCO2e for our 2019 annual report. The carbon footprint for the 3 books of CIMB Annual Report 2020 is 14.485kgCO2e. We are committed to reducing the environmental impact of our annual report and will continue working to reduce the amount of greenhouse gasses (GHG) emitted throughout the entire designing and printing process.

There is approximately 62% reduction Paper and printing in paper used, wastes are being responsibly handled 73,125 less sheets in the printing and production of CIMB Annual Report 2020 compared to our 2019 Annual Report. Printed with carbon neutral press machines, eco materials and managed under and certified with ISO 14001:2015 environmental management system to minimise environmental impact. Paper sourced from responsibly managed forests that provide environmental benefits. Covers are printed on FSC certified Mix credit Xtella Brilliant White 300 gsm paper; Inner pages are printed on FSC certified Mix credit Xtella Brilliant White 128 gsm paper. to recycle and up-cycle materials in order to reduce the burden on landfills.

About This Report At CIMB Group, our aspiration is to build a high performing sustainable organisation to help advance customers and society. Towards fulfilling this purpose, we embrace principles of good governance, responsible banking and Values-based Intermediation. We also take an inclusive approach to planning and delivering our growth strategies. Our efforts are always focussed on going beyond meeting immediate expectations of our most critical stakeholders, to deliver shared value, which is all about helping them shape a better future. Our Annual Report is a true account of our performance, our ability to overcome challenges, and optimise our potential as a purpose-driven business. ‘FutureForward’ is our endeavour to make business a force for good, a catalyst to a better planet and a sustainable future. R EPORTING SCOPE AND BOUNDAR IES This Annual Report covers our financial and non-financial performance during the period 1 January 2020 to 31 December 2020. Through this report, it is our sincere effort to keep our stakeholders abreast of key developments; programmes and initiatives; market challenges and business solutions; our achievements; mid- to long-term direction; and the overall health of operations in 2020 in various geographical markets where we operate. The report also presents rich insights and forward-looking statements on financial position and performance in the year ahead. Our report is particularly relevant for our stakeholders in the ASEAN markets of Malaysia, Indonesia, Singapore, Thailand, Brunei, Cambodia, Myanmar, Vietnam and Laos. A range of other stakeholders across the globe will also find our report informative. Our financial statements are independently audited and provide in-depth and transparent disclosure of our financial performance. Unless we indicate otherwise, all the data presented relates to the Group, which includes our banking operations and our subsidiaries. In preparing our report, we were guided by the requirements of local and international statutory and reporting frameworks, including those of Bursa Malaysia. N AV I G AT I O N I CO N S S TA K E H O L D E R S Shareholders/ Investors Employees Regulators Customers Suppliers Communities Delivering Sustainable Financial Returns Customer Centricity Purpose-driven Organisation Disciplined Execution Transform Fundamentals S T R AT E G I C T H E M E S C A P I TA L S Financial Manufactured Social Human Intellectual Natural

M AT E R I A L I T Y All our Annual Reports present a balanced and accessible assessment of our strategies, performance, governance, sustainability and prospects. The various matters and developments included in the 2020 edition were determined by a range of considerations, such as quantitative and qualitative criteria; issues likely to impact our ability to deploy our strategies or create shared value and sustain financial and non-financial performance; the matters covered in reports presented to our Board of Directors; the risks identified by our risk management team; and the interests of our key stakeholders. We also consider factors that affect the economic, environmental, social and governance landscape in various countries and regions where we conduct business. I N T E G R AT E D A P P R O A C H In documenting our reports, our attempt is to establish clear linkages between our business performance and various internal and external factors or influences such as market trends, stakeholder expectations, organisational priorities, regulatory regime, competitive strategies, national agenda, and global best practices. In 2020, we have also adopted various principles prescribed by the International Integrated Reporting Council. S TAT E M E N T O F T H E B O A R D O F D I R E C T O R S O F CIMB GROUP HOLDINGS BERHAD The Board acknowledges its responsibility to ensure the integrity of the Annual Report. In the Board’s opinion, the report addresses all material issues and matters and fairly presents the Group’s performance for the year 2020. Approved by the Board of Directors and signed on behalf of the Board: Datuk Mohd Nasir Ahmad Dato’ Abdul Rahman Ahmad Chairman Group Chief Executive Officer/ Executive Director KEY MARKET TRENDS Impacts of COVID-19 & Accelerated Digital Penetration Financial Market Trends & Fluctuations Proliferation of Technology New Competitors Geopolitical and Economic Developments Shifting Policy and Regulatory Landscape Economic, Environmental, Social and Governance (EES&G) Factors Customers of the Future Credit Risk Non-Financial Risk: Fraud Risk Non-Financial Risk: Shariah NonCompliance Risk Country Risk Market Risk Non-Financial Risk: Business Continuity Risk Liquidity & Funding Risk Sustainability Risk Non-Financial Risk: Operational Risk Non-Financial Risk: Technology Risk Interest Rate Risk in The Banking Book Climate Change Diversity and Inclusion Sustainability Awareness and Participation Corporate Citizenship and Volunteerism Financial Literacy, Inclusion and Wellbeing Sustainable Finance Corporate Culture Governance Sustainable Supply Chain Customer Experience Health, Safety and Well-being Talent Attraction, Growth and Retention RISKS M AT E R I A L M AT T E R S Technology

What’s Inside This Report 2 ERXW 7KLV 5HSRUW 6 6KDUHG 9DOXHV # &Ζ0% 7 6WDNHKROGHUVȇ ([SHFWDWLRQV Material Matters 8 &DSLWDOV ΖQSXWV DQG .3ΖV 10 RZ 'R :H &UHDWH 6KDUHG 9DOXH" 13 (FRQRPLF 9DOXH 'LVWULEXWHG 5HWDLQHG 22 2YHUYLHZ 24 2XU 3UHVHQFH 24 2XU 3URȴOH 26 &RUSRUDWH 0LOHVWRQHV 2XU HULWDJH 14 &Ζ0%ȇV 9DOXH &UHDWLRQ 0RGHO 16 0HVVDJH IURP 7KH &KDLUPDQ 28 )RQG )DUHZHOO 30 .H\ LJKOLJKWV RI 32 2XU 5HVSRQVH WR &29Ζ' M A N A G E M E N T D I S C U S S I O N A N D A N A LY S I S S T R AT E G I C R E V I E W 46 (FRQRPLF 5HYLHZ 2XWORRN 49 0DUNHW 7UHQGV SSURDFKHV 34 *URXS &(2ȇV 2YHUYLHZ 50 .H\ 5LVNV DQG 0LWLJDQWV 52 *URXSȇV 7KHPHV 6WUDWHJLF PERFORMANCE RE VIE W 60 )LYH HDU *URXS )LQDQFLDO 6XPPDU\ 61 )LYH HDU *URXS )LQDQFLDO LJKOLJKWV 62 6LPSOLȴHG *URXS 6WDWHPHQW RI )LQDQFLDO 3RVLWLRQ 63 4XDUWHUO\ )LQDQFLDO 3HUIRUPDQFH 54 65 9DOXH GGHG 6WDWHPHQWV 66 &DSLWDO 0DQDJHPHQW 67 &UHGLW 5DWLQJV 70 %DODQFH 6KHHW 0DQDJHPHQW 71 ΖQYHVWRU 5HODWLRQV 77 )LQDQFLDO &DOHQGDU 64 .H\ ΖQWHUHVW %HDULQJ VVHWV DQG /LDELOLWLHV *URXS )LQDQFLDO 5HYLHZ E\ *URXS &)2 BUSINESS REVIEW 78 *URXS &RQVXPHU %DQNLQJ 82 *URXS :KROHVDOH %DQNLQJ 86 *URXS ΖVODPLF %DQNLQJ 80 *URXS &RPPHUFLDO %DQNLQJ 84 *URXS 7UDQVDFWLRQ %DQNLQJ 88 &Ζ0% 'LJLWDO VVHWV

LEADERSHIP 90 %RDUG RI 'LUHFWRUV 100 *URXS 6KDULDK &RPPLWWHH 113 XPDQ &DSLWDO 'HYHORSPHQW 92 %RDUG RI 'LUHFWRUVȇ 3URȴOH 101 *URXS 6KDULDK &RPPLWWHH 3URȴOH 120 &RUSRUDWH 6WUXFWXUH 97 *URXS &RPSDQ\ 6HFUHWDU\ȇV 3URȴOH 98 %RDUG RI 0DMRU 6XEVLGLDULHV 121 *URXS 2UJDQLVDWLRQ 6WUXFWXUH 104 *URXS 0DQDJHPHQW 106 *URXS 0DQDJHPHQW 3URȴOH GOVERNANCE 122 &KDLUPDQȇV 6WDWHPHQW RQ &RUSRUDWH *RYHUQDQFH 124 &RUSRUDWH *RYHUQDQFH 2YHUYLHZ 6WDWHPHQW 142 GGLWLRQDO 'LVFORVXUHV 165 XGLW &RPPLWWHH 5HSRUW 143 6WDWHPHQW RQ 5LVN 0DQDJHPHQW DQG ΖQWHUQDO &RQWURO 169 %RDUG 6KDULDK &RPPLWWHH Report 155 5LVN 0DQDJHPHQW S U S TA I N A B I L I T Y S TAT E M E N T HIGHLIGHTS AND ACHIE VEMENTS 191 5HJLRQDO 1RWDEOH 'HDOV 172 ERXW &Ζ0% 6XVWDLQDELOLW\ 5HSRUW 196 1RWDEOH FKLHYHPHQWV 174 6XVWDLQDELOLW\ 3ULQFLSOHV DQG 6WUDWHJ\ 184 6XVWDLQDEOH FWLRQ 198 &RUSRUDWH (YHQW LJKOLJKWV 200 0HGLD LJKOLJKWV 186 6XVWDLQDEOH %XVLQHVV 188 &RUSRUDWH 6RFLDO 5HVSRQVLELOLW\ 189 *RYHUQDQFH DQG 5LVN 190 6WDNHKROGHU (QJDJHPHQW DQG GYRFDF\ S TA K E H O L D E R I N F O R M AT I O N 202 6KDUHKROGHUVȇ 6WDWLVWLFV 205 ΖQWHUQDO 3ROLFLHV 3URFHGXUHV DQG *XLGHOLQHV 211 7RS 3URSHUWLHV RI &Ζ0% *URXS 212 &RUSRUDWH ΖQIRUPDWLRQ 214 *URXS &RUSRUDWH 'LUHFWRU\ 216 1RWLFH RI QQXDO *HQHUDO 0HHWLQJ 222 6WDWHPHQW FFRPSDQ\LQJ 1RWLFH RI QQXDO *HQHUDO 0HHWLQJ 231 GPLQLVWUDWLYH 'HWDLOV IRU WK QQXDO *HQHUDO 0HHWLQJ *0 RI &Ζ0% *URXS ROGLQJV %HUKDG Ʉȏ 3UR[\ )RUP 9LHZ RXU QQXDO 5HSRUW FFRXQWV DQG RWKHU LQIRUPDWLRQ DERXW &Ζ0% *URXS ROGLQJV %HUKDG DW www.cimb.com

Shared Value @ CIMB Shared Value at CIMB is not just a functional or emotional dimension of our business. It goes beyond delivering products and services that caters to the needs of our customers, career expectations of our employees, growth aspirations of our supply chain partners and delivering returns to our investors and shareholders. W &Ζ0% 6KDUHG 9DOXH LV RXU PRWLYDWLRQ WR PDNH VWDNHKROGHUV SDUW DQG SDUFHO RI RXU SXUSRVH 2XU NH\ REMHFWLYH LV WR WDNH DQ LQFOXVLYH DSSURDFK E\ PRELOLVLQJ RXU VWDNHKROGHUV WR SDUWLFLSDWH DQG SOD\ D FULWLFDO UROH LQ VKDSLQJ D VXVWDLQDEOH IXWXUH DQG D EHWWHU WRPRUURZ ΖQ RWKHU ZRUGV DV ERWK FDWDO\VWV DQG EHQHȴFLDULHV RI RXU H RUWV DQG SURJUDPPHV WKDW FUHDWH YDOXH RXU VWDNHKROGHUV DQG WKHLU LQWHUHVWV DUH RI SULPDU\ FRQFHUQ DQG XWPRVW SULRULW\ WR XV :H DUH DOZD\V WU\LQJ WR EULGJH WKH JDS EHWZHHQ WKH YDOXH SHUFHLYHG E\ RXU VWDNHKROGHUV DQG WKH YDOXH SURSRVHG DQG GHOLYHUHG E\ XV 7RZDUGV WKLV ZH DVVLPLODWH DQG RSWLPLVH UHVRXUFHV GULYH RXU RSHUDWLRQDO FDSDELOLWLHV DQG OHYHUDJH RQ RXU FRQWURO PHFKDQLVPV WR GHOLYHU UHDO YDOXH WR DOO RXU VWDNHKROGHUV 6 In the long-term, we aim to bring about a systemic change in the banking industry, build a highperforming sustainable organisation and inspire positive economic, environmental, social and governance performance and impacts. The whole process of value creation requires us to: Reduce our negative footprint from our business and operations, making our performance and growth sustainable and meaningful. CIMB *URXS ROGLQJV %HUKDGɅAnnual Report 2020 Create a positive handprint through VXVWDLQDEOH ȴQDQFLQJ solutions as well as by promoting sustainability principles and leadership to advance customers and society.

Stakeholders’ Expectations & Material Matters 7KH SURFHVV RI 6KDUHG 9DOXH &UHDWLRQ DW &Ζ0% VWDUWV ZLWK FUHGLEOH LQSXWV DQG IHHGEDFN IURP RXU PRVW FULWLFDO VWDNHKROGHUV RQ YDULRXV DVSHFWV RI RXU EXVLQHVV DQG RSHUDWLRQV :H ȴQG RSSRUWXQLWLHV WR LQWHUDFW ZLWK RXU VWDNHKROGHUV DW HYHU\ WRXFKSRLQW LQ DGGLWLRQ WR RXU IRFXVHG DQG SXUSRVHIXO HQJDJHPHQW H RUWV RQ DQ DQQXDO EDVLV ΖQ ZH FRQGXFWHG IRFXV JURXSV VXUYH\V DQG WDUJHWHG LQWHUYLHZV ZLWK PRUH WKDQ VWDNHKROGHUV LQFOXGLQJ RXU FXVWRPHUV HPSOR\HHV LQYHVWRUV DQG VXSSOLHUV IURP 0DOD\VLD ΖQGRQHVLD 6LQJDSRUH 7KDLODQG DQG &DPERGLD 2XU SULPDU\ REMHFWLYH ZDV WR VROLFLW IHHGEDFN LGHQWLI\ DQ\ HPHUJLQJ LVVXHV RU DUHDV RI FRQFHUQV DQG PRVW LPSRUWDQWO\ XQGHUVWDQG WKH H[SHFWDWLRQV RI RXU VWDNHKROGHUV EHWWHU %DVHG RQ WKH ȴQGLQJV ZH ZHUH DEOH WR YDOLGDWH ERWK WKH VL[ KLJKO\ PDWHULDO LVVXHV DV ZHOO DV WKH HLJKW LPSRUWDQW WRSLFV WKDW ZHUH HVWDEOLVKHG IURP WKH PDWHULDOLW\ DVVHVVPHQW H[HUFLVH XQGHUWDNHQ LQ 'XULQJ WKH \HDU GXH WR WKH XQSUHFHGHQWHG LPSDFWV RI &29Ζ' RQ SHRSOH HFRQRP\ DQG EXVLQHVV WKUHH PDWHULDO WRSLFV HDOWK 6DIHW\ :HOO EHLQJ )LQDQFLDO /LWHUDF\ ΖQFOXVLRQ :HOO EHLQJ DQG &OLPDWH &KDQJH VKLIWHG RQ WKH PDWHULDOLW\ PDWUL[ IRU WKHLU LPSRUWDQFH WR VWDNHKROGHUV UHODWLYH WR WKHLU VLJQLȴFDQFH WR &Ζ0%ȇV ((6 LPSDFWV )RU ZH KDYH DOVR EHHQ DEOH WR HVWDEOLVK WKH FRPPRQDOLW\ DQG DOLJQPHQW RI KLJKO\ PDWHULDO LVVXHV DFURVV RXU FRUH 6( 1 PDUNHWV ZKLFK LV HVVHQWLDO WR EH DEOH WR GHYLVH DQG GHSOR\ VWUDWHJLHV DQG SURJUDPPHV WKDW EHQHȴW RXU VWDNHKROGHUV DFURVV RXU IRRWSULQW )RU PRUH LQIRUPDWLRQ SOHDVH UHIHU WR SDJHV LQ &Ζ0% *URXS 6XVWDLQDELOLW\ 5HSRUW Common Stakeholders Concerns and Priorities across our ASEAN Markets 0DOD\VLD ΖQGRQHVLD 6LQJDSRUH 7KDLODQG DQG &DPERGLD ȏ *RYHUQDQFH ȏ 7HFKQRORJ\ ȏ &XVWRPHU ([SHULHQFH ȏ 7DOHQW WWUDFWLRQ *URZWK DQG Retention ȏ &OLPDWH &KDQJH ȏ 6XVWDLQDEOH )LQDQFH ȏ &XVWRPHU ([SHULHQFH ȏ 7HFKQRORJ\ ȏ 6XVWDLQDEOH )LQDQFH ȏ )LQDQFLDO /LWHUDF\ ΖQFOXVLRQ DQG :HOO EHLQJ ȏ HDOWK 6DIHW\ DQG :HOO EHLQJ ȏ HDOWK 6DIHW\ DQG :HOO EHLQJ ȏ 7HFKQRORJ\ ȏ &XVWRPHU ([SHULHQFH ȏ 7DOHQW WWUDFWLRQ *URZWK DQG Retention ȏ *RYHUQDQFH ȏ 6XVWDLQDEOH 6XSSO\ &KDLQ ȏ *RYHUQDQFH ȏ HDOWK 6DIHW\ DQG :HOO EHLQJ ȏ )LQDQFLDO /LWHUDF\ ΖQFOXVLRQ DQG :HOO EHLQJ ȏ &XVWRPHU ([SHULHQFH ȏ 7HFKQRORJ\ ȏ ȏ ȏ ȏ *RYHUQDQFH 7HFKQRORJ\ &XVWRPHU ([SHULHQFH )LQDQFLDO /LWHUDF\ ΖQFOXVLRQ DQG :HOO EHLQJ ȏ &OLPDWH &KDQJH ȏ 6XVWDLQDEOH )LQDQFH ȏ 6XVWDLQDELOLW\ ZDUHQHVV DQG 3DUWLFLSDWLRQ ȏ )LQDQFLDO /LWHUDF\ ΖQFOXVLRQ DQG :HOO EHLQJ ȏ &RUSRUDWH &LWL]HQVKLS DQG 9ROXQWHHULVP ȏ 6XVWDLQDELOLW\ ZDUHQHVV DQG 3DUWLFLSDWLRQ ȏ 6XVWDLQDEOH )LQDQFH ȏ &OLPDWH &KDQJH SHAREHOLDERS/INVESTORS CUSTOMERS EMPLOYEES SUPPLIERS REGULATORS COMMUNITIES CIMB *URXS ROGLQJV %HUKDGɅAnnual Report 2020 7

Capitals: Inputs and KPIs 7R DGGUHVV WKH H[SHFWDWLRQV RI RXU FULWLFDO VWDNHKROGHUV ZKLOH H HFWLYHO\ UHVSRQGLQJ WR various market trends, we plan our resource inputs in the form of various capitals, namely, Financial Capital, Manufactured Capital, Social & Relationship Capital, Natural Capital, XPDQ &DSLWDO DQG ΖQWHOOHFWXDO &DSLWDO :H RUFKHVWUDWH WKH H RUWV DFURVV PLVVLRQ FULWLFDO functions of our business, by aligning strategies across our core ASEAN markets, as well as E\ EDODQFLQJ ȴQDQFLDO DQG QRQ ȴQDQFLDO LQGLFDWRUV RI SHUIRUPDQFH F I N A N C I A L C A P I TA L 2XU PDQDJHPHQW RI FDSLWDO ȵRZV HQVXUHV D KHDOWK\ EDODQFH VKHHW DQG VXVWDLQV RXU DELOLW\ WR LQYHVW LQ IXWXUH JURZWK ZKLOH PHHWLQJ WKH EDQNLQJ QHHGV RI RXU FXVWRPHUV 0DLQWDLQLQJ D VWURQJ FDSLWDO SRVLWLRQ DOORZV XV WR GHOLYHU PRQHWDU\ YDOXH WR RXU VKDUHKROGHUV DV ZHOO DV WR KHOS RWKHU FDSLWDOV FRQWULEXWH WR WKH RYHUDOO SHUIRUPDQFH RI WKH RUJDQLVDWLRQ DQG GHOLYHU VXVWDLQDEOH UHWXUQV WR RXU VWDNHKROGHUV GGLWLRQDOO\ PDQDJLQJ RXU ȴQDQFLDO FDSLWDO ZLOO SRVLWLYHO\ LPSDFW WKH VWDELOLW\ RI WKH EDQN *URXS DV ZHOO DV WKH FRXQWULHV ZKHUH ZH RSHUDWH Inputs Total assets Loan Portfolio Mix Outputs Risk management frameworks Cost to Income or (ɝFLHQF\ Ratio/CIR CET-1 Ratio Return on Equity/ROE M A N U FA C T U R E D C A P I TA L 2XU SK\VLFDO QHWZRUNV DQG WHFKQRORJLFDO FDSDELOLWLHV IRUP WKH FULWLFDO LQIUDVWUXFWXUH QHHGHG WR DFKLHYH KLJK RSHUDWLRQDO SHUIRUPDQFH 'LJLWDO LQIUDVWUXFWXUH LQ SDUWLFXODU DOORZV XV WR XQORFN WKH SRWHQWLDO RI RXU RWKHU FDSLWDOV DQG LV HVSHFLDOO\ LPSRUWDQW IRU RXU VHFWRU WR FUHDWH VDIH VHFXUH DQG VXSHULRU FXVWRPHU H[SHULHQFHV 2XU PDQXIDFWXUHG FDSLWDO DOVR KHOSV WR LPSURYH ȴQDQFLDO LQFOXVLYLW\ WKURXJK WKH FUHDWLRQ RI RSSRUWXQLWLHV DQG IDFLOLWLHV IRU H[SDQGLQJ WKH VFRSH DQG GHOLYHU\ PRGHO RI RXU ȴQDQFLDO VHUYLFHV Inputs No. of Branches; No. of ATMs/ Customer Touchpoints Geographical Footprint Outputs Investments in Technology No. of Active Internet/ Mobile Banking Customers No. of Active Enquiries and Transactions via Online Platforms Customer to Branch Ratio or Physical Touchpoints per Customer 8UEDQ 5XUDO S O C I A L & R E L AT I O N S H I P C A P I TA L 2XU EUDQG LV VWUHQJWKHQHG E\ WKH UHODWLRQVKLSV DQG WKH WUXVW WKDW ZH EXLOG ZLWK RXU VWDNHKROGHUV %HLQJ D UHJLRQDO *URXS VRFLDO QHWZRUNV DQG UHODWLRQVKLS HTXLW\ KHOS IRUJH SDUWQHUVKLSV H[SDQG RXU FXVWRPHU EDVH DQG EXLOG HFRV\VWHPV ZLWK VKDUHG SXUSRVH SULQFLSOHV DQG SURJUHVV :H ZRUN ZLWK RXU ZLGH QHWZRUN RI VWDNHKROGHUV WR FUHDWH D VWDEOH ȴQDQFLDO VHUYLFHV HQYLURQPHQW IRU WKH FRXQWULHV ZKHUH ZH RSHUDWH 2XU UHJLRQDO QHWZRUN DQG EUDQG HTXLW\ LPSURYH RXU VRFLDO DQG UHODWLRQVKLS FDSLWDO ZKLOH VWUHQJWKHQLQJ RXU SRVLWLRQ LQ 6( 1 8 CIMB *URXS ROGLQJV %HUKDGɅAnnual Report 2020 Inputs Outputs No. of Customers Customer Satisfaction Score/NPS score Contributions to Community Sustainability Index Ratings ASEAN Clients/ Networks ASEAN Trade Financing/ Transactions

Capitals: Inputs and KPIs N AT U R A L C A P I TA L 2XU RSHUDWLRQV DV ZHOO DV WKH FOLHQWV WKDW ZH VXSSRUW FRQVXPH ZDWHU HQHUJ\ DQG RWKHU UDZ PDWHULDOV DQG SURGXFH ZDVWH DQG HPLVVLRQV 2XU PDQDJHPHQW RI QDWXUDO FDSLWDO UHVWV RQ PLQLPLVLQJ RXU GLUHFW DQG LQGLUHFW QHJDWLYH IRRWSULQW DFURVV WKH YDOXH FKDLQ DQG FUHDWLQJ SRVLWLYH KDQGSULQWV WKURXJK VWUDWHJLF EXVLQHVV LQWHUYHQWLRQV ΖW DOVR LQFOXGHV RXU LQYHVWPHQWV LQWR SULRULW\ 6'*V DQG DVVHW DOORFDWLRQ LQWR *UHHQ 6XVWDLQDEOH ΖPSDFW ORDQV DFWLYLWLHV DQG SURMHFWV :KLOH RXU DVSLUDWLRQ LV WR PHDVXUH PDQDJH DQG UHSRUW ERWK GLUHFW DQG LQGLUHFW LPSDFWV FXUUHQWO\ ZH DUH SULRULWLVLQJ RXU GLUHFW IRRWSULQW Inputs Electricity Use Energy Use N:K N:K Outputs Green and Sustainable Impact products H U M A N C A P I TA L Reduction in Scope 1 and Scope 2 GHG Emissions Intensity (Direct) Energy Intensity Returns on Green and Sustainable Impact (QYLURQPHQW OLQNHG SURGXFWV I N T E L L E C T U A L C A P I TA L XPDQ FDSLWDO LV WKH PRVW FULWLFDO LQSXW LQWR RXU EXVLQHVV DQG RXU IRFXV LV QRW MXVW RQ EXLOGLQJ D SURGXFWLYH DQG VNLOIXO ZRUNIRUFH EXW DOVR SUHSDULQJ WKHP WR VXUYLYH DQG FRPSHWH LQ WKH GLVUXSWLYH PDUNHWSODFH RI WKH IXWXUH QXUWXULQJ HQYLURQPHQW DQG HPSRZHULQJ FXOWXUH DOORZ RXU SHRSOH WR VHDPOHVVO\ GHOLYHU WR RUJDQLVDWLRQDO QHHGV DQG H[SHFWDWLRQV ZKLOH DOVR FDWDO\VLQJ WKHLU RZQ SHUVRQDO DQG SURIHVVLRQDO JURZWK 2XU XOWLPDWH REMHFWLYH LV WR LPSURYH RXU KXPDQ FDSLWDO ' PL[ GLYHUVLW\ LQFOXVLRQ DQG ZHOO EHLQJ RI RXU VWD Inputs V D XQLYHUVDO 6( 1 EDQNLQJ JURXS ZH UHO\ RQ RXU NQRZOHGJH UHSRVLWRULHV H[SHULHQFH UHSXWDWLRQ DQG RXU LQQRYDWLYH SURFHVVHV WR FUHDWH GLVUXSWRUV DQG GL HUHQWLDWRUV VHWWLQJ XV DSDUW IURP RXU FRPSHWLWRUV JLYLQJ XV D YDOXH DGYDQWDJH Inputs Development of New Digital Solutions or Technologies Investment in IT/Tech No. of New Product Launches/Improvements 6WD &RVW Investment in Training that supports Strategic Themes and Material Issues No. of Engagement Sessions ZLWK PDQDJHPHQW Outputs Brand Value UDQNLQJ ZDUGV LQGH[ No. of Published Papers for the Industry Outputs No. of Employee Training Hours No. of Knowledge or Value Creation Platforms Created Employee Engagement Talent 3D Mix CIMB *URXS ROGLQJV %HUKDGɅAnnual Report 2020 9

How Do We Create Shared Value? FOR CIMB & # teamCIMB* We manage our business and people with the responsibility of delivering sustainable ȴQDQFLDO UHWXUQV FRPPLWPHQW WR SULQFLSOHV RI JRRG JRYHUQDQFH DQG WKH VWUDWHJLF UROH RI our Board, Senior Leadership and skilled workforce collectively contribute to shaping a SURȴWDEOH RUJDQLVDWLRQ (PSOR\HHV W H AT M AT T E R S Risk, Governance & Culture Talent, Diversity, Inclusion & Well-being 5HPDLQ UHVLOLHQW DQG UHVSRQVLYH WR WKH G\QDPLF RSHUDWLQJ HQYLURQPHQW )XWXUH SURRI HPSOR\HHV E\ XSVNLOOLQJ DQG UHVNLOOLQJ WDOHQW HQDEOLQJ WKHP WR PDQDJH HPHUJLQJ ULVNV DQG RSSRUWXQLWLHV ΖQWHJUDWH HQYLURQPHQWDO VRFLDO DQG JRYHUQDQFH ULVNV LQWR RXU ULVN PDQDJHPHQW IUDPHZRUN 3URPRWH GLYHUVLW\ WR IRVWHU LQQRYDWLRQ DQG GULYH SHUIRUPDQFH 8SKROG KLJK VWDQGDUGV RI FRUSRUDWH JRYHUQDQFH LQ WKH FRQGXFW RI EXVLQHVV DQG YDOXH FKDLQ &UHDWH D FXOWXUH RI KLJK SHUIRUPDQFH E\ SURPRWLQJ WHDP&Ζ0% HWKRV 2SHUDWH ZLWK LQWHJULW\ DQG WUDQVSDUHQF\ WRZDUGV VWDNHKROGHUV &UHDWH RSSRUWXQLWLHV IRU HPSOR\HHV DQG YDOXH FKDLQ partners 2SHUDWLRQDOLVH LQFOXVLYH DQG DJLOH SROLFLHV DQG SURFHVVHV WKDW FRQWULEXWH WR HPSOR\HH SURGXFWLYLW\ DQG ZHOO EHLQJ 6WUHQJWKHQ FRPSOLDQFH PRQLWRULQJ DQG UHSRUWLQJ FRQWUROV DQG PHFKDQLVPV H O W W E C R E AT E VA L U E 6WUHQJWKHQ RXU YDOXH SURSRVLWLRQ DQG DELOLW\ WR GHOLYHU UHWXUQV WR LQYHVWRUV DQG VKDUHKROGHUV 6WUDWHJLVH RXU UHVRXUFHV DQG UHLQIRUFH RXU DELOLW\ WR SODQ DQG DFKLHYH UHVLOLHQW JURZWK &UHDWH D EHWWHU ZRUN SODFH HQYLURQPHQW WKDW LV LQFOXVLYH GLYHUVH DQG SDUWLFLSDWLYH ZLWK KRUL]RQWDO DQG YHUWLFDO JURZWK RSSRUWXQLWLHV IRU HPSOR\HHV K E Y D R I V E R S O F S H A R E D VA L U E *URXS (QWHUSULVH 5LVN 0DQDJHPHQW )UDPHZRUN *URXS 'LYLGHQG 3ROLF\ *URXS XPDQ 5HVRXUFHV 3ROLFLHV DQG 3URFHGXUHV &RGH RI &RQGXFW &RGH RI (WKLFV XPDQ 5LJKWV *XLGHOLQHV (PSOR\HH (QJDJHPHQW ΖQFOXVLYHQHVV 5HFUXLWPHQW 5HPXQHUDWLRQ 3ROLF\ &Ζ0% *URXS 'LYHUVLW\ 6WDWHPHQW %RDUG 'LYHUVLW\ DQG ΖQFOXVLRQ 3HUIRUPDQFH 0DQDJHPHQW 3HRSOH 'HYHORSPHQW 3ROLF\ *URXS 2FFXSDWLRQDO 6DIHW\ DQG HDOWK 3ROLF\ 3URFHGXUHV *URXS 3URFXUHPHQW 3ROLF\ 6XVWDLQDEOH 3URFXUHPHQW *XLGHOLQHV 9HQGRU &RGH RI &RQGXFW HIGHLIGHTS 2020 52.2% Cost to Income or (ɝFLHQF\ 5DWLR 2.1% Return on Equity 30% Female Directors on the Board RM1.2 billion in Procurement Spend towards Suppliers/Vendors (Malaysia**) 0DMRULW\ RI RXU VXSSOLHUV DUH EDVHG LQ 0DOD\VLD ZKLFK DFFRXQWV IRU RI RXU WRWDO *URXS SURFXUHPHQW VSHQG 2XU ODUJHVW VSHQGV DUH LQ *URXS 7HFKQRORJ\ *URXS 2SHUDWLRQV DQG *URXS GPLQLVWUDWLRQ 3URSHUW\ 10 CIMB *URXS ROGLQJV %HUKDGɅAnnual Report 2020

How Do We Create Shared Value? FOR CUSTOMERS & CLIENTS We support the aspirations of our customers and clients by taking an inclusive approach to growth. Our objective is to create net positive impact through our products and services, positively advancing customers and making business a force for good. W H AT M AT T E R S Customer Centricity &XOWLYDWH D ȆFXVWRPHU ȴUVWȇ PLQGVHW 7UDQVIRUP FXVWRPHU MRXUQH\V WR FUHDWH D XQLTXH DQG XQLIRUP H[SHULHQFH 'HVLJQ DQG GHOLYHU ȴQDQFLDO DQG GLJLWDO VROXWLRQV WKDW FRQWULEXWH WR ZHOO EHLQJ DQG ZHOIDUH 2 HU EHVSRNH SURGXFWV VHUYLFHV DQG DGYLVRU\ WR HPSRZHU EXVLQHVVHV IRU DFKLHYLQJ JURZWK DPELWLRQV (VWDEOLVK SDUWQHUVKLSV WR UDLVH DZDUHQHVV DQG EXLOG FDSDFLW\ WR GULYH UHVSRQVLEOH DQG FRPSHWLWLYH EXVLQHVVHV RI WKH IXWXUH (QFRXUDJH LQGLYLGXDOV DQG EXVLQHVVHV WR PDQDJH WKHLU ȴQDQFHV EHWWHU LPSURYLQJ WKHLU ZHOO EHLQJ DQG TXDOLW\ RI OLIH Sustainable Finance 0RELOLVH FDSLWDO ȵRZV IRU JUHDWHU JRRG ZKLOH PHHWLQJ EXVLQHVV PRWLYHV (QDEOH SROLFLHV DQG JXLGHOLQHV WR PDQDJH H[SRVXUH WR YDULRXV VXVWDLQDELOLW\ ULVNV WR FUHDWH SRVLWLYH LPSDFWV DQG UHGXFH QHJDWLYH LPSDFWV Financial Inclusion &RQWULEXWH WR VRFLR HFRQRPLF GHYHORSPHQW E\ FUHDWLQJ EDQNLQJ RSSRUWXQLWLHV IRU WKH XQGHUVHUYHG DQG GLVDGYDQWDJHG FRPPXQLWLHV DQG GHPRJUDSKLFV WRZDUGV EXLOGLQJ D PRUH UHVLOLHQW DQG ȴQDQFLDOO\ VHFXUH population H O W W E C R E AT E VA L U E 7UHDW FXVWRPHUV IDLUO\ ZLWK LQWHJULW\ DQG FRPPLWPHQW WR ȴQDQFLDO LQFOXVLYHQHVV DQG ZHOO EHLQJ *LYH DFFHVV WR ȴQDQFH R HU UHVSRQVLEOH SURGXFWV DQG LQVSLUH VXVWDLQDEOH EXVLQHVV SUDFWLFHV ΖPSURYH FUHGLW TXDOLW\ E\ PHHWLQJ UHVSRQVLEOH OHQGLQJ VWDQGDUGV KEY DRIVERS OF S H A R E D VA L U E &XVWRPHU ([SHULHQFH &; 3ROLF\ 7UHDWLQJ &XVWRPHU )DLUO\ *URXS 6XVWDLQDEOH )LQDQFLQJ 3ROLF\ *6)3 DQG 6HFWRU *XLGHV Ζ7 6HFXULW\ 3ROLF\ *URXS 3HUVRQDO 'DWD 3URWHFWLRQ 3ROLF\ HIGHLIGHTS 2020 Within 72% NPS Relative to Peers 5 million CIMB Digital Users 179 Financing Facilities with in-depth due diligence on Environmental and Social risks 25,000 Customer to Branch Ratio or Physical Touchpoints per Customer CIMB *URXS ROGLQJV %HUKDGɅAnnual Report 2020 11

How Do We Create Shared Value? F O R S O C I E T Y & CO M M U N I T Y We champion purposeful programmes to help communities prosper and shape a better SODQHW )URP ȴQDQFLDO OLWHUDF\ WR JHQGHU HPSRZHUPHQW DQG IURP HQWUHSUHQHXUVKLS WR environmental stewardship, we identify issues that impede socio-economic development of communities who matter to us. W H AT M AT T E R S Corporate Citizenship Sustainability/Climate Change 8QGHUVWDQG WKH QHHGV DQG H[SHFWDWLRQV RI FRPPXQLWLHV ΖQVWLOO D VHQVH RI VRFLDO UHVSRQVLELOLW\ DQG FRPPXQLW\ VWHZDUGVKLS DPRQJVW HPSOR\HHV (QFRXUDJH SDUWQHUVKLSV ZLWK JUDVVURRWV RUJDQLVDWLRQV OHDG 1*2V DQG FRPPXQLW\ JURXSV IRU JUHDWHU LPSDFW 0LQLPLVH QHJDWLYH LPSDFW RI RXU RSHUDWLRQV DQG ȴQDQFHG DFWLYLWLHV RQ WKH HQYLURQPHQW DQG FRPPXQLWLHV 0DQDJH RXU GLUHFW FDUERQ IRRWSULQW E\ PRQLWRULQJ DQG UHGXFLQJ HPLVVLRQV DQG ZDVWH IURP RXU RSHUDWLRQV :RUN ZLWK LQGXVWU\ SHHUV DQG VWDNHKROGHUV WR UDLVH DZDUHQHVV DQG PRELOLVH DFWLRQ RQ FOLPDWH UHVLOLHQFH LQ WKH ȴQDQFLDO VHFWRU Social Inequalities VVHVV WKH VRFLDO LQHTXDOLWLHV DQG LQMXVWLFHV SUHYDOHQW LQ FRPPXQLWLHV WKDW PDWWHU WR XV DFURVV PDUNHWV (PSRZHU FRPPXQLWLHV E\ HTXLSSLQJ WKHP ZLWK VNLOOV UHVRXUFHV DQG RSSRUWXQLWLHV WKDW ZLOO DGYDQFH WKHLU ZHOIDUH DQG ZHOO EHLQJ ΖQWHJUDWH FRPPXQLW\ PHPEHUV LQWR PDLQVWUHDP PDUNHWSODFH E\ SURPRWLQJ HQWUHSUHQHXULDO DQG HGXFDWLRQ SURJUDPPHV H O W W E C R E AT E VA L U E 3URYLGH RSSRUWXQLWLHV IRU HPSOR\HHV WR GHVLJQ DV ZHOO DV FRQWULEXWH WR FRPPXQLW\ SURJUDPPHV &KDQQHO VLJQLȴFDQW LQYHVWPHQWV WR SXUSRVHIXO FRPPXQLW\ SURJUDPPHV DQG LQLWLDWLYHV &UHDWH ORQJ WHUP QHW SRVLWLYH HQYLURQPHQWDO DQG VRFLDO LPSDFW LQ DUHDV WKDW PDWWHU WR FRPPXQLWLHV K E Y D R I V E R S O F S H A R E D VA L U E *URXS 6XVWDLQDELOLW\ 3ROLF\ 6XVWDLQDELOLW\ 5LVN 0DQDJHPHQW )UDPHZRUN *URXS GPLQLVWUDWLRQ DQG 3URSHUW\ 0DQDJHPHQW 3ROLF\ *URXS &RUSRUDWH 5HVSRQVLELOLW\ 3ROLF\ *URXS &65 3ROLF\ )OH[ &65 3ROLF\ (PSOR\HH 9ROXQWHHULVP HIGHLIGHTS 2020 Top 35% Dow Jones Sustainability Index (DJSI) Ranking 8.8% Reduction (YoY) in Scope 1 and Scope 2 GHG Emissions Intensity RM29.3 million Invested in Communities, supporting 118,808 EHQHȴFLDULHV 12 CIMB *URXS ROGLQJV %HUKDGɅAnnual Report 2020

Economic Value Distributed & Retained 2020 945,000 1,200,000 4,606,672 DISTRIBUTED TO REINVES T TO THE GROUP (Dividend Reinvestment Plan; Depreciation & Amortisation; Retain Earnings) RM’000 29,300 DISTRIBUTED TO SUPPLIER S/ VENDOR S (Group Procurement) RM’000 2019 45,800 DISTRIBUTED TO THE COMMUNIT Y (CSR/Community Investments) RM’000 2020 5,144,070 2019 2019 2020 2019 2020 2019 896,192 2020 5,764,674 1,519,653 2019 DISTRIBUTED TO E M P L OY E E S (Personnel Costs) RM’000 383,760 1,142,901 DISTRIBUTED TO THE GOVERNMENT (Taxation & Zakat) RM’000 693,046 DISTRIBUTED TO P R O V I D E R S O F C A P I TA L (Cash Dividends to Shareholders & Non-controlling Interests) RM’000 2020 D I S T R I B U T I O N O F T O TA L E C O N O M I C VA L U E 10.2% 13.6% 33.9% 58.5% 0.3% 42.5% 2020 2019 13.0% 7.0% 4.4% Ʉ7R HPSOR\HHV Ʉ7R WKH *RYHUQPHQW 0.3% 5.1% Ʉ7R SURYLGHUV RI FDSLWDO Ʉ7R WKH FRPPXQLW\ 11.2% Ʉ7R WKH VXSSOLHUV YHQGRUV Ʉ7R UHLQYHVW WR WKH *URXS Community investments LQFOXGH FRQWULEXWLRQV WR FKDULWLHV 1*2V DQG UHVHDUFK LQVWLWXWHV XQUHODWHG WR WKH RUJDQLVDWLRQȇV FRPPHUFLDO UHVHDUFK DQG GHYHORSPHQW IXQGV WR VXSSRUW FRPPXQLW\ LQIUDVWUXFWXUH VXFK DV UHFUHDWLRQDO IDFLOLWLHV DQG GLUHFW FRVWV RI GHYHORSLQJ DQG LPSOHPHQWLQJ VRFLDO DQG HQYLURQPHQWDO SURJUDPPHV LQFOXGLQJ DUWV DQG HGXFDWLRQDO HYHQWV Ȃ DOO FKDQQHOOHG WKURXJK &Ζ0% )RXQGDWLRQ DV ZHOO DV UHVSHFWLYH EXVLQHVV XQLWV Value to Suppliers/Vendors LQFOXGH SD\PHQW PDGH WRZDUGV SURGXFWV RU VHUYLFHV RU LQYHVWPHQWV LQ DQ\ VXSSOLHU HGXFDWLRQ RU GHYHORSPHQW SURJUDPPHV 0DMRULW\ RI RXU VXSSOLHUV DUH EDVHG LQ 0DOD\VLD ZKLFK DFFRXQWV IRU RI RXU WRWDO *URXS SURFXUHPHQW VSHQG 2XU ODUJHVW VSHQGV DUH LQ *URXS 7HFKQRORJ\ *URXS 2SHUDWLRQV DQG *URXS GPLQLVWUDWLRQ 3URSHUW\ CIMB *URXS ROGLQJV %HUKDGɅAnnual Report 2020 13

CIMB’s Value Creation Model INPU T S Supported by sound institutional framework Our business model and operating processes are managed conduct, sustainability and stakeholder stewardship. K E Y BU S INE S S A R E A S Refer to Capital: Inputs and KPIs pages 8 & 9. Financial Strong balance sheet with invested capital and total assets valued at RM602.4 billion Manufactured 668 branches, 6,153 ATMs, 8,546 self-service customer access points CONSUMER BANKING COMMERCIAL BANKING WHOLESALE BANKING ISLAMIC BANKING CIMB DIGITAL ASSETS TRANSACTION BANKING Refer to Business Review pages 78-89. M A R K E T T R E NDS IMPAC T ING

Annual Report 2020 compared to our 2019 Annual Report. The total carbon footprint for printing CIMB Annual Report 2020 was 11,588kgCO2e, compared to 14,987kgCO2e for our 2019 annual report. The carbon footprint for the 3 books of CIMB Annual Report 2020 is 14.485kgCO2e. We are committed to reducing the environmental impact of our annual report .

CIMB 0% Easy Pay Cash Back Campaign Terms and Conditions 1. CIMB 0% Easy Pay Cash Back Campaign ("Campaign") is jointly organized by CIMB Bank Berhad [Registration No: 197201001799 (13491-P)] ("CIMB Bank") and CIMB Islamic Bank Berhad [Registration No: 200401032872 (671380-H) ("CIMB Islamic").CIMB Bank and/or CIMB Islamic shall

CIMB BANK CIMB NIAGA CIMB INVESTMENT BANK CIMB THAI BANK CIMB ISLAMIC CIMB BANK PLC CIMB VIETNAM CIMB Bank* is the Group’s commercial bank in Malaysia with 259 branches across the country. It has subsidiaries in Thailand, Cambodia and Vietnam, as well as branches in Singapore, Philippines

CIMB - CIMB Investment Bank Berhad. CIMB Group - CIMB Group Sdn. Bhd. CIMB-Principal or the Manager - CIMB-Principal Asset Management Berhad. CIMB-Principal Fund CIS - - Any unit trust funds that may be offered by CIMB-Principal. Refers to collecti

70 ibraheem hammood mhana cimb 1500 71 imad mahmood ali cimb 50 72 imtithal ismael jaloot cimb 1000 73 intidhar jabir idan al-tharwani cimb 1500 74 iqbal khalaf erabee alhraishawi cimb 1500 . 103 muwafaq fadhil jaddoa al-dhaydan cimb 1500 104 nabe

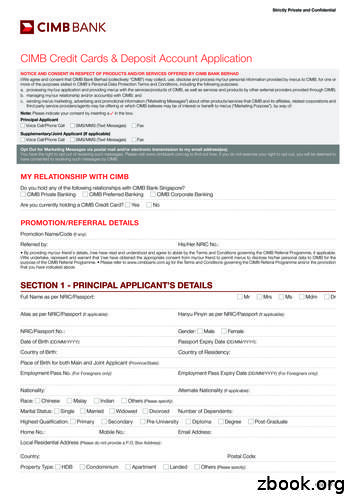

I agree and consent that CIMB Bank Berhad (collectively “CIMB”) may collect, use, disclose and process my personal information provided by me to CIMB, for one or more of the purposes stated in CIMB’s Personal Data Protection Terms and Conditions, including the following purposes: a

(b) 1 copy of latest Bank Statement/Payslip/EA Form/Income Tax Return Form. IMPORTANT NOTES: 1. Please read the general terms and conditions of CIMB (“CIMB’s General Terms and Conditions”). 2. The application herein is subject to the approval of CIMB and CIMB reserves the right

CGS-CIMB’s General Terms and Conditions and Risk Disclosure Statement - Islamic Broking (“CGS-CIMB’s General Terms and Conditions”). 2. The application herein is subject to the approval of CGS-CIMB and CGS-CIMB reserves the right

CIMB Credit Cards & Deposit Account Application NOTICE AND CONSENT IN RESPECT OF PRODUCTS AND/OR SERVICES OFFERED BY CIMB BANK BERHAD I/We agree and consent that CIMB Bank Berhad (collectively “CIMB”) may collect, use, disclose and process my/our persona