The AGR Graduate Recruitment Survey 2015 - Cdn.ymaws

The AGR Graduate Recruitment Survey 2015 Winter Review Produced for AGR by

The AGR Graduate Recruitment Survey 2015 Winter Review

Graduate Recruitment Survey 2015 Winter Review Association of Graduate Recruiters 6 Bath Place Rivington Street London EC2A 3JE Survey produced for AGR by CFE Phoenix Yard Upper Brown Street Leicester LE1 5TE For more information please contact Hayley Lamb on 0116 229 3300 or hayley.lamb@cfe.org.uk Website: www.cfe.org.uk All information contained in this report is believed to be correct and unbiased, but the publisher does not accept responsibility for any loss arising from decisions made upon this information. CFE and the Association of Graduate Recruiters All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying or otherwise, without prior permission of the publisher. 4

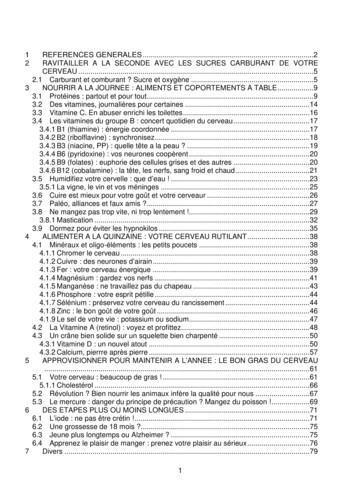

Graduate Recruitment Survey 2015 Winter Review Contents Foreword . 6 Executive Summary . 7 Introduction . 10 Graduate vacancies. 12 Graduate vacancies in 2013-2014 and 2014-2015 . 12 Expected changes in vacancies by sector . 14 Vacancies in 2013-2014 by business sector . 15 Vacancies in 2013-2014 by region . 16 Vacancies in 2013-2014 by career area . 17 Applications and offers . 19 Applications per graduate vacancy . 19 Unfilled vacancies . 20 Turn-down rates of employer offers . 22 Share of hires who had previously worked for their employer . 23 Time to offer . 24 Graduate recruitment marketing . 26 Total marketing spend in 2013-2014 and 2014-2015. 26 Marketing spend per vacancy . 27 Mean spend on key activities in 2013-2014 and 2014-2015 . 29 Relationships with universities for marketing graduate vacancies . 31 School leaver opportunities . 34 School leaver opportunities offered in 2013-2014 and 2014-2015. 34 Number of school leaver opportunities in 2013-2014 and 2014-2015 . 36 School leaver opportunities in 2013-2014 by business sector . 37 Marketing of school leaver opportunities . 37 Appendix . 40 Changes to 2015 Winter Review . 40 Methodology . 41 Profile of respondents . 41 5

Graduate Recruitment Survey 2015 Winter Review Foreword Employer members continue to expand their investment in graduates and early talent. Our industry is recruiting more graduates than ever before with vacancies set to rise this year by a further 11.9%. But this increase brings problems: almost half of our AGR employer members had challenges filling vacancies in 2014, with 1,422 vacancies reported as unfilled. Difficulties in attracting the right talent with the right mix of skills in the right location are on the increase. Not since 2008 has the problem been so pronounced. Increasingly our employer members are taking a holistic approach to Emerging Talent. Over 75% our employers now actively engaged in the schools market. School leaver opportunities appear to be complementing graduate programmes rather than replacing them but we need to continue our efforts to understand and influence this market. The graduate labour market is too often treated as a single entity rather than a series of individual sectors with their own distinct supply and demand forces. You will notice that in this year’s report we have made it easier for you to benchmark your recruitment activity within your sector as well as more generally. You will notice that sectors differ in their proportion of unfilled vacancies, their turn-down rates of offers, their presence on campus, their marketing spend per vacancy and more. Beneath the headline findings, you will find a wealth of insight to help you develop your graduate recruitment strategies. We will continue to invest in our research and reporting capabilities. Key results will again be made available through an online data dashboard to enable you to explore the data in more depth. Please do continue to engage with AGR, let us know what you need from your organisation and enjoy the report. Stephen Isherwood Chief Executive, AGR 6

Graduate Recruitment Survey 2015 Winter Review Executive Summary Graduate vacancies AGR employers are predicting an increase in graduate vacancies of 11.9% from 2013-2014 to 2014-2015. This follows an actual increase of 4.3% in the previous recruitment season. The top four sectors expecting to see an increase in vacancies are: IT/Telecommunications sector (26.9%), public sector (23.0%), construction companies or consultancies (22.1%) and engineering (19.7%). Only three sectors are predicting small decreases: energy, water or utility companies (-0.3%), FMCG companies (-5.0%) and consulting or business services firms (-5.3%). In 2013-2014 accountancy or professional services firms accounted for 22.2% of all graduate vacancies, followed by the public sector (13.3%), engineering or industrial companies (12.7%) and retail (10.4%). London continues to attract the highest number of vacancies (45.0%) across AGR members, with the South East attracting a further 8.9%. Applications and Offers 1422 vacancies were unfilled in 2013-14, with nearly half (44.8%) of all AGR employers with unfilled vacancies. The average number of unfilled vacancies across all employers was 5.4% per employer. On average, 14.4% of offers to graduates were turned down. Only two employers had turn-down rates over 20%: IT/Telecommunications (22.0%) and law firms (20.6%). Across AGR members, on average, 26.5% of graduate positions were filled by people who had previously worked for the same employer through an internship or placement programme. The average “time to offer”, that is the time that elapses between an applicant applying and receiving an offer, was 13 weeks (although this figure varies significantly by sector and hiring volumes). Graduate recruitment marketing Employers are increasing their marketing spend. The mean marketing spend per AGR member was 94,750 in 2013-2014. This figure is expected to rise to 103,500 in the 2014-2015 recruitment season. The marketing budget per vacancy in the 2013-2014 recruitment season was 2,007 amongst AGR members. This is expected to increase in 2014-2015 to 2,069. AGR members allocated a marketing budget to a wide range of activities in 2013-2014 and plan to continue to allocate their budgets to a similar range of activities in 2014-2015. On campus activities (93.8%) proved to be the most popular activity, closely followed by general online activities (91.0%) and print (89.9%). However, online promotions attract the highest mean spend at 26,000, followed by on campus activities ( 21,250) and print ( 14,250). Of particular note is the increasing use of social media marketing with 52.5% of AGR members planning to spend money in this area in 2014-15, up from 44.4% in the 2013-14 recruitment season. 7

Graduate Recruitment Survey 2015 Winter Review Very few (5.2%) AGR employers did not visit or work with UK universities to market their graduate vacancies in 2013-2014. On average, AGR members worked with 16.9 universities. School leaver opportunities Over two-thirds (68.2%) of AGR members offered school leaver opportunities in 2013-2014; an increase from 54.7% in 2012-2013 (as reported in the Winter 2014 Review). AGR employers are predicting a further increase in this activity, with almost three-quarters (72.7%) of employers planning to offer opportunities in 2014-2015. Apprenticeships continue to be the most popular type of opportunity on offer for school leavers. Almost half of AGR employers (47.0%) offered Apprenticeships in 2013-14, with the proportion predicted to rise to 51.5% in the next year. A total of 16,906 school leaver opportunities were offered by 104 AGR employers in 2013-2014. One-third (32.9%) of AGR employers offering school leaver opportunities reported that they had established a relationship with 1-10 schools in order to promote their opportunities and just over a quarter (26.0%) had established relationships with 11-50 schools. AGR members were asked to state the total budget allocated to school leaver attraction activities during the 2013-2014 recruitment season; almost half of AGR members (46.2%) did not allocate any budget to school leaver attraction activities, just over a fifth (20.4%) spent up to 10,000 and 12.9% spent 10,001 to 25,000. 8

Graduate Recruitment Survey 2015 Winter Review Introduction 9

Graduate Recruitment Survey 2015 Winter Review Introduction Welcome to the AGR Graduate Recruitment Survey 2015 – Winter Review. The AGR Graduate Recruitment Survey is the definitive study of AGR employer members and their recruitment practices, providing up-to-the-minute insights into conditions and trends in the graduate recruitment market. It provides regular benchmarking of key market indicators including vacancy levels. As the leading survey of graduate recruitment practices, spanning the longest continuous series of recruitment seasons, the survey is the primary source of information on graduate recruitment levels, methods and practices amongst AGR members. This means that it is an invaluable tool for assessing, organising and optimising graduate recruitment and development activities. The Graduate Recruitment Survey is conducted twice a year. Undertaken on behalf of AGR by CFE Research, the Winter Review explores AGR employers in relation to: Graduate vacancy levels for the 2013-2014 recruitment season by business sector and region Predicted vacancy levels for the 2014-2015 recruitment season Graduate recruitment and marketing practices The use of school leaver programmes The findings are presented in three chapters structured to reflect the areas outlined above. Chapter 1 focuses on vacancy levels while Chapter 2 examines the number of applications received per vacancy and offers to graduates, Chapter 3 looks at AGR employers’ spend on activities to attract graduate talent. Chapter 4 explores the prevalence of school leaver programmes amongst graduate recruiters. 10

Graduate Recruitment Survey 2015 Winter Review Chapter 1 Graduate vacancies 11

Graduate Recruitment Survey 2015 Winter Review Graduate vacancies This chapter looks at actual year-end vacancy levels for the 2013-2014 recruitment season and presents AGR members’ predictions or expectations for the current recruitment season (2014-2015). Graduate vacancies in 2013-2014 and 2014-2015 Overall, findings from the Winter 2015 review represent continued optimism amongst employers, with an increasingly healthy graduate recruitment market. Collectively, employers are estimated to have offered a total of 21,682 vacancies during the 2013-2014 recruitment season. The year-end figures for 2013-2014 illustrate that the number of graduate vacancies increased by 4.3% (amongst employers who provided both vacancy figures)1, with a further sharp rise expected in 2014-2015 of 11.9% (Figure 1.1). 2000 14.7% 2001 14.6% 2002 -6.5% 2003 -3.4% 2004 15.5% 2005 5.1% 2006 5.1% 2007 12.7% 2008 2009 0.6% -8.9% 2010 8.9% 2011 2012 1.7% -8.2% 2013 4.3% 2014 4.3% 2015 (predicted) 11.9% Figure 1.1: Graduate vacancy changes at AGR employers 2000 to 2015 (predicted) – Percentage increase or decrease on previous year (varying bases) 1 The percentage change is calculated for employers who responded to both the Winter 2014 and the Winter 2015 Review to ensure robustness of the data. 12

Graduate Recruitment Survey 2015 Winter Review The trend in graduate vacancies amongst AGR members continues to follow that of the UK economy, which has enjoyed two years of economic growth, with GDP having now surpassed its pre-recession levels. Further strong growth is predicted in 2015. The predicted increase in vacancy levels amongst AGR members is matched by a corresponding rise in the mean number of vacancies offered per employer. After observing very little change in the mean number of vacancies per AGR employer between 2010 and 2012, the last two years have seen steady growth in the mean number of vacancies, with a particularly large rise occurring in 2014. Furthermore, AGR members expect there to be even more substantial increases in the mean number of vacancies next year (Figure 1.2). 2010 99.4 2011 99.6 2012 2013 2014 2015 (predicted) 98.2 103.8 107.8 121.2 Figure 1.2: Mean number of vacancies per AGR employer 2009 to 2015 (predicted) – Varying bases Part of this rise can be attributed to the increasing investment of the largest employers into graduate recruitment. However, even when the largest employers are discounted (those recruiting over 500 graduates per year), the mean number of vacancies continues to rise with 71.9 vacancies on average in 2014 and 79.5 predicted in 2015. 13

Graduate Recruitment Survey 2015 Winter Review Expected changes in vacancies by sector Table 1.3 below presents the expected percentage change in vacancies from 2013-2014 to 2014-2015 by sector2. Table 1.3: Percentage change in vacancies from 2013-2014 to 2014-2015 by sector (predicted) IT/Telecommunications 26.9% Public sector 23.0% Construction company or consultancy 22.1% Engineering or industrial company 19.7% Investment bank or fund managers 12.3% Banking or financial services 10.3% Accountancy or professional services firm 6.8% Law firm 3.3% Retail 0.7% Energy, water or utility company -0.3% FMCG company -5.0% Consulting or business services firm -5.3% The majority of sectors expect to increase their vacancies, with only three predicting a fall in vacancy levels in the 2014-2015 recruitment season. When comparing these figures to those reported in the Winter 2014 review, we find that the IT/Telecommunications sector (26.9%) and public sector (23.0%) continue to expect strong growth in vacancy levels. In the Winter 2014 review, investment bank or fund managers expected a decline in vacancy levels, whereas this year, this sector believes that vacancy levels will rise by 12.3%. In contrast to the previous year where a sharp rise was predicted, the energy, water and utility sector state that they anticipate vacancy levels to fall slightly in 2014-2015. 2 The following sectors are not reported in our analysis as the small number of respondents within the sector may jeopardise their anonymity: Oil companies, chemical or pharmaceutical companies, insurance and transport or logistics companies. 14

Graduate Recruitment Survey 2015 Winter Review Vacancies in 2013-2014 by business sector Table 1.4 outlines the distribution of vacancies by sector3 in 2013-2014 amongst AGR employers. Table 1.4: Vacancies at AGR employers by sector in 2013-2014 % of 21,682 vacancies Accountancy or professional services firm 22.2% Public sector 13.3% Engineering or industrial company 12.7% Retail 10.4% Banking or financial services 9.7% IT/Telecommunications 8.3% Law firm 5.9% Investment bank or fund managers 4.3% Consulting or business services firm 3.2% Construction company or consultancy 1.8% FMCG company 1.4% Energy, water or utility company 1.3% Insurance company 0.5% Other 0.9% 3 The following sectors are not reported in our analysis as the small number of respondents within the sector may jeopardise their anonymity: Oil companies, chemical or pharmaceutical companies and transport or logistics companies. 15

Graduate Recruitment Survey 2015 Winter Review Reflecting the previous two Winter surveys, the accountancy and professional services sector continues to provide around one-fifth of the total vacancies offered by AGR employers. Whilst the public sector (13.3%) and retail (10.4%) account for a similar proportion of vacancies as in 2012-2013, there has been a rise in the percentage of the total number of vacancies offered by the banking and financial services (9.7%), as well as the engineering/industrial sectors (12.7%). Vacancies in 2013-2014 by region Whilst the largest proportion of graduate vacancies for AGR members are based within the London area (45.0%), the proportion has declined from the previous year, when the capital provided 50.1% of total vacancies. The distribution of vacancies otherwise continues to follow a similar trend to previous years. Wales (1.9%) and Northern Ireland (1.2%) offer the smallest proportion of total vacancies, with just 5.6% of graduate vacancies being offered outside the UK. Table 1.5: Vacancies at AGR employers by region in 2013-2014 % of 18,464 vacancies London 45.0% South East 8.9% West Midlands 6.7% North West 6.3% Scotland 5.9% South West 5.2% East Midlands 4.5% Yorkshire and Humberside 4.2% North East 2.6% East of England 2.1% Wales 1.9% Northern Ireland 1.2% Europe 1.7% The Americas 1.5% Asia 1.2% The Middle East 0.4% Rest of World 0.8% *The base appears as 18,464 instead of 21,682 because some responding organisations did not provide information about the regions where they recruit. Please note recruiters may be offering vacancies in more than one region simultaneously. 16

Graduate Recruitment Survey 2015 Winter Review Vacancies in 2013-2014 by career area Accountancy (14.8%) was the main type of job vacancy offered by AGR employers, followed by IT (11.5%) and consulting (10.8%). Very few positions, however, were offered in the fields of research and development (0.9%), actuarial (0.9%), logistics (0.9%) and science (0.7%). Table 1.6: Vacancies at AGR employers by career area in 2013-2014 % of 18,784 vacancies Accountancy 14.8% IT 11.5% Consulting 10.8% General management 10.4% Legal Work 7.1% Financial management 5.2% Investment banking 4.1% Mechanical Engineering 3.4% Sales/customer management 3.4% Civil engineering 2.4% Electrical/electronic engineering 2.6% Human resources 1.8% Retail management 1.3% Marketing 1.2% Manufacturing engineering 1.1% Purchasing 1.1% Research and Development 0.9% Logistics 0.9% Actuarial 0.9% Science 0.7% Other 14.5% *The base appears as 18,784 instead of 21,682 because some responding organisations did not provide information about the regions where they recruit. Please note recruiters may be offering vacancies in more than one region simultaneously. 17

Graduate Recruitment Survey 2015 Winter Review Chapter 2 Applications and offers 18

Graduate Recruitment Survey 2015 Winter Review Applications and offers This chapter of the report looks at the number of applications AGR members received per vacancy, examines unfilled vacancies and the proportion of graduates who have previously worked for their employer before being hired as graduates. It also provides data on turn-down rates and the average time to offer. Applications per graduate vacancy AGR members were asked how many completed applications they received in total in 2013-2014. On average across AGR members, 74.5 applications were received for every graduate recruited in 2013-20144. This indicates that on the whole application volumes appear to be decreasing as this is lower than the number of applications received (midway through the recruitment season) per vacancy in 2012-2013 (85.3 reported in the Summer 2013 Review).On average, those employers who offered a smaller number of vacancies received a higher number of applications per vacancy. All employers 74.5 1-25 graduates 96.7 26-50 graduates 75.2 51-75 graduates 58.4 76-100 graduates 52.1 101-250 graduates 53.9 251-500 graduates More than 500 graduates 46.2 28.3 Figure2.1: Average number of applications per vacancy received by AGR employers in 2013-2014 by intake size – Varying bases Figure 2.2 indicates the average number of applications per vacancy by sector5. The sector with the largest number of applications per vacancy is FMCG at 146.4, followed banking or financial services at 107.3. 4 Analysis has been undertaken on those who provided us with exact vacancy and application figures only. The following sectors are not reported in our analysis as the small number of respondents may jeopardise their anonymity: oil companies, chemical or pharmaceutical companies, transport or logistics companies and insurance companies. 5 19

Graduate Recruitment Survey 2015 Winter Review All employers 74.5 FMCG company 146.4 Banking or financial services 107.3 Investment bank or fund managers 101.5 Energy, water or utility company 96.8 IT/Telecommunications 87.3 Retail 71.2 Consulting or business services firm 64.9 Law firm 59.6 Engineering or industrial company 55.8 Construction company or consultancy 41.7 Public sector 41.5 Accountancy or professional services firm Other 36.1 149.8 Figure 2.2: Average number of applications per vacancy received by AGR employers in 2013-2014 by sector – Varying bases Unfilled vacancies Despite an increase in the total vacancies available, and the number of applications still far exceeding the number of places, the challenge of filling graduate vacancies is widespread this year. 44.8% of employers – almost half – had one or more unfilled vacancies, while the average proportion of unfilled vacancies per employer at 5.4%. Employers with unfilled vacancies reported a total of 1,422 unfilled vacancies in 2013/14 compared with 19,282 positions filled in their respective companies. IT and telecommunications employers had the largest proportion of unfilled vacancies (11.8%), followed by energy, water or utility companies (11.1%). 20

Graduate Recruitment Survey 2015 Winter Review All employers 5.4% IT/Telecommunications 11.8% Energy, water or utility company 11.1% Construction company or consultancy 7.7% Consulting or business services firm 7.3% Law firm 5.9% Insurance company 5.9% Accountancy or professional services firm 4.8% Public sector 3.9% Engineering or industrial company 3.4% FMCG company 2.8% Retail 2.7% Banking or financial services 1.4% Investment bank or fund managers 1.4% Other 3.7% Figure 2.3: Average proportion of unfilled vacancies by sector 2013-2014 Base variable In-depth interviews were carried out with a range of AGR members In order to understand what could be contributing to vacancies remaining unfilled. A wide range of factors were quoted: An employer in the IT sector commented “The required standard of technical graduates remains high, and as a result of increased competition, the standard of applicants has decreased on the whole – within our organisation we cannot decrease the high standards that we require.” Another employer, from the public sector, also linked the unfilled vacancies with the quality of applicants “These [vacancies] were for candidates from disciplines that are notoriously difficult to recruit for.” Whilst an employer from the engineering sector confirmed a complex mix of factors created their shortfall: “a number of reasons including business complexity, the way we run our recruitment and selection process given the resource we have, and the large numbers to fill, changing business needs and market competition.” 21

Graduate Recruitment Survey 2015 Winter Review Turn-down rates of employer offers The average turn-down rate, defined as the proportion of graduates that did not accept a graduate position that was offered to them, was 14.4%. Fast moving consumer goods companies had the highest proportion of graduates accepting roles, with only 2.7% of offers being turned down. Consulting or business services firms (8.4%) and retail (10.0%) also reported turn-down rates of 10% or lower. IT and telecommunications firms (22.0%) and law firms (20.6%) reported the highest turn-down rates, both above 20%, hinting at more intense competition for candidates within their respective sectors. All employers 14.4% IT/Telecommunications 22.0% Law firm 20.6% Engineering or industrial company 16.9% Energy, water or utility company 15.4% Accountancy or professional services firm 13.4% Public sector 13.2% Construction company or consultancy 12.6% Banking or financial services 10.6% Retail 10.0% Consulting or business services firm FMCG company Other 8.4% 2.7% 19.7% Figure 2.4: Average acceptance rate (proportion of candidates that they offered places to that accepted) of AGR members by sector 2013-2014 Base variable During the in-depth interviews, several employers commented that their turndown rates this year had been higher than expected. In terms of the reasons, one confirmed that they had “an increase in offers that were declined by graduates quite late in the recruitment cycle” while another mentioned a change in candidate behaviour: “seems graduates are holding a couple of offers and deciding late in the cycle”. 22

Graduate Recruitment Survey 2015 Winter Review Share of hires who had previously worked for their employer Many graduates find work opportunities with employers that they’ve worked with previously, for example through internships, gap years or placements. In total, 3,865 of the 16,953 graduates recruited during 2013-2014 (by employers who provided a response) filled a vacancy with an employer for whom they had previously worked. On average, 26.5% of vacancies were filled this way across all employers sampled. Two employers (out of 169) stated that they had filled all of their graduate vacancies with graduates who had worked with them previously. In contrast, 16.0% of employers who responded to this question did not recruit any graduates this way. There are also big differences between the sectors as shown below: All employers 26.5% Law firm 56.4% Consulting or business services firm 38.0% FMCG company 36.6% Banking or financial services 23.9% Engineering or industrial company 21.4% Accountancy or professional services firm 20.9% Construction company or consultancy 18.4% Insurance company 18.1% Energy, water or utility company 17.3% Retail 16.0% IT/Telecommunications 14.3% Public sector 5.7% Other 6.4% Figure 2.5: Average proportion of vacancies filled by graduates who have already worked for their organisation before (e.g. 6 through internships or gap placements) 2013-2014 Base variable Law firms reported the largest proportion of vacancies filled by graduates who had worked for them previously (56.4%), followed by consulting and business services firms (38.0%) and fast moving consumer goods companies (36.6%). 6 The following sectors are not reported in our analysis as the small number of respondents may jeopardise their anonymity: oil companies, chemical or pharmaceutical companies, transport or logistics companies and Investment or fund managers. 23

Graduate Recruitment Survey 2015 Winter Review Time to offer The average “time to offer” – that is, the time between an applicant applying and receiving an offer - was 13 weeks. Just over a fifth of employers (20.9%) were able to make an offer within 5 weeks of applicants applying, compared to 7.5% of employers that required over 21 weeks to make an offer. All employers 13 Public sector 15 Law firm 15 Engineering or industria

Welcome to the AGR Graduate Recruitment Survey 2015 - Winter Review. The AGR Graduate Recruitment Survey is the definitive study of AGR employer members and their recruitment practices, providing up-to-the-minute insights into conditions and trends in the graduate recruitment market. It provides regular benchmarking of key market indicators .

May 02, 2018 · D. Program Evaluation ͟The organization has provided a description of the framework for how each program will be evaluated. The framework should include all the elements below: ͟The evaluation methods are cost-effective for the organization ͟Quantitative and qualitative data is being collected (at Basics tier, data collection must have begun)

Silat is a combative art of self-defense and survival rooted from Matay archipelago. It was traced at thé early of Langkasuka Kingdom (2nd century CE) till thé reign of Melaka (Malaysia) Sultanate era (13th century). Silat has now evolved to become part of social culture and tradition with thé appearance of a fine physical and spiritual .

On an exceptional basis, Member States may request UNESCO to provide thé candidates with access to thé platform so they can complète thé form by themselves. Thèse requests must be addressed to esd rize unesco. or by 15 A ril 2021 UNESCO will provide thé nomineewith accessto thé platform via their émail address.

̶The leading indicator of employee engagement is based on the quality of the relationship between employee and supervisor Empower your managers! ̶Help them understand the impact on the organization ̶Share important changes, plan options, tasks, and deadlines ̶Provide key messages and talking points ̶Prepare them to answer employee questions

Dr. Sunita Bharatwal** Dr. Pawan Garga*** Abstract Customer satisfaction is derived from thè functionalities and values, a product or Service can provide. The current study aims to segregate thè dimensions of ordine Service quality and gather insights on its impact on web shopping. The trends of purchases have

Chính Văn.- Còn đức Thế tôn thì tuệ giác cực kỳ trong sạch 8: hiện hành bất nhị 9, đạt đến vô tướng 10, đứng vào chỗ đứng của các đức Thế tôn 11, thể hiện tính bình đẳng của các Ngài, đến chỗ không còn chướng ngại 12, giáo pháp không thể khuynh đảo, tâm thức không bị cản trở, cái được

Le genou de Lucy. Odile Jacob. 1999. Coppens Y. Pré-textes. L’homme préhistorique en morceaux. Eds Odile Jacob. 2011. Costentin J., Delaveau P. Café, thé, chocolat, les bons effets sur le cerveau et pour le corps. Editions Odile Jacob. 2010. Crawford M., Marsh D. The driving force : food in human evolution and the future.

Pipe Size ASTM Designation in mm D2310 D2996 2 - 6 50 - 150 RTRP-11FU RTRP-11FU1-6430 8 - 16 200 - 400 RTRP-11FU RTRP-11FU1-3220. Fittings 2 to 6 inch Compression-molded fiberglass reinforced epoxy elbows and tees Filament-wound and/or mitered crosses, wyes, laterals and reducers 8 to 16 inch Filament-wound fiberglass reinforced epoxy elbows. Filament-wound and/or mitered crosses, tees, wyes .