10 STOCKS

10STOCKSFºR 2021

Inside THIS REPORTClick an article to read more:Thank You & 3Wishes for 2021What 2020 Taught MeAbout the FutureAppianCloudflareLemonadeMercadoLibreTom GardnerNasdaq: APPNNasdaq: LMNDMorgan HouselNYSE: NETNew Tool:The Allocator10 Favorites FromAcross the FoolFiverrFulgent GeneticsOktaPinterestAmanda KishNYSE: FVRRNasdaq: MELINasdaq: OKTAShopifyZoom VideoCommunicationsNYSE: SHOPNasdaq: ZMRich GreifnerNasdaq: FLGTNYSE: PINS

WELCOME:THANK YOU & 3WISHES FOR 2021results, not the investor who’s ignoring allHello, Fools, and Happy New Year!of the stakeholders in an organization andThank you for being a part of everythinghoping that their position as a shareholderthat we brought to the world together.will be the primary focus of a company.As you know, 2020 was a survival year,Instead, we are all stakeholders andand now we head into one of the greatestlong-term thinkers hoping we can find greatrebuilding opportunities in our lifetime, cerTOM GARDNERcompanies that are going to make a diftainly in the 27-year history of The Motleyference in the world and profit from beingFool — the opportunity to be supportive ofassociated with them. So I hope for you and for all ofentrepreneurs and innovators, to invest our time andus that we continue to look at the data that shows thatour capital in solving the most important problems.really all the wealth of the public markets ends up inI’m happy that we get to do it together.the hands and in the pockets and the digital accounts ofOur mission is to make the world smarter, happier,long-term, business-focused investors.and richer in all of our Foolish experiences together. SoAnd my third wish for you, and in the year ahead, isI have three wishes I’d love to share with you for thethat we do everything we can to make the lives of thenew year.people around us smarter, happier, and richer — andFirst, we take even more pleasure and find eventhat we do so for ourselves as well. We want to domore success in identifying the great organizations ofeverything we can to make 2021 the unforgettable yearour time. How they’re priced in the short term really isthat it deserves to be and that we all hope for.a secondary or tertiary concern. It’s much more aboutThank you for being a part of The Motley Fool inwhere they’re going, what they’re trying to solve, and2020. So many of you have been with us since 2015,how much they care about all the stakeholders, all the2010, 2000, 1993. We debuted in the spring of 1993, andpartners, everyone connected to that organization.some of you are still hanging out in Fooldom with usThe great companies are going to build a pathwayand investing for the long term.to prosperity over the next 25 years. They’re goingThank you so much for being a part of our mission,to be innovating, they’re going to be organizing andhelping to lead our mission and co-owning our brandprioritizing their work to make sure that they’re doingwith us as we try to help as many people as we cansomething of consequence. Those are the businessesmake better decisions in their financial and theirthat we want to support here at The Motley Fool, andprofessional lives. So thank you.I wish that for you and for me and for all of us that weBest of good health and happiness for you and yourcontinue to do a better and better job of locating themfamily, and let’s go make 2021 a year that we’ll neverand preparing to invest in them for the long term.forget.That’s my second wish. As the days and weeks pass,Fool on!I want to demonstrate even more that the Motley Foolcommunity is dedicated to being the investor that greatorganizations deserve — and that is not the short-termthinker. Not the investor who’s using leverage to juice10 STOCKS FOR 20211

LOOKING AHEAD:WHAT 2020TAUGHT ME ABOUTTHE FUTUREMORGAN HOUSEL2This was the year that felt like a decade.That’s probably the most commonthing you’ll hear about 2020: the feelingthat time slowed down. The early daysof spring, when COVID-19 first enteredour lives, felt like it lasted an eternity.February feels like a different lifetime ago.The leading theory for why timeoccasionally feels like it slows is thattime perception is driven by the numberof memories formed in a period, andmemories are created by experiencesthat are new and surprising. It’s why themonotony of commuting to work on thesame road for 20 years passes withoutleaving a mark, but summer break seemsto last forever for a child experiencing herfirst summer camp.Time seems to have slowed in 2020because for the first time since childhoodmany of us have been bombarded withnew and surprising experiences.We learned how to work from home.How to use new technologies.How powerful exponential growthcan be.We learned that the economy can stopovernight.And that isolation is exhausting, evenfor introverts.10 STOCKS FOR 2021Entrepreneur Derrik Sivers oncewrote:“ People only really learn when they’resurprised. If they’re not surprised, thenwhat you told them just fits in with whatthey already know. No minds werechanged. No new perspective. Justmore information. ”As we head into a new year — avaccine in hand, light seemingly at theend of the tunnel despite a virus stillraging — I’ve been thinking about whatI’ve learned from this surprising year andwhat it means for 2021 and beyond.Three things come to mind.1. Risk is what you don’t see,aren’t talking about, andaren’t prepared for.The investment industry spent the betterpart of the last decade debating whatthe biggest risk to the stock market andeconomy was.We wondered: Was it budget deficits?The Federal Reserve printing money?Trade wars? High valuations? Profitmargins? Interest rate hikes? Tax hikes?An incredible amount of energy was

spent on these topics.But in hindsight, we know noneof those things were the biggest risk.The biggest risk by far was avirus no one was talking about untilthis year, because no one knew itexisted before this year.This year was a blunt-forcereminder that the biggest economicand investing risk is what no one’stalking about, because if no one’stalking about it, no one’s preparedfor it, and if no one’s prepared forit, its damage will be amplifiedwhen it arrives.Think about the four biggesteconomic and investing risks of thelast century. They were, I’d argue:the Great Depression, Pearl Harbor,September 11, and COVID-19.The common denominator ofthese events is how surprising theywere to virtually everyone whenthey occurred.Sure, some people warned theeconomy was getting overheated inthe late 1920s, and epidemiologistshave been warning about a viralpandemic for years. But a GreatDepression? Or an economic shutdown requiring trillions of dollarsin government stimulus? It justwasn’t on people’s radar.Surprise wreaks economic havocfor two reasons.One, people aren’t preparedfinancially. The amount of debtthey hold, the size of their emergency funds, and their annualbudget forecasts can break underthe pressure of an event they neveranticipated.Two, people aren’t preparedpsychologically. Surprises canshake your beliefs about how youassume the world works in waysthat leave you paranoid, pessimistic,and overestimating the odds of therecent surprise occurring again.Paying attention to known risksis smart. But we should acknowledge that what we can’t see andaren’t talking about will likely bemore consequential than all theknown risks combined.That’s usually how it worksevery year. I doubt 2021 will bemuch different.Nobel-prize winning psychologist Daniel Kahneman once said:“ Whenever we are surprised bysomething, even if we admitthat we made a mistake, we say,‘Oh I’ll never make that mistakeagain.’ But, in fact, what youshould learn when you make amistake because you did notanticipate something is that theworld is difficult to anticipate.That’s the correct lesson to learnfrom surprises: that the world issurprising. ”The solution isn’t to become afatalist. It’s to value room for error,and expect that things like recessions and bear markets can occur atany moment, rather than relying onspecific forecasts of when they willoccur.The Foolish investing approachis, in many ways, centered aroundlong-term optimism and an acceptance that market volatility doesnot prevent a company from innovating and creating value over thelong run. Buying good companiesand holding them for a long time10 STOCKS FOR 2021does not rely on knowing whenthe next recession will come, whatthe market will do next quarter, orwhether the biggest economic riskis an interest rate hike, a change tothe tax code, or a pandemic. Andgood thing, too — because I don’tthink anyone can forecast thosethings.2. Innovation and progressdon’t tend to happen wheneveryone is calm, happy,and safe. They happenwhen there’s a shock to thesystem and problems aresolved out of necessity.In some ways, 2020 is what technologists in 1995 assumed the worldwould look like in 2000.At the beginning of the dot-comboom in the early 1990s, the visionwas that the internet would createa world where you could work fromanywhere, buy everything online,and do most of your socializationonline instead of in person.But fast forward to, say, 2019,and that vision hadn’t reallyplayed out — at least not to its fullpotential.Physical offices were packed,and if your company was based inChicago, you probably had to livein Chicago. Grocery stores werepacked. Airlines had their bestyear ever as business travel was inrecord demand.Then 2020 hit.In April, Microsoft CEO SatyaNadella said, “We’ve seen two years’worth of digital transformation intwo months.”3

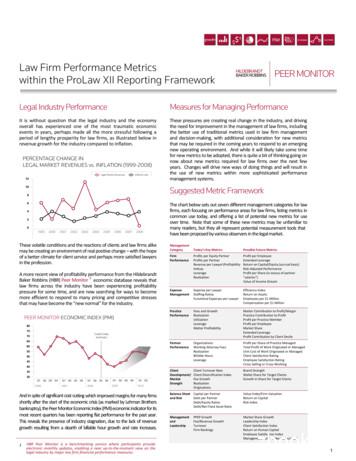

He’s not exaggerating. Considerthis chart from investment firmAlger:U.S. business investment55%Digital50%Physical45%201520162017When technology was niceto have, companies embraced itwarmly. When it was essential tosurvival, they bet the farm on itvirtually overnight.A lot of the history of innovationworks that way.The biggest innovations rarelyoccur when everyone’s happy andsafe, or when the future looks bright.They happen when people are alittle panicked and worried, andwhen the consequences of not acting quickly are too painful to bear.That was true during WorldWar II and the Cold War, wheneverything from penicillin to jets torockets to atomic energy, interstatehighways, synthetic rubber, microprocessors, GPS, radar, and digitalphotography were created.It was true in the 1930s duringthe Great Depression, which,according to economist AlexanderField, was the most productivedecade the U.S. economy has everseen. For all the suffering andunemployment, surviving businesses were forced — not nudged,but forced — to find new efficiencies and new ways to sell productsto consumers who had less moneyand patience. That gave rise to thesupermarket, laundromats, and the4201820192020widespread adoption of assemblylines.It’s true in 2020, too. And I thinkit bodes well for 2021 and beyond.The hardest thing aboutstress-induced innovation isreconciling that positive long-termtrends can be born when peopleare suffering the most. It makesthe topic difficult to even discusswithout looking insensitive.But think about what’s happened in the past year.The first documented case ofCOVID-19 was December 1, 2019.Twelve months and two weekslater, tens of millions of vials ofa 95%-effective vaccine are beingshipped around the world. That isthe fastest vaccine developmentin history, by far. And we’ve doneit with a technology — mRNA —that’s not only the first of its kindbut has the potential to teach usthings useful in treating otherdiseases, most notably cancer.Nicole Lurie of the Coalitionfor Epidemic PreparednessInnovations recently said: “I don’tthink the world of vaccine development will ever be the same again.”Things tend to move quicklyfrom there. In his book How We Gotto Now, Steven Johnson writes:10 STOCKS FOR 2021“ Innovations usually begin lifewith an attempt to solve aspecific problem, but once theyget into circulation, they end uptriggering other changes thatwould have been extremelydifficult to predict. An innovation, or cluster of innovations,in one field ends up triggeringchanges that seem to belong toa different domain altogether. ”That, I believe, is happeningin medicine as we speak. There’scurrently so much experimentation,with stakes so high, that you knowwe’re going to look back in thefuture — maybe next year, maybenext decade — and recognizethe incredible developments thathappened that wouldn’t have beenpossible without the frenzied rushto find a cure for COVID-19 in 2020.This doesn’t end with medicine.New business applications for allindustries surged 77% in the thirdquarter. More people than ever arestriking out on their own, startingsomething new, trying somethingdifferent.Or think about entire cities. Ifjust a handful of big tech companies allow their employees to workremotely, one of the biggest socialproblems of the last generation

— affordable housing — suddenlymoves in the right direction.Having so much economicpotential clustered in a few neighborhoods in California and NewYork created 2 million starterhomes in cities with good jobs andcheap homes in cities with pooreconomic prospects. Even a smallshift to permanent remote workcould make cities more livable, withless traffic and more affordablehomes, and rural areas more prosperous with good, high-paying jobs.It’s a rebalancing of geographicadvantages that wouldn’t have beenpossible without COVID-19.As we look ahead to 2021, thefocus is mostly on recovery fromthe damage inflicted in 2020. That’show it should be: some 10 millionfewer Americans have jobs todaythan did a year ago, and the toppriority should be getting themback to work.But beyond recovery, we shouldalso recognize that we are — rightnow — in what is probably thegreatest period of n periods we’ve seen in perhaps80 years.I’m always a long-term optimist.But I think there’s good reason tobelieve the future of innovation isbrighter today than it was a year ago.3. Optimism beginswell before it’s obvious.On February 24, Warren Buffettwent on CNBC and said “Wecertainly won’t be selling” stocksduring the decline.A few weeks later he sold billionsof dollars of airline stocks, exitinghis entire position in the industry.You can call this hypocritical,but I think it’s just an acknowledgment of how the economy turnedso bad, so fast, creating a businesscatastrophe potentially moresevere than the Great Depression.Things were bad. They’re stillbad.And yet.The S&P 500 looks like it’ll finish the year up about 12% — prettyclose to its historic average annualreturn.The Nasdaq will finish the yearup something close to 40%. That’sthe kind of thing you might expectto see during the strongest economy in history, not the weakest in acentury.The bull market that began inlate March caught many by surprise.It didn’t seem to make any sensegiven how bad things were on theground.It was easy to view the disconnect between Wall Street andMain Street as a sign of a bubble,perhaps propped up by the FederalReserve’s easy-money policies.And maybe it is. This story isn’tover yet.But there’s a long history ofthe stock market rebounding wellahead of the economy, leaving manyconfused investors in its wake.It happened during the lastrecession, when the stock marketbottomed and began surging higherin March 2009 even though theeconomy kept shedding jobs foranother year, and there wasn’t adecent level of sustained economicgrowth for another three years.I’m not big on economicforecasting, both because it’s notimportant to how I invest andbecause I think so few can do it10 STOCKS FOR 2021accurately. But as we sit here inDecember 2020, you can imaginea world where widespread vaccination allows businesses to reopenin the coming months, and tens ofmillions of Americans who havebeen cooped up for a year aredesperate to go on vacation, eat at arestaurant, and travel to see family.The amount of pent-up demandthat could be unleashed in thecoming months could be extraordinary, especially given the amount ofstimulus money circulating aroundthe economy.Perhaps the market saw thatcoming in March. Perhaps that’swhy the market has been surgingsince then.That wasn’t obvious to manypeople in March, because we liveour lives day to day, in the moment,when job losses and the constantthreat of infection dominated ourview of the world. The market,though, wasn’t that concerned withwhat was happening then. It waslooking six to 12 months ahead.Doing well as a Foolish investorrequires long-term optimism. Butoptimism has an important nuancethat was reinforced in 2020: It doesnot mean you think that everythingwill go right and there will only begood news. Optimism means thingswill likely work out in the long run,even if the short run is filled withbad news, setback, decline, disappointment, and damage. That’s whythe stock market can grow evenwhen the economy is a mess.Buffett summarized thisperfectly in 2008 when he wrote:“If you wait for the robins, springwill be over.”So it goes in 2020. And may weawait the robins in 2021. S5

NEW TOOL:THE ALLOCATORAMANDA KISH,CFA, CFP6As we flip the calendar to 2021, manyinvestors are grappling with uncertainty.And while the new year is a time whenmany of us dust off resolutions to eatbetter or get more exercise, there is onetask that we think every investor shouldcheck off their to-do list early in the year— reviewing their portfolio’s asset allocation. Getting asset allocation right at theoutset can help mitigate quite a bit of theuncertainty surrounding us now and mayalso help keep investors on track no matter what surprises 2021 throws our way.While our primary focus as Fools willalways be on identifying stocks we thinkwill outpace the market over the longrun, we believe asset allocation is a vitalpart of building a successful investmentportfolio. Just owning excellent stocksisn’t enough — we consider how thosestocks interact with each other and whatthe portfolio looks like as a whole.Asset allocation addresses the questionof what an investment portfolio looks likeon a top-down basis. In other words, howmuch have you invested in asset classessuch as large-cap stocks, small-cap stocks,international stocks, bonds, and cash? Wethink looking at a portfolio through thelens of asset allocation is important fortwo primary reasons.10 STOCKS FOR 2021First, taking an allocation-level viewhelps investors avoid missing out on anysignificant investment opportunitiesaround the globe. An investor can builda portfolio consisting solely of solid U.S.large-cap companies, but that means theycould be missing out on all the returnsfrom small-cap stocks or overseas emerging market stocks. Investors who have atarget allocation to all major asset classescan add an important layer of diversification to their portfolio while still ensuringthat they can devote the most shelf spaceto those companies and corners of themarket that have the greatest returnpotential.Second, asset allocation helps investors manage risk and potentially avoidcatastrophic mistakes that could endangertheir hard-earned wealth. Every investorhas their own unique set of life circumstances and financial goals, so it makessense that everyone’s portfolio will look alittle bit different.Depending on an investor’s age andinvestment time horizon, they mightwant to be heavily invested in stocks —or it may be more prudent to balancetheir allocation more evenly betweenstocks and cash or bonds. Likewise,investors who are more risk tolerant

and not bothered by short-termmarket drops can invest moreaggressively, which means moreexposure to stocks. Folks who aremore cautious and who may losesleep at night when the market fallsprobably want a more conservativeallocation, which means a lighterallocation to stocks.People generally don’t getexcited about investing in safetyassets such as cash and bonds, butthey are one of the best investmentvehicles for protecting capitaland reducing volatility within aportfolio. Homing in on the rightasset allocation can help investorsnot only maximize return

our lives, felt like it lasted an eternity. February feels like a different lifetime ago. The leading theory for why time occasionally feels like it slows is that time perception is driven by the number of memories formed in a period, and memories are created

U. S. Commercial M14 Barrels 218 USGI M14 Stock Designs 219 USGI M14 Wood Stocks 220 USGI M14 Synthetic Stocks 224 USGI M14E2 Stocks 228 Commercial Synthetic Match Grade Stocks 228 Folding and Telescoping Commercial Stocks 229 Other Stocks 237 Hand Guards 239 USGI Sights 242 Commercial Sights 244

Unlisted stocks 0 — Stocks other than unlisted stocks 2 3,611 For additional purchase as the purpose of expec-tation of the quantitative effectiveness to hold the stocks by further enhancement with the long-term and stable business relationships (Stocks with decreased number of shares i

U Gestión de stocks nidad 3 En esta unidad aprenderás a. Obtener previsiones de aprovisionamiento y demanda por periodos. Analizar las necesidades de stocks de una empresa. Determinar la capacidad óptima del lote económico de pedido. Valorar la importancia de una gestión de stocks eficiente. Determinar los niveles de stocks máximo, mínimo, .

NASD stocks. The table shows that small stocks tend to have higher returns than big stocks and high-book-to-market stocks have higher returns than low-BE/ME stocks. Table I also reports estimates of the three-factor time-series regression (2). If the three-factor model (1) describes expected returns, the regression inter-cepts should be close .

Synthetic Base Stocks Group I, Group II and Group III base stocks that are manufactured by refining processes are referred to as 'mineral' base stocks The term 'synthetic' is used to describe lubricants that have been processed -This includes Group IV base stocks 'Synthetic' is also used when marketing Group III base

The BaSIcS for InveSTIng In STockS stocks that pay large dividends are less volatile capitalization of 1 billion or less (market capitaliza - tion is a company’s stock price multiplied by the num-ber of shares outstanding). Foreign stocks add valuable diversification to a purely domestic stock portfolio. That’s because U. s.

1-year 3-year 5-year 10-year Municipal bonds High-yield bonds International bonds Aggregate bonds Large stocks Small stocks International stocks Emerging-market stocks % Return –10 00 10 –10 10 –100 01 0 –10 10 –0.7 3.3 –4.5 –5.0 0.8 1.4 –3.6 –0.4 –14.6 2.6 3.2 1.7 –2.6 1.0 15.1 12.9 5.5 –6.4 7.3 5.3 5.0 0.5 2.9 12.6 10 .

00 Would you still put it in a bank savings account? Why or why not? 00 Are there alternatives available that would bring you a 4% to 6% return? 7 Dividend-Paying Stocks Student Handout: Dividend-Paying Stocks Stocks You’ve heard of the stock market, but what exactly are stocks? A share of stock in a corporation is a share of ownership. When .